- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

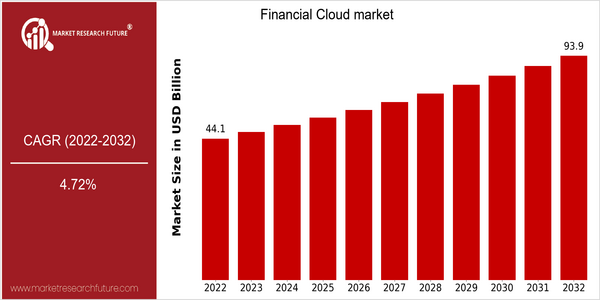

| Year | Value |

|---|---|

| 2022 | USD 44.11 Billion |

| 2032 | USD 93.92 Billion |

| CAGR (2024-2032) | 4.72 % |

Note – Market size depicts the revenue generated over the financial year

The Financial Cloud market is poised for significant growth, with a current valuation of USD 44.11 billion in 2022, projected to reach USD 93.92 billion by 2032. This growth trajectory reflects a compound annual growth rate (CAGR) of 4.72% from 2024 to 2032, indicating a steady expansion in the adoption of cloud-based financial solutions. The increasing demand for cost-effective, scalable, and secure financial services is driving this market forward, as organizations seek to enhance operational efficiency and improve customer experiences through digital transformation. Several technological trends are contributing to this growth, including the rise of artificial intelligence and machine learning in financial analytics, the increasing importance of data security and compliance, and the shift towards remote work environments. Key players in the Financial Cloud space, such as Amazon Web Services, Microsoft Azure, and Oracle, are actively investing in innovative solutions and forming strategic partnerships to enhance their service offerings. For instance, recent collaborations between fintech startups and established cloud providers are facilitating the development of tailored financial solutions, further propelling market growth and positioning the Financial Cloud as a critical component of the modern financial ecosystem.

Regional Market Size

Regional Deep Dive

The Financial Cloud market is experiencing significant growth across various regions, driven by the increasing demand for digital transformation in financial services. In North America, the market is characterized by a high adoption rate of cloud technologies among financial institutions, spurred by the need for enhanced operational efficiency and data security. Europe is witnessing a surge in regulatory compliance requirements, pushing organizations to adopt cloud solutions that facilitate better data management and reporting. Meanwhile, the Asia-Pacific region is rapidly emerging as a key player, with a growing number of fintech startups leveraging cloud technologies to innovate and expand their services. The Middle East and Africa are also seeing increased investment in cloud infrastructure, driven by government initiatives aimed at modernizing financial services. Latin America is gradually embracing cloud solutions, although challenges such as regulatory hurdles and infrastructure limitations remain.

Europe

- The European Union's General Data Protection Regulation (GDPR) has prompted financial institutions to invest in cloud solutions that ensure data privacy and compliance, leading to a surge in demand for secure cloud services.

- Fintech companies in the UK and Germany are increasingly utilizing cloud platforms to develop innovative financial products, with organizations like Revolut and N26 setting benchmarks for digital banking services.

Asia Pacific

- The rapid growth of fintech in Asia-Pacific, particularly in countries like Singapore and India, is driving the adoption of cloud solutions, with startups leveraging cloud infrastructure to scale their operations quickly.

- Government initiatives, such as the Monetary Authority of Singapore's (MAS) support for fintech innovation, are fostering a conducive environment for cloud adoption in the financial sector.

Latin America

- The Brazilian government is implementing regulations that encourage the adoption of cloud technologies in the financial sector, aiming to enhance financial inclusion and digital transformation.

- Fintech companies in Latin America, such as Nubank and Mercado Pago, are increasingly leveraging cloud solutions to offer innovative financial services, despite facing challenges related to infrastructure and regulatory compliance.

North America

- The rise of Open Banking initiatives in North America is driving financial institutions to adopt cloud solutions that enhance customer experience and data sharing capabilities, with companies like Plaid leading the charge.

- Major players such as Amazon Web Services and Microsoft Azure are expanding their offerings tailored specifically for the financial sector, focusing on compliance and security features to meet stringent regulatory requirements.

Middle East And Africa

- The UAE's government has launched initiatives like the Dubai Blockchain Strategy, which encourages financial institutions to adopt cloud-based solutions for enhanced transparency and efficiency.

- In South Africa, the Financial Sector Conduct Authority (FSCA) is promoting the use of cloud technologies to improve regulatory compliance and risk management among financial institutions.

Did You Know?

“As of 2023, over 70% of financial institutions in North America have adopted some form of cloud technology, significantly enhancing their operational efficiency and customer service capabilities.” — Gartner Research

Segmental Market Size

The Financial Cloud segment plays a crucial role in the overall financial services market, currently experiencing robust growth driven by increasing demand for digital transformation and enhanced operational efficiency. Key factors propelling this segment include the rising need for secure data storage solutions and the regulatory push for compliance with data protection laws, such as GDPR and CCPA. Additionally, the shift towards remote work has accelerated the adoption of cloud-based financial solutions, enabling organizations to maintain business continuity and agility. Currently, the Financial Cloud segment is in a scaled deployment stage, with notable leaders like AWS, Microsoft Azure, and Google Cloud providing tailored solutions for financial institutions. Use cases are diverse, ranging from core banking systems and payment processing to risk management and fraud detection. The ongoing trend of fintech innovation, coupled with macro events like the COVID-19 pandemic, catalyzes the shift towards cloud solutions. Technologies such as artificial intelligence and machine learning are also shaping this segment, enhancing analytics capabilities and driving smarter decision-making in financial operations.

Future Outlook

The Financial Cloud market is poised for significant growth from 2022 to 2032, with a projected market value increase from $44.11 billion to $93.92 billion, reflecting a compound annual growth rate (CAGR) of 4.72%. This growth trajectory is underpinned by the increasing adoption of cloud-based solutions among financial institutions, driven by the need for enhanced operational efficiency, scalability, and cost-effectiveness. As organizations continue to migrate their operations to the cloud, we anticipate that by 2032, approximately 70% of financial services will be utilizing cloud technologies, up from around 40% in 2022, indicating a robust shift towards digital transformation in the sector. Key technological drivers such as advancements in artificial intelligence, machine learning, and data analytics are expected to further propel the Financial Cloud market. These technologies enable financial institutions to leverage vast amounts of data for improved decision-making, risk management, and customer engagement. Additionally, regulatory frameworks promoting data security and compliance will encourage more firms to adopt cloud solutions, ensuring that they meet stringent requirements while benefiting from the flexibility and innovation that cloud services offer. Emerging trends, including the rise of fintech companies and the increasing importance of cybersecurity, will also shape the landscape, as traditional banks and new entrants alike seek to enhance their service offerings and maintain competitive advantages in an evolving market.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 44.11 billion |

| Growth Rate | 11.40% (2022-2030) |

Financial Cloud Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.