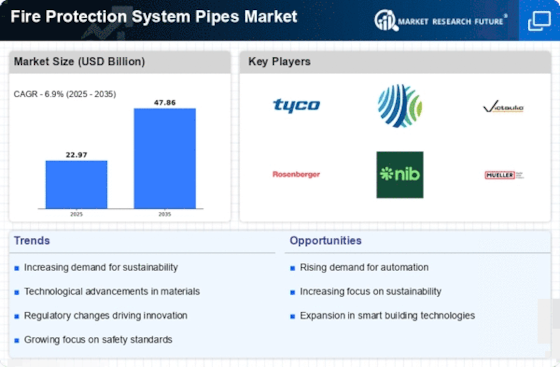

Market Share

Fire Protection System Pipes Market Share Analysis

The Fire protection system pipes Market, an essential segment within the broader fireplace safety enterprise, employs a lot of marketplace share positioning techniques to establish an awesome presence in a competitive environment. Market leaders prioritize continuous innovation in fire protection system pipes. This involves developing pipes with advanced materials, such as corrosion-resistant alloys or thermoplastic substances, to decorate durability and overall performance. Innovative product offerings set corporations apart within the market. Tailoring fire protection system pipes for specific programs is a strategic technique. Manufacturers provide pipes in numerous sizes, substances, and configurations to meet the various desires of industries, such as business buildings, industrial centers, and residential complexes. Customization complements marketplace competitiveness. Forming strategic partnerships with fireplace protection machine installers is a collaborative marketplace positioning method. Companies collaborate with installers to understand project necessities, provide technical assistance, and ensure seamless integration of their pipes into ordinary fireplace safety systems. These partnerships contribute to marketplace visibility and boom. The marketplace emphasizes the significance of corrosion resistance and longevity in fire protection system pipes. Manufacturers invest in materials and coatings that resist corrosion, making sure the pipes preserve their structural integrity over a prolonged lifespan. Expanding strategically into new international markets is crucial for marketplace growth. Fire protection system pipe manufacturers set up a presence in areas with increasing urbanization, infrastructure development, and heightened recognition of fireplace protection. Offering responsive customer support and training is vital. Fire protection system pipe producers prioritize consumer delight by offering technical help, schooling sessions, and after-income help. Implementing strategic pricing fashions is critical for marketplace positioning. Fire protection system pipe producers develop pricing techniques that stabilize competitiveness with profitability. Establishing a robust online presence through virtual advertising is essential in the modern-day enterprise panorama. Building a robust emblem and handling reputation is essential for market popularity. Fire protection system pipe producers put money into branding efforts, highlighting product reliability, compliance, and innovative features. Adopting a proactive method of regulatory compliance is critical. Fire protection system pipe carriers live knowledgeable about evolving rules related to hearth safety, substance standards, and setup practices. Investing in team member education and improvement is a strategic move. Fire protection system pipes groups make sure that their team of workers is nicely versed in technical specifications, enterprise standards, and customer support. Continuous tracking of marketplace developments is pivotal for staying ahead of the competition. Implementing energy-efficient production practices is a complete marketplace positioning strategy.

Leave a Comment