Fiber Optic Components Size

Market Size Snapshot

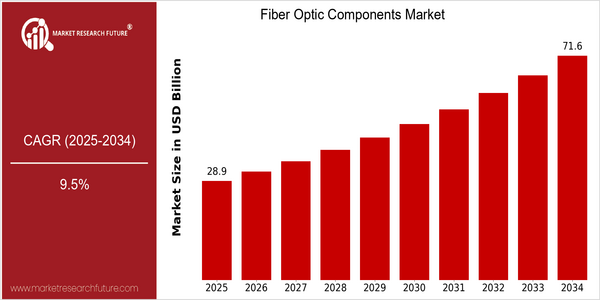

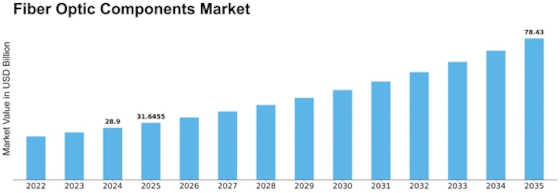

| Year | Value |

|---|---|

| 2025 | USD 28.89 Billion |

| 2034 | USD 71.62 Billion |

| CAGR (2025-2034) | 9.5 % |

Note – Market size depicts the revenue generated over the financial year

The fiber-optic components market is projected to grow at a CAGR of 4.3% from 2017 to 2025, and to expand to a CAGR of 6.8 % from 2026 to 2034. This represents a strong CAGR of 9.5% over the forecast period. The demand for high-speed Internet and the proliferation of data centers are the main drivers of this growth. Business and consumers are looking for faster and more reliable connections. In addition, the rise of smart cities and the Internet of Things (IoT) is accelerating the need for advanced fiber-optic technology to handle the huge data traffic generated by the connected devices. In response, leading fiber-optic component manufacturers such as Corning Incorporated, Finisar Corp., and Prysmian Group are investing in research and development to improve their products. Also, strategic initiatives such as acquisitions, joint ventures, and strategic alliances are becoming more common. Companies are trying to take advantage of their complementary strengths and expand their reach. Product launches have highlighted the dynamic nature of the market. The latest launches of high-capacity fiber-optic cables and advanced connectivity solutions have given the companies the opportunity to capitalize on the growing demand for fiber-optic technology in various industries.

Regional Market Size

Regional Deep Dive

The fibre-optic components market is experiencing a significant growth in various regions. This is due to the increasing demand for high-speed Internet, the development of telecommunications and the expansion of data centres. Each region has its own peculiarities, influenced by the rate of technology uptake, the regulatory environment and the economy. North America leads in innovation and development, Europe is concentrating on sustainable development and compliance, Asia-Pacific is rapidly expanding due to urbanization and digital transformation, the Middle East and Africa are investing in the telecommunications network, and Latin America is developing through the efforts of governments and private investors.

Europe

- In Europe, the European Union's Digital Single Market strategy aims to improve connectivity and digital services, leading to increased investments in fiber optic infrastructure across member states.

- Innovations in fiber optic technology, such as the development of bend-insensitive fibers, are being spearheaded by companies like Prysmian Group and Nexans, enhancing the efficiency and performance of fiber networks.

Asia Pacific

- The Asia-Pacific region is witnessing rapid urbanization and a surge in internet users, with countries like China and India leading the charge in fiber optic deployment to support their growing digital economies.

- Government initiatives, such as China's 'Broadband China' strategy, are significantly boosting investments in fiber optic infrastructure, which is expected to enhance connectivity and drive market growth.

Latin America

- Latin America is experiencing growth in the fiber optic market due to government programs aimed at improving internet access, such as Brazil's National Broadband Plan, which promotes the deployment of fiber networks.

- Private investments from companies like Telefónica and Oi are also driving the expansion of fiber optic infrastructure, enhancing connectivity in urban and rural areas alike.

North America

- The North American market is heavily influenced by major telecommunications companies like AT&T and Verizon, which are investing in fiber optic networks to enhance broadband services and meet the growing demand for data.

- Recent regulatory changes, such as the FCC's initiatives to promote broadband access in rural areas, are expected to drive the deployment of fiber optic components, thereby expanding market opportunities.

Middle East And Africa

- In the Middle East and Africa, countries like the UAE and South Africa are investing heavily in fiber optic networks to improve telecommunications infrastructure and support economic growth.

- The African Union's initiatives to enhance regional connectivity through fiber optic cables are expected to facilitate better access to information and communication technologies, thereby expanding the market.

Did You Know?

“Did you know that fiber optic cables can transmit data at speeds of up to 100 Gbps over long distances without significant loss of signal quality?” — International Telecommunication Union (ITU)

Segmental Market Size

The market for fiber optics is booming, driven by the demand for high-speed data transmission. The growth of cloud computing and the development of 5G are both pushing the market for fiber optics. Also, government policies that encourage the rollout of fiber-optic networks to remote areas are pushing demand. The market is currently in the process of being rolled out, with companies like Corning and Prysmian Group leading the way in innovation and production. The most notable projects are the rollout of fiber-optic networks in cities across North America and Europe, which will improve access to the Internet. In the areas of telecommunications, data centers and automation, fiber optics are vital to the transmission of data. Besides these, trends like the drive for sustainable development and government initiatives to improve the quality of the country's telecommunications networks are driving the market. Also, the development of new fiber-optic technologies such as WDM and advanced fiber-optic manufacturing methods are shaping the evolution of the industry.

Future Outlook

The Optical Components Market is projected to grow at a significant CAGR of 9.5% from 2025 to 2034. The growth will be driven by the increasing demand for high-speed Internet, driven by the proliferation of cloud computing, the Internet of Things (IoT), and 5G technology. In addition, as the demand for faster and more reliable data transmission increases, the penetration of fiber optic solutions in various industries, such as telecommunications, health care, and smart cities, will increase. In the future, the urban population will exceed 60%. Moreover, the development of cost-effective and efficient optical cables and components will also promote the market growth. Also, innovations in the manufacturing process and material will improve performance and reduce costs, which will enable fiber optics to be widely used in various applications. In addition, government policies to promote the development of broadband networks and digital transformation will also accelerate market growth. The integration of artificial intelligence into the management of optical networks and the increasing focus on sustainable development will further promote the development of the market.

Leave a Comment