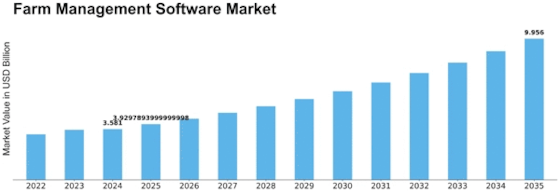

Farm Management Software Size

Farm Management Software Market Growth Projections and Opportunities

The market for farm management software is changing quickly because of breakthroughs in technology, shifting gardening methods, and a growing need for better farm management. As the world's population grows, so does the interest in making food, which forces farmers to come up with creative ways to get their work done faster. The Farm Management Software market has become an important part of this change because it gives farms tools to simplify tasks, improve management, and boost overall efficiency.

Coordinating accurate gardening procedures quickly is one of the most important things that drives the market. Farmers today are using technologies like GPS, cameras, and data analysis more and more to get new information about their areas all the time. This information can be gathered and analyzed with the help of farm management software, which gives farmers a full picture of their jobs. This move toward precision farming is not only better using resources, but it's also helping with fair gardening projects, which fits with the worldwide focus on protecting the environment.

Cloud-based Farm Management Software makes it easier for partners to work together and makes sure that farmers can make quick, well-informed choices that lead to higher levels of skill and production.

There are also more mobile apps on the market that are designed to help with farm management. Farmers can use their cell phones or computers to monitor and handle different parts of their activities with these apps' easy-to-understand interfaces. The portable-driven method makes Farm Management Software more flexible, meeting the needs of both small and large farms. This trend is making cutting-edge agricultural innovations more accessible to everyone, so farms can benefit from computerized setups as long as all other factors stay the same.

Some of the most important things that are helping the Farm Management Software market grow are government programs and grants. Many states around the world understand how important digitalization is for gardening and are giving farmers financial incentives to adopt new technology-based systems. These factors are not only increasing the popularity of Farm Management Software, but they are also propelling growth in the industry as companies try to meet the evolving needs of the rural area.

Leave a Comment