Feed Antioxidants Size

Market Size Snapshot

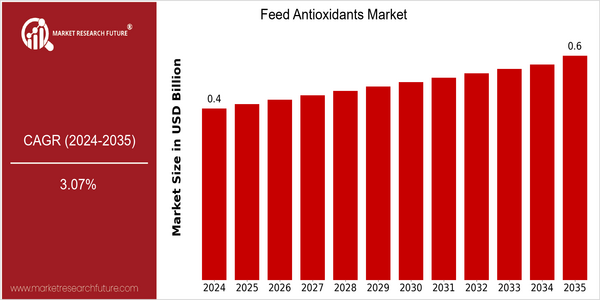

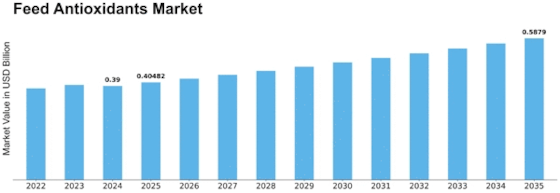

| Year | Value |

|---|---|

| 2024 | USD 0.39 Billion |

| 2035 | USD 0.55 Billion |

| CAGR (2025-2035) | 3.07 % |

Note – Market size depicts the revenue generated over the financial year

The global feed antioxidants market is poised for steady growth, with a current market size of USD 0.39 billion in 2024, projected to reach USD 0.55 billion by 2035. This growth trajectory reflects a compound annual growth rate (CAGR) of 3.07% from 2025 to 2035. The increasing demand for high-quality animal feed, driven by the rising global meat consumption and the need for enhanced livestock health, is a significant factor contributing to this market expansion. Additionally, the growing awareness of the benefits of antioxidants in improving feed quality and extending shelf life is further propelling market growth.

Technological advancements in feed formulation and the development of innovative antioxidant products are also key drivers of this market. Companies such as BASF, Kemin Industries, and Cargill are at the forefront, investing in research and development to create more effective and sustainable feed antioxidant solutions. Strategic initiatives, including partnerships and product launches, are enhancing their market presence and addressing the evolving needs of the livestock industry. As the market continues to evolve, these factors will play a crucial role in shaping the future landscape of the feed antioxidants sector.

Regional Market Size

Regional Deep Dive

The Feed Antioxidants Market is experiencing significant growth across various regions, driven by increasing awareness of animal health and the quality of feed products. In North America, the market is characterized by a strong emphasis on research and development, with a focus on natural antioxidants due to rising consumer demand for organic and non-GMO products. Europe is witnessing stringent regulations that promote the use of safe and effective feed additives, while the Asia-Pacific region is rapidly expanding due to rising livestock production and a growing middle class. The Middle East and Africa are seeing increased investments in livestock farming, and Latin America is capitalizing on its agricultural strengths to enhance feed quality and safety.

Europe

- The European Union has implemented stricter regulations on synthetic antioxidants, pushing manufacturers to innovate and adopt natural alternatives, thereby reshaping the market landscape.

- Organizations such as the European Feed Manufacturers' Federation (FEFAC) are advocating for the use of feed antioxidants to improve animal health and product quality, influencing market dynamics.

Asia Pacific

- Countries like China and India are ramping up their livestock production, leading to a surge in demand for feed antioxidants to enhance feed quality and animal health.

- Innovations in feed formulations, particularly the incorporation of herbal antioxidants, are gaining traction, with companies like Adisseo leading the charge in product development.

Latin America

- Brazil is focusing on sustainable agricultural practices, leading to increased adoption of natural feed antioxidants to meet both domestic and export market demands.

- The region's strong agricultural base is fostering partnerships between local farmers and multinational companies to enhance feed quality through innovative antioxidant solutions.

North America

- The U.S. Food and Drug Administration (FDA) has recently updated its guidelines on feed additives, encouraging the use of natural antioxidants, which is expected to boost the market for plant-based feed antioxidants.

- Key players like BASF and Cargill are investing heavily in R&D to develop innovative antioxidant solutions that cater to the growing demand for sustainable animal feed.

Middle East And Africa

- The African Union is promoting initiatives to improve livestock productivity, which includes the use of feed antioxidants to enhance feed efficiency and animal health.

- Local companies are increasingly collaborating with international firms to access advanced feed technology, thereby boosting the market for feed antioxidants in the region.

Did You Know?

“Did you know that the use of antioxidants in animal feed can significantly extend the shelf life of feed products, reducing waste and improving overall feed efficiency?” — Animal Feed Science and Technology Journal

Segmental Market Size

The Feed Antioxidants Market is experiencing stable growth, driven by increasing awareness of animal health and the need for enhanced feed quality. Key factors propelling demand include the rising incidence of oxidative stress in livestock and the growing emphasis on natural feed additives due to consumer preferences for clean-label products. Regulatory policies favoring the use of safe and effective antioxidants further bolster this segment's relevance in the market.

Currently, the adoption of feed antioxidants is in a mature stage, with companies like BASF and Kemin Industries leading the way in product innovation and market penetration. Primary applications include their use in poultry, swine, and ruminant feeds to improve shelf life and nutritional value. Notable trends accelerating growth include sustainability initiatives aimed at reducing waste and enhancing feed efficiency, alongside technological advancements in formulation and delivery methods. The integration of natural antioxidants, such as tocopherols and rosemary extracts, exemplifies the shift towards more sustainable practices in the feed industry.

Future Outlook

The Feed Antioxidants Market is poised for steady growth from 2024 to 2035, with a projected market value increase from $0.39 billion to $0.55 billion, reflecting a compound annual growth rate (CAGR) of 3.07%. This growth trajectory is underpinned by the rising demand for high-quality animal feed, driven by the increasing global population and the corresponding need for sustainable livestock production. As consumers become more health-conscious, the demand for meat and dairy products that are free from harmful additives is expected to rise, further propelling the adoption of feed antioxidants in the industry.

Key technological advancements and regulatory policies are anticipated to play a significant role in shaping the market landscape. Innovations in feed formulation and the development of natural antioxidants are likely to gain traction, as they align with the growing trend towards organic and clean-label products. Additionally, government initiatives aimed at promoting animal health and welfare are expected to bolster the use of feed antioxidants, as they help in prolonging the shelf life of feed and enhancing the overall health of livestock. As a result, the penetration of feed antioxidants in the animal nutrition sector is projected to increase, with usage rates expected to reach approximately 25% of total feed formulations by 2035, reflecting a significant shift towards more health-oriented feeding practices.

Leave a Comment