Market Share

Introduction: Navigating Competitive Dynamics in the Feed Binders Market

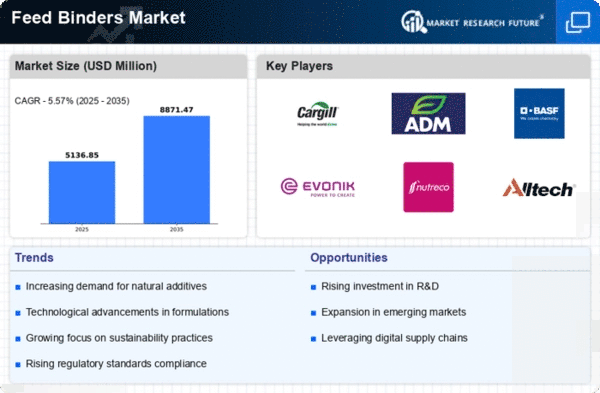

The Feed Binders Market is witnessing a transformative shift driven by rapid technology adoption, evolving regulatory landscapes, and heightened consumer expectations for sustainability and quality. Key players, including traditional feed manufacturers, innovative biotech firms, and emerging startups, are fiercely competing for market leadership by leveraging advanced solutions such as AI-based analytics and IoT-enabled monitoring systems. These technology-driven differentiators not only enhance product efficacy but also streamline supply chain operations, thereby influencing market positioning. Additionally, regional growth opportunities are emerging, particularly in Asia-Pacific and Latin America, where increasing livestock production and a shift towards organic farming practices are creating demand for high-performance feed binders. Strategic deployment trends for 2024–2025 will focus on integrating green infrastructure and automation to meet both regulatory requirements and consumer preferences, setting the stage for a dynamic competitive landscape.

Competitive Positioning

Full-Suite Integrators

These vendors offer comprehensive solutions across multiple segments of the feed binders market.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| E. I. du Pont de Nemours and Company (U.S.) | Strong R&D capabilities | Innovative feed binder solutions | North America, Europe |

| Archer-Daniels-Midland Company (U.S.) | Extensive supply chain network | Diverse agricultural products | Global |

| J.M. Huber Corporation (U.S.) | Specialized product formulations | Functional ingredients | North America, Europe |

Specialized Technology Vendors

These companies focus on niche technologies and innovative solutions tailored for specific applications in feed binders.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| CP Kelco U.S., Inc. (U.S.) | Expertise in hydrocolloids | Gelling agents and stabilizers | North America, Europe, Asia |

| FMC Corporation (U.S.) | Advanced biopolymer technology | Natural feed additives | Global |

| Gelita AG (Germany) | High-quality gelatin products | Gelatin and collagen peptides | Europe, Asia, Americas |

Infrastructure & Equipment Providers

These vendors supply essential infrastructure and equipment that support the production and application of feed binders.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Darling Ingredients Inc. (U.S.) | Sustainable sourcing practices | Animal by-products processing | North America, Europe |

| Roquette Freres S.A. (France) | Focus on plant-based solutions | Starch and protein products | Global |

| Emsland-Starke GmbH (Germany) | Expertise in potato starch | Starch-based feed binders | Europe, Asia |

| Avebe U.A. (the Netherlands) | Innovative potato-based products | Starch and protein solutions | Europe, Asia |

Emerging Players & Regional Champions

- NutraBlend (USA): Specializes in natural feed binders derived from plant sources, recently secured a contract with a major poultry producer to enhance feed efficiency, challenging established players by focusing on sustainability and clean label products.

- BindTech Solutions (Germany): Offers innovative synthetic binders with enhanced moisture retention properties, recently implemented a pilot project with a leading aquaculture firm, complementing traditional vendors by providing advanced formulations that improve feed stability.

- AgriBind (Brazil): Focuses on locally sourced organic binders, recently partnered with regional livestock farms to promote sustainable practices, positioning itself as a regional champion by addressing local market needs and competing with global brands on price and availability.

- FeedWell Innovations (India): Develops customized feed binder solutions for small to medium-sized enterprises, recently launched a new product line tailored for dairy farmers, challenging larger companies by offering flexible and affordable options.

Regional Trends: The Feed Binders Market is witnessing a shift towards sustainable and organic solutions, particularly in North America and Europe, where consumers demand cleaner labels. In Asia-Pacific, there is a growing trend towards customized solutions to cater to diverse livestock needs, while Latin America is focusing on cost-effective and locally sourced products. Technology specialization is leaning towards bio-based binders and innovative formulations that enhance feed efficiency and stability.

Collaborations & M&A Movements

- Cargill and ADM entered into a partnership to develop innovative feed binder solutions aimed at improving animal nutrition and reducing waste, enhancing their competitive positioning in the sustainable feed market.

- BASF acquired the feed binder division of Evonik Industries to strengthen its portfolio in animal nutrition and expand its market share in the feed additives sector.

- Nutreco and DSM collaborated to create a new line of feed binders that utilize bio-based materials, responding to increasing regulatory pressures for sustainable practices in the feed industry.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Sustainability | Cargill, BASF | Cargill has implemented sustainable sourcing practices for its feed binders, focusing on reducing carbon footprints. BASF has developed bio-based feed binders that enhance animal nutrition while minimizing environmental impact, as evidenced by their recent product launch in Europe. |

| Product Innovation | ADM, Evonik | ADM has introduced innovative feed binder formulations that improve feed efficiency and animal health, supported by recent trials showing enhanced growth rates in livestock. Evonik's focus on amino acid-based binders has led to significant advancements in nutritional profiles, as demonstrated in their latest research publications. |

| Regulatory Compliance | Nutreco, Alltech | Nutreco has established a robust compliance framework to meet global feed safety standards, ensuring their products are accepted in diverse markets. Alltech has actively engaged in regulatory discussions, positioning itself as a thought leader in feed binder safety and efficacy. |

| Market Reach | BASF, Cargill | BASF has expanded its global distribution network, allowing for better market penetration in Asia and South America. Cargill's extensive supply chain capabilities enable it to serve a wide range of customers, from small farms to large agribusinesses, enhancing its market presence. |

| Customer Support and Service | Nutreco, Alltech | Nutreco offers comprehensive technical support and training for its customers, ensuring effective use of their feed binders. Alltech has developed a customer-centric approach, providing tailored solutions and ongoing support, which has been well-received in the market. |

Conclusion: Navigating the Feed Binders Landscape

The Feed Binders Market is characterized by intense competitive dynamics and fragmentation, with both legacy and emerging players vying for market share. Regional trends indicate a growing demand for sustainable and innovative solutions, prompting vendors to adapt their strategies accordingly. Legacy players are leveraging established distribution networks and brand loyalty, while emerging companies are focusing on agility and technological advancements. Key capabilities such as AI integration, automation of production processes, sustainability initiatives, and operational flexibility will be critical in determining market leadership. As decision-makers navigate this evolving landscape, understanding these dynamics will be essential for crafting effective strategies that align with market demands and capitalize on emerging opportunities.

Leave a Comment