Feed Yeast Size

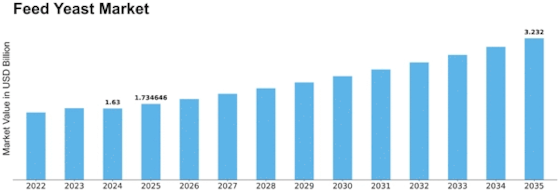

Feed Yeast Market Growth Projections and Opportunities

The feed yeast market faces dynamic forces that affect organic market, valuation, and development. The growing awareness of feed yeast's nutritional benefits in animal slims is driving this industry. As domesticated animal manufacturers focus on animal health and performance, feed yeast, rich in proteins, nutrients, and minerals, has gained quality. This has increased interest in feed yeast in the animal industry since it improves feed quality and supports optimal animal growth.

The focus on practical and natural animal nutrition boosts feed yeast sales. Animal manufacturers want eco-friendly options that boost critter performance and meet wider maintainability goals. Feed yeast, a natural and sustainable ingredient, reduces dependency on synthetic additives and enhances domesticated animal production.

Rational improvements and ongoing research shape feed yeast market aspects. Understanding the healthy structure of yeast and its positive effects on animal health helps develop creative yeast-based products. The disparity in product contributions allows animal manufacturers to use yeast definitions tailored to different creature species' diets, promoting market growth.

Feed yeast marketing requires administrative considerations. The company follows animal feed additive rules. Manufacturers must follow these standards to ensure feed yeast product safety and efficacy. Quality standards and affirmations provide administrative consistency and increase consumer trust in feed yeast used in animal nutrition.

Industry competition between yeast, feed, and wholesalers affects market factors. Due to intense competition, product development, crucial coordination, and severe evaluation have occurred. Organizations are focusing on differentiating their contributions by generating yeast-based details that meet certain healthy requirements, promoting animal growth and health. Due to the ban on anti-toxins in animal feed, a large market share is expected in Europe throughout the survey period. The growing use of dairy products will also boost the feed yeast sector here.

Leave a Comment