Government Support and Incentives

Government initiatives in Canada are playing a crucial role in the growth of the farm management-software market. Various programs and subsidies are being introduced to encourage farmers to adopt advanced technologies. For instance, the Canadian government has allocated over $100 million to support digital agriculture initiatives, which include funding for software solutions that enhance farm productivity and efficiency. This financial backing is likely to stimulate investment in farm management software, making it more accessible to a broader range of farmers. As a result, the market is expected to see increased adoption rates, particularly among small to medium-sized enterprises that may have previously been hesitant to invest in such technologies.

Enhanced Connectivity and Collaboration

The farm management-software market is benefiting from enhanced connectivity and collaboration among stakeholders in the agricultural sector. With the rise of cloud-based solutions, farmers can now easily share data and collaborate with agronomists, suppliers, and other stakeholders. This interconnectedness fosters a more integrated approach to farming, allowing for better resource management and improved communication. As farmers increasingly recognize the value of collaboration, the demand for software that facilitates these connections is likely to grow. The market is expected to see a rise in solutions that offer collaborative features, which could enhance overall productivity and efficiency in agricultural operations.

Rising Demand for Sustainable Practices

The farm management-software market in Canada is experiencing a notable shift towards sustainable agricultural practices. Farmers are increasingly seeking software solutions that facilitate eco-friendly farming methods, such as precision agriculture and resource optimization. This trend is driven by consumer demand for sustainably sourced products, which has surged by approximately 30% in recent years. As a result, software that helps track and manage sustainable practices is becoming essential. The integration of sustainability metrics into farm management software not only aids in compliance with environmental regulations but also enhances marketability. Consequently, the farm management-software market is likely to expand as more farmers adopt these technologies to meet both regulatory and consumer expectations.

Technological Advancements in Agriculture

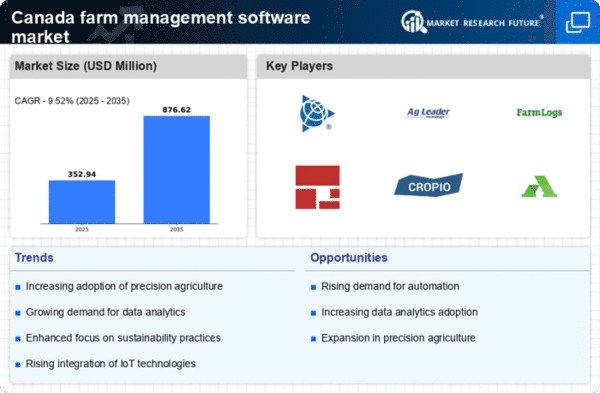

The rapid pace of technological advancements is significantly influencing the farm management-software market in Canada. Innovations such as artificial intelligence, machine learning, and big data analytics are being integrated into farm management solutions, providing farmers with powerful tools for decision-making. These technologies enable real-time data analysis, which can lead to improved crop yields and resource management. The market for farm management software is projected to grow by approximately 15% annually as these technologies become more prevalent. As farmers recognize the potential of these advancements to enhance productivity and profitability, the demand for sophisticated software solutions is likely to increase, further driving market growth.

Increasing Focus on Data-Driven Decision Making

In the current agricultural landscape, there is a growing emphasis on data-driven decision making within the farm management-software market. Farmers are increasingly utilizing data analytics to optimize their operations, from crop planning to resource allocation. This trend is supported by the availability of vast amounts of agricultural data, which can be harnessed to make informed decisions. Approximately 70% of Canadian farmers report that data analytics has improved their operational efficiency. As a result, software solutions that offer robust data analysis capabilities are becoming essential tools for modern farming. This shift towards data-centric approaches is likely to propel the growth of the farm management-software market as more farmers seek to leverage data for competitive advantage.