Fiberglass Flooring Size

Fiberglass Flooring Market Growth Projections and Opportunities

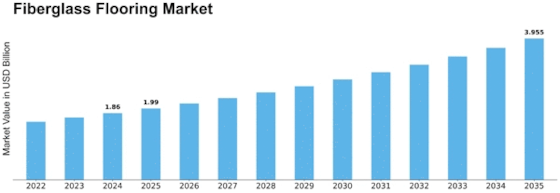

Various market forces have an impact on the fiberglass flooring market, determining its growth and dynamics. The rising demand for durable and low-maintenance floors in residential, commercial, and industrial sectors constitutes a major factor. Resilience, resistance to wear and tear, and ease of cleaning make fiberglass flooring an optimal choice. Fiberglass Flooring Market Size was valued at USD 1635.20 million in 2022. In addition, the Fiberglass Flooring Industry is expected to grow from USD 1746.39 million by 2023 to USD 3259.58 million by 2032 at a CAGR of 7.2% during the forecast period (2023 - 2032). Also, the construction sector has a significant influence on the fiberglass flooring market elements, with growing global construction activities, especially in developing nations' stronger needs for robust flooring solutions. The size of this market can also be influenced by environmental issues such as sustainability. This recyclability and minimal environmental impact during production make it one of the best choices today for fiberglass floors due to the increased focus on sustainable products among consumers worldwide today. Rising awareness around ecological footprints has led consumers and corporates alike to prefer environmentally friendly flooring alternatives in line with green building practices. In another case, innovation and technological advances are also among the key factors driving this market forward. Through continuous R&D efforts, various properties inherent within fiberglass floorings have been improved, making them more versatile for different applications brought about by technological advances. The latest technologies are responsible for better performance characteristics of fiberglass floorings while reducing their production costs at once because they have become even more competitive. In addition, economic factors significantly affect trends in the marketplace. Construction activities and consumer spending patterns depend on how economically regions or countries develop as whole entities. A rise in construction projects and consumer confidence during economic growth periods boosts the fiberglass flooring industry. Conversely, economic downturns may lead to a slowdown in construction activities, thus negatively impacting the market. Furthermore, globalization and international trade are instrumental in shaping the fiberglass flooring market. Geographical borders no longer confine raw materials availability, production technologies, and market trends as economies become more integrated. For instance, this aspect allows manufacturers of fiberglass floorings to enter different markets where they can address customer needs that are not only diverse but also grow from one place to another. However, it exposes them to worldwide economic uncertainties as well as trade conflicts, hence demanding caution lest strategic plans fail to meet these challenges accordingly.

Leave a Comment