Fencing Size

Fencing Market Growth Projections and Opportunities

The Fencing Market is greatly determined by many common factors that altogether influence its progression and development. The first prominent consideration is security and privacy, which providers the demand for fencing solutions in the residential, commercial and industrial domains. Under the circumstances of growing criminal rates and unauthorized access, property owners begin looking for fences and other security measures to prevent the intrusion.

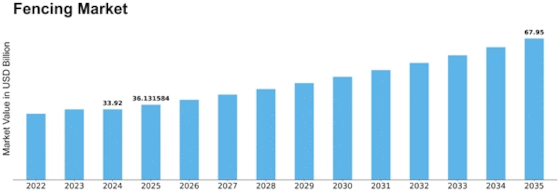

In 2021, the Fencing Market Size had already amounted to USD 13.81 Billion. The Fencing sector is expected to witness a significant growth from the current estimated value of USD 16.17 Billion in 2022 to USD 35.12 Billion by 2030 at an annual rate of 10.17%.

Aside from this, the involvement of the construction sector in fencing market is also significant. Along with the urbanization and infrastructure expansion worldwide, the demand for fencing design in residential areas, commercial spaces and within the public infrastructure projects constantly goes up. Security fencing not only acts as a security measure but can also be used as an aesthetic that adds to the exterior design and landscaping.

Regulations and policies related to the government will also enormously affect the fencing market. The task of complying with the safety rules among the industrial sector goes a long way in inspiring the use of some specific types of fencing that are tailored to fit the high standards. In addition, the environmental regulations help finding the materials for fences and the environmentally safe ones are preferred.

Specific financial factors, such as disposable income and construction expenses, affect the availability of houses for sale. Consumption rises and is more likely to be spent on improvements of their home during periods of economic prosperity; thereby, the demand for a fencing product increases. However, economic downfalls would lead to the decreased construction works, and as a result, the market for fencing might have short-term decline.

Technological improvement considerably contributes towards the development of the fencing industry. Innovations like smart fences with integrated security functions, automation, as well as remote surveillance capabilities get popular. Therefore, these technological advancements are not only at a high level in terms of the efficiency of the fencing solutions but also because of the increasing demand for integrated security systems.

Global tendencies, which include smart cities growing in popularity and more attention paid to the sustainable way of life, affect the fencing market. Smart city projects usually comprise up-to-date smart fencing technology meant for smart security and crowd control systems. Furthermore, customers become more aware of environmental conservation and hence there is a growing demand for fencing materials that are eco-friendly and can be recycled.

Leave a Comment