Research methodology on Fertility Services Market

1.0 Introduction

The research report titled “Global Fertility Services Market” published by Market Research Future (MRFR) provides an in-depth analysis of the fertility services market, along with an assessment of current trends, market dynamics, and their expected impact on the global fertility services market in near future and forecasts from 2023 to 2032. Moreover, this report also classifies the fertility services market into various segments and offers insights into market trends, drivers, opportunities, and challenges impacting the overall market.

2.0 Research Methodology

This research is an extensive quantitative and qualitative study of the global Fertility Services market. The research methodology employed in this research report involves extensive secondary research, followed by primary research. The primary research entailed one-on-one and face-to-face interviews. Secondary research includes data collated from company websites, industry white papers, journal articles, and databases. The report also draws insights from competitive landscape analysis and detailed market segmental analysis.

2.1 Data Collection

The data collection phase of the research is carried out through extensive secondary and primary research. In the secondary research phase, a comprehensive review of trade publications, news sites, and industry websites is conducted to capture data from a wide range of sources. In the primary research phase, interviews with senior executives and industry experts were conducted to collect in-depth information about the market, competitors’ strategies, and the market dynamics in different regions.

2.2 Research Strategy

The research strategy adopted to analyze the fertility services market is two-pronged – qualitative and quantitative. The qualitative approach is used to understand the market drivers, challenges, and regional trends affecting the growth of the market. The statistical data collated from various industry sources are used to analyze the market size, share, volume and future projections.

2.3 Market segmentation

The global fertility services market is segmented into product type, end-user, and region.

By product type, the market is segmented into infertility Donor Services & Cryopreservation, Ovum Donation & Frozen Embryo, IVF Procedures, Artificial Insemination, Egg Donation, Surrogacy, and Others.

By end-user, the market is segmented into Hospitals, Fertility Clinics & Centers, Ambulatory Surgery Centers, and Others.

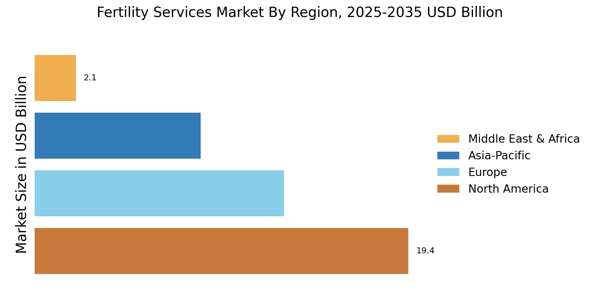

By region, the market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World (ROW).

2.4 Analysis Tools

The analysis tools used to capture the analysis of the fertility services market included SWOT Analysis, Porter’s Five Forces Analysis, and PESTEL Analysis. These various tools are employed to answer questions related to market developments, price structure, and industry trends that could affect the growth of the market during the forecast period. The focus is placed on the current market trends and how they are likely to shape the global fertility services market in the near future.

3.0 Expected Outcome/Conclusion

The fertility services market is expected to witness strong growth during the forecast period 2023 to 2032. Market players are focused on introducing new technologies and products to cater to a larger consumer base and cater to the increased demand for fertility services. The key players in the market are introducing new and advanced products for different types of fertility treatments to meet the growing demand for infertility treatments globally.

This report provides a detailed analysis of the market trends in different regions and provides insights into the competitive landscape and industry dynamics. Market players are innovating and launching new and advanced product offerings. Market players are focusing on enhancing their growth in different regions by taking advantage of government initiatives and regulations regarding fertility treatments. The market is expected to remain promising, as players are introducing new and innovative products and services for fertility treatments.