- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

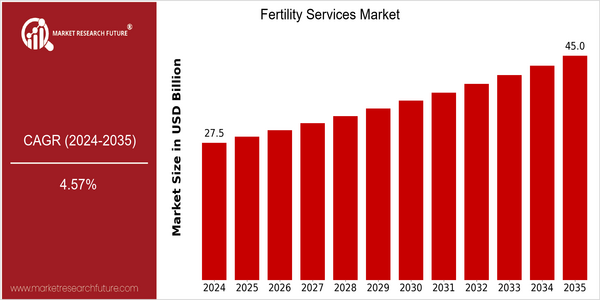

Fertility Services Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 27.51 Billion |

| 2035 | USD 45.0 Billion |

| CAGR (2025-2035) | 4.57 % |

Note – Market size depicts the revenue generated over the financial year

The fertility services market is projected to grow at a CAGR of 7.7% from 2024 to 2035. This growth translates into a CAGR of 4.57% from 2025 to 2035, indicating a strong demand for fertility services in the next ten years. The main reasons for this growth are the rising prevalence of infertility, which is caused by factors such as delayed childbearing, lifestyle changes, and a growing awareness of the importance of reproductive health. Also, technological developments in assisted reproductive technology (ART), including in vitro fertilization (IVF) and genetic testing, are expected to boost market growth. In particular, the use of artificial intelligence in ART procedures is expected to improve the success rate and patient outcomes. Cooper Surgical, Merck KGaA, and Vitrolife are investing in R & D, entering into strategic alliances, and launching new products to take advantage of these opportunities. Recent collaborations to integrate digital health solutions into fertility treatments are expected to improve the patient experience and increase access to care, which will also drive the fertility services market.

Regional Deep Dive

The Fertility Services Market is a growing market, with increasing awareness of reproductive health, advancements in assisted reproductive technology (ART), and changes in social and cultural attitudes towards family planning. North America, Europe, Asia-Pacific, the Middle East and Africa (MEA), and Latin America are the key regions where the fertility services market is influenced by a combination of cultural attitudes towards fertility, regulatory frameworks, and economic conditions. Each region presents opportunities and challenges with a focus on personalized treatment and the integration of technology into fertility services.

North America

- In the past few years, telemedicine has become increasingly important in the field of fertility. Companies like Progyny and Kindbody offer remote consultations and treatment plans that have made fertility treatment more accessible.

- The development of ART services has been facilitated by legislative changes, such as the recent extension of health insurance to include assisted reproductive technology in many states.

- The new market conditions are influenced by the social trends towards delayed childbearing and the increased acceptance of single parents and same-gender couples seeking fertility treatment.

Europe

- The European Society for Human Reproduction and Embryology (ESHRE) is a European organization which has been active in establishing guidelines and standards for ART, and promoting the use of best practices in the member countries.

- Denmark and Sweden lead the way when it comes to the success rate of fertility treatment. They have the best ART systems in the world, and they are among the best-funded countries in the world.

- The new social phenomenon of egg freezing is particularly prevalent among young women in cities, and reflects the changing social attitudes to family planning.

Asia-Pacific

- The rapid growth of fertility clinics in China and India is largely due to the rise in the number of people with disposable income and the increase in the number of people who are aware of their reproductive health. In India, the Society for Assisted Reproduction plays a key role.

- The vitrification technique has become increasingly popular. It allows a woman to freeze her ovules for later use, and is especially popular with working women.

- In countries such as Australia, where the government provides some funding for in vitro fertilization, it is easy to obtain the treatment and more and more couples seek help.

MEA

- Besides the American Hospital in Dubai, the United Arab Emirates is emerging as a major hub for medical tourism, with advanced clinics like the German Hospital in Dubai attracting patients from all over the world.

- Culture and social attitudes towards fertility are changing, with younger generations showing a greater tolerance for assisted reproduction.

- Israel is a country where the regulatory framework is conducive to the development of new reproductive technology and where the fertility service market is advancing rapidly.

Latin America

- The number of clinics in Brazil has risen sharply, and with the help of the Brazilian Society for Reproductive Medicine (SBMR), which campaigns for the expansion of access to assisted reproduction, and raises awareness of sexual health issues, there is a new wave of interest in the subject.

- The increasing prevalence of infertility, the greater acceptance of ART, and the greater availability of fertility services are driving demand for these services, particularly in the urban areas.

- In Argentina, the government is beginning to support the treatment of infertility. Some provinces are paying for IVF treatments, which will facilitate the use of these treatments for a larger number of people.

Did You Know?

“In the United States, about 1 in 8 couples are infertile, indicating the need for fertility services.” — Centers for Disease Control and Prevention (CDC)

Segmental Market Size

Infertility treatments are experiencing a period of growth, driven by the growing awareness and acceptance of assisted reproductive technology (ART). The rising infertility rates, influenced by lifestyle changes and delayed childbearing, are also a major driver. Advances in reproductive technology have also enhanced the success rate. In addition, supportive regulatory policies in developed economies such as North America and Europe have created a more favourable environment for the growth of ART.

The use of assisted reproduction is now at a mature stage, with IVF clinics in the United States and Europe setting the standards. The main methods used are IVF, sperm freezing, sperm vitrification and sperm injection. The most well-known companies are the Fertility Institute of Illinois and CCRM Fertility. The emergence of telemedicine in the field of fertility treatment, together with the social shift towards family planning, has accelerated the growth of the market. Artificial intelligence and sperm freezing will shape the future of the market, bringing both efficiency and safety.

Future Outlook

The fertility services market is set to grow significantly from 2024 to 2035. It is estimated to grow from $27,510.9 million to $45 billion, at a CAGR of 4.57%. This growth is driven by a combination of rising infertility rates, increased awareness and acceptance of assisted reproductive technology (ART), and advancements in medical technology. As a result of the changing social attitudes towards ART, more couples and individuals are seeking treatment, which is increasing the penetration rate. This penetration rate is expected to reach 15% in 2035, compared to a projected 10% in 2024. This will reflect the growing reliance on ART for family planning.

Artificial intelligence in embryo selection and the use of genetic screening are expected to enhance the effectiveness and availability of fertility treatment. Furthermore, the favourable policies of the state and private institutions to reduce the financial burden of fertility treatment will further promote the growth of the market. The trend towards the use of telemedicine in the field of infertility consultation and the increasing popularity of egg freezing among younger women are expected to further stimulate the market. Consequently, the industry players will have to adopt new strategies to meet the changing needs and preferences of consumers and to remain competitive in the dynamic market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 36.13 Billion |

| Market Size Value In 2023 | USD 39.75 Billion |

| Growth Rate | 10.02% (2023-2032) |

Fertility Services Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.