-

Executive Summary

-

Market Attractiveness Analysis

- Global Financial Analytics Market, by Component

- Global Financial Analytics Market, by Deployment

- Global Financial Analytics Market, by Organization Size

- Global Financial Analytics Market, by Application

- Global Financial Analytics Market, by Vertical

- Financial Analytics Market, by Region

-

Scope of the Report

-

Market Definition

-

Scope of the Study

-

Market Structure

-

Key Buying Criteria

-

Macro Factor Indicator Analysis

-

Market Research Methodology

-

Research Process

-

Primary Research

-

Secondary Research

-

Market Size Estimation

-

Forecast Model

-

List of Assumptions

-

Market Insights

-

Industry Overview of the Global Financial Analytics Market

-

Introduction

-

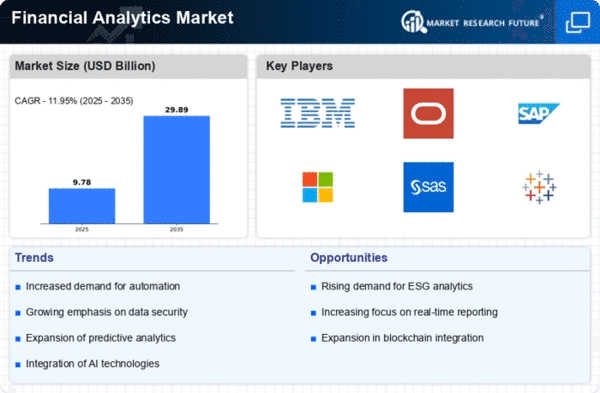

Drivers

- Growing need on data driven financial decisions in end-users

- Advancement in Business Intelligence (BI) and business analytics tools

- Growing adoption of predictive analytics

- Drivers Impact Analysis

-

Restraints

- Regulations and standards

- Security and privacy concerns

- Restraints Impact Analysis

-

Opportunities

- Technological advancements such as AI and machine learning

- Growing adoption of predictive analytics

-

Challenges

- Integration of data from data silos

-

Market Factor Analysis

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitutes

- Intensity of Rivalry

-

Value Chain/Supply Chain of the Global Financial Analytics Market

-

Global Financial Analytics Market, by Component

-

Introduction

-

Software

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Services

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Global Financial Analytics Market, by Deployment Type

-

Introduction

-

On-Premise

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Cloud

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Global Financial Analytics Market, by Organization Size

-

Introduction

-

Large Enterprises

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Small and Medium-Sized Enterprises

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Global Financial Analytics Market, by Application

-

Introduction

-

Governance, Risk, and Compliance Management

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Customer Management

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Wealth Management

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Financial Forecasting and Budgeting

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Transaction Monitoring

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Stock Management

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Fraud Detection and Prevention

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Others

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Global Financial Analytics Market, by Vertical

-

Introduction

-

BFSI

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Retail & Ecommerce

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Government and Defense

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Healthcare and Life Sciences

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Energy and Utilities

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Manufacturing and Automotive

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Telecommunication and IT

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Transportation and Logistics

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Others

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Region, 2020–2027

-

Global Financial Analytics Market, by Region

-

Introduction

-

North America

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Component, 2020–2027

- Market Estimates & Forecast, by Deployment Mode, 2020–2027

- Market Estimates & Forecast, by Organization Size, 2020–2027

- Market Estimates & Forecast, by Application, 2020–2027

- Market Estimates & Forecast, by Vertical, 2020–2027

- US

- Canada

- Mexico

-

Europe

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Component, 2020–2027

- Market Estimates & Forecast, by Deployment Mode, 2020–2027

- Market Estimates & Forecast, by Organization Size, 2020–2027

- Market Estimates & Forecast, by Application, 2020–2027

- Market Estimates & Forecast, by Vertical, 2020–2027

- Germany

- France

- UK

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Component, 2020–2027

- Market Estimates & Forecast, by Deployment Mode, 2020–2027

- Market Estimates & Forecast, by Organization Size, 2020–2027

- Market Estimates & Forecast, by Application, 2020–2027

- Market Estimates & Forecast, by Vertical, 2020–2027

- China

- India

- Japan

- Rest of Asia-Pacific

-

Rest of the World

- Market Estimates & Forecast, 2020–2027

- Market Estimates & Forecast, by Component, 2020–2027

- Market Estimates & Forecast, by Deployment Mode, 2020–2027

- Market Estimates & Forecast, by Organization Size, 2020–2027

- Market Estimates & Forecast, by Application, 2020–2027

- Market Estimates & Forecast, by Vertical, 2020–2027

- Middle East & Africa

- South America

-

Company Landscape

-

Competitive Overview

-

Competitor Dashboard

-

Major Growth Strategies in the Global Financial Analytics Market

-

Competitive Benchmarking

-

Market Share Analysis

-

XXXX: The leading player in terms of number of developments in the Global Financial Analytics Market

-

Key Developments & Growth Strategies

- Product Launches/Service Deployment

- Mergers & Acquisitions

- Joint Ventures

- Business Expansion

-

Company Profiles

-

Fair Isaac Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Oracle Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

TIBCO Software Inc.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

IBM Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Zoho Corporation

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Google

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

SAP

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

MicroStrategy Incorporated

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

TABLEAU SOFTWARE

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Teradata

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

SAS Institute Inc.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Rosslyn Data Technologies

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Deloitte Touche Tohmatsu Limited

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

QlikTech International AB

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

ALTERYX, INC.

- Company Overview

- Product/Business Segment Overview

- Financial Updates

- Key Developments

-

Conclusion

-

LIST OF TABLES

-

Global Financial Analytics Market, by Region, 2020–2027

-

North America: Financial Analytics Market, by Country, 2020–2027

-

Europe: Financial Analytics Market, by Country, 2020–2027

-

Asia-Pacific: Financial Analytics Market, by Country, 2020–2027

-

Middle East & Africa: Financial Analytics Market, by Country, 2020–2027

-

South America: Financial Analytics Market, by Country, 2020–2027

-

Global Financial Analytics Component Market, by Region, 2020–2027

-

North America: Financial Analytics Component Market, by Country, 2020–2027

-

Europe: Financial Analytics Component Market, by Country, 2020–2027

-

Table10 Asia-Pacific: Financial Analytics Component Market, by Country, 2020–2027

-

Table11 Middle East & Africa: Financial Analytics Component Market, by Country, 2020–2027

-

Table12 South America: Financial Analytics Component Market, by Country, 2020–2027

-

Table13 Global Financial Analytics Deployment Mode Market, by Region, 2020–2027

-

Table14 North America: Financial Analytics Deployment Mode Market, by Country, 2020–2027

-

Table15 Europe: Financial Analytics Deployment Mode Market, by Country, 2020–2027

-

Table16 Asia-Pacific: Financial Analytics Deployment Mode Market, by Country, 2020–2027

-

Table17 Middle East & Africa: Financial Analytics Deployment Mode Market, by Country, 2020–2027

-

Table18 South America: Financial Analytics Deployment Mode Market, by Country, 2020–2027

-

Table19 Global Financial Analytics Vertical Market, by Region, 2020–2027

-

Table20 North America: Financial Analytics Vertical Market, by Country, 2020–2027

-

Table21 Europe: Financial Analytics Vertical Market, by Country, 2020–2027

-

Table22 Asia-Pacific: Financial Analytics Vertical Market, by Country, 2020–2027

-

Table23 Middle East & Africa: Financial Analytics Vertical Market, by Country, 2020–2027

-

Table24 South America: Financial Analytics Vertical Market, by Country, 2020–2027

-

Table25 Global Financial Analytics Component Market, by Region, 2020–2027

-

Table26 Global Financial Analytics Deployment Type Market, by Region, 2020–2027

-

Table27 Global Financial Analytics Vertical Market, by Region, 2020–2027

-

Table28 North America: Financial Analytics Market, by Country

-

Table29 North America: Financial Analytics Market, by Component

-

Table30 North America: Financial Analytics Market, by Deployment Type

-

Table31 North America: Financial Analytics Market, by Vertical

-

Table32 Europe: Financial Analytics Market, by Country

-

Table33 Europe: Financial Analytics Market, by Component

-

Table34 Europe: Financial Analytics Market, by Deployment Type

-

Europe: Financial Analytics Market, by Vertical

-

Table36 Asia-Pacific: Financial Analytics Market, by Country

-

Table37 Asia-Pacific: Financial Analytics Market, by Component

-

Table38 Asia-Pacific: Financial Analytics Market, by Deployment Type

-

Asia-Pacific: Financial Analytics Market, by Vertical

-

Table40 Middle East & Africa: Financial Analytics Market, by Country

-

Table41 Middle East & Africa: Financial Analytics Market, by Component

-

Table42 Middle East & Africa: Financial Analytics Market, by Deployment Type

-

Table43 Middle East & Africa: Financial Analytics Market, by Vertical

-

Table44 South America: Financial Analytics Market, by Country

-

Table45 South America: Financial Analytics Market, by Component

-

Table46 South America: Financial Analytics Market, by Deployment Type

-

Table47 South America: Financial Analytics Market, by Vertical

-

LIST OF FIGURES

-

Global Financial Analytics Market Segmentation

-

Forecast Methodology

-

Porter’s Five Forces Analysis of the Global Financial Analytics Market

-

Value Chain of the Global Financial Analytics Market

-

Share of the Global Financial Analytics Market, by Country, 2020 (in %)

-

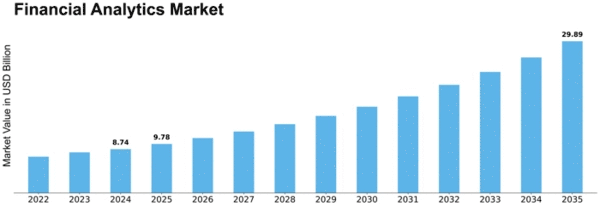

Global Financial Analytics Market, 2020–2027

-

Sub-Segments of Component

-

Global Financial Analytics Market Size, by Component, 2020

-

Share of the Global Financial Analytics Market, by Component, 2020–2027

-

Global Financial Analytics Market Size, by Deployment Type, 2020

-

Share of the Global Financial Analytics Market, by Deployment Type, 2020–2027

-

Global Financial Analytics Market Size, by Vertical, 2020–2027

-

Share of Global Financial Analytics Market, by Vertical, 2020–2027

Leave a Comment