Market Analysis

Fiber Optic Connector Market (Global, 2024)

Introduction

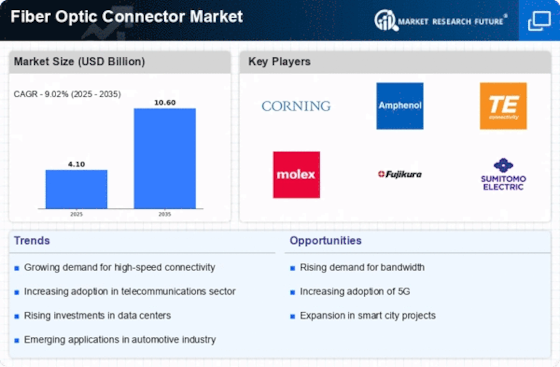

The fibre-optic connection market is expected to experience a considerable growth, as the need for high-speed data transmission continues to grow across several industries, such as telecommunications, data centres, and enterprise networks. With more and more companies relying on a robust and reliable network, the role of the fibre-optic connection in ensuring seamless and optimum performance becomes more and more important. In recent years, there have been many innovations in connection technology, which are based on the need for higher speed and lower latency. The cloud, the Internet of Things, and smart city initiatives are also driving the fibre-optic solutions market. This report analyses the key trends, developments, and opportunities in the fibre-optic connection market.

PESTLE Analysis

- Political

- The fiber-optics market will be influenced by political factors in 2024, including government initiatives to improve digital infrastructure. The US government, for example, has allocated $ 65 billion under the Broadband Development Act to increase access to high-speed Internet, which will directly affect the demand for fiber-optics. In addition, international trade policies and tariffs on imported components will affect the supply chain. The US imposes tariffs of up to 25 percent on some imported products, including optical fibers, which may lead to higher costs for manufacturers.

- Economic

- The year 2024. A brisk market for optical fibers. Telecommunications and data centers are growing. The telecommunications sector is expected to earn $1.7 trl., Much of this money will go into the modernization of existing networks. The unemployment rate in the technology sector is expected to be 3.5%. A stable labor market that encourages innovation and the production of optical fibers. This economic stability encourages investment in new technology and the development of new tools.

- Social

- In 2024, the public is clamoring for high-speed Internet and reliable connections, which is driving the demand for fiber-optic solutions. Surveys indicate that approximately 75% of consumers rate Internet speed and reliability as the most important factors in choosing their Internet service provider. This is resulting in increased investment in fiber-optic networks. Furthermore, the growing trend of remote work and distance learning is putting further pressure on the Internet, and thus on the demand for fiber-optic connections. Both households and businesses are looking to enhance their Internet connections.

- Technological

- A new fiber-optics market is on the way. Several innovations, such as the development of advanced plug-in connections, such as MTP and MPO, have increased the speed of data transmission and shortened the installation time. The 5G market is experiencing rapid growth, with an estimated 1.5 billion 5G connections worldwide by 2024. This will require the use of high-speed fiber-optic connections to cope with the increasing traffic. Smart technology is also boosting the efficiency of fiber-optic networks.

- Legal

- Legal factors affecting the fiber-optic connection market in 2024 include the compliance of telecommunications equipment with international standards and regulations. The International Telecommunications Union (ITU) has set specific standards for fiber-optic connections that manufacturers must comply with in order to ensure the safety and interoperability of their products. In addition, data protection laws, such as the General Data Protection Regulation (GDPR) in Europe, impose strict requirements on the management and confidentiality of data, which affects the design and implementation of fiber-optic networks to ensure compliance.

- Environmental

- In the year 2024, the market for fiber-optic cables will be characterized by a growing emphasis on environmentalism and eco-friendliness. Production of cables and fittings is subject to a number of regulations designed to reduce carbon dioxide emissions, and the European Union has set a goal of reducing greenhouse gas emissions by a total of 55 per cent by the year 2030. Furthermore, manufacturers are increasingly adopting eco-friendly materials and production processes, and an estimated 30 per cent of new fiber-optic products are now made from materials that are fully re-cyclable.

Porter's Five Forces

- Threat of New Entrants

- The market for fiber-optic connections has a medium barrier to entry, as it requires significant capital investment in both technology and manufacturing. The existing operators enjoy economies of scale and brand loyalty, which act as a deterrent to new entrants. However, technological advances and growing demand for high-speed Internet access could attract new companies looking to exploit growth opportunities.

- Bargaining Power of Suppliers

- Suppliers’ bargaining power in the fiber-optics market is relatively low. There are numerous suppliers of both components and materials, which leads to a highly competitive market. Suppliers can easily be replaced if prices rise or quality decreases, which weakens their bargaining power. Furthermore, the availability of alternative materials and technologies reduces suppliers’ bargaining power even further.

- Bargaining Power of Buyers

- The buyer in the fiber-optic cable market has considerable negotiating power due to the presence of several suppliers and the availability of various products. Large telecommunications operators and data centers can usually negotiate better prices and terms of trade because they often purchase in large quantities. And the growing demand for high-speed data connections also gives them the power to bargain for the best prices.

- Threat of Substitutes

- The threat of substitution in the market for fibre-optic connections is moderate. In spite of their superiority in terms of speed and bandwidth, alternative products such as copper cables and wireless solutions can be used in certain applications. However, as the demand for high-speed data transmission increases, the advantages of fibre-optic connections will probably limit the impact of substitutes.

- Competitive Rivalry

- Competition is intense in the market for fiber-optic cables, and many manufacturers are vying for a share of the market. Competition is based on price, quality, and technological innovation. The speed of technological change and the growing demand for connection solutions are also putting further pressure on competition. To maintain their competitive edge, companies must keep improving and innovating.

SWOT Analysis

Strengths

- High data transmission speeds and bandwidth capabilities.

- Growing demand for high-speed internet and telecommunications.

- Durability and resistance to electromagnetic interference.

- Increasing adoption in various industries such as healthcare, IT, and telecommunications.

Weaknesses

- Higher initial installation costs compared to traditional copper connectors.

- Fragility of fiber optic cables can lead to higher maintenance costs.

- Limited availability of skilled technicians for installation and maintenance.

- Complexity in handling and installation may deter some users.

Opportunities

- Expansion of 5G networks driving demand for fiber optic solutions.

- Emerging markets showing increased investment in telecommunications infrastructure.

- Technological advancements leading to more efficient and cost-effective products.

- Growing trend of smart cities and IoT applications requiring robust connectivity.

Threats

- Intense competition from alternative technologies such as wireless solutions.

- Economic downturns affecting capital expenditure in infrastructure projects.

- Supply chain disruptions impacting availability of raw materials.

- Regulatory challenges and standards compliance in different regions.

Summary

The fibre-optic market in 2024 will be characterized by its strengths in high-speed data transmission and the growing demand from industries, but also by its weaknesses in high installation costs and a lack of skilled labor. Opportunities are provided by the expansion of 5G networks and technological development, while threats are competition and economic conditions. In this dynamic environment, strategic focus on innovation and market development is key.

Leave a Comment