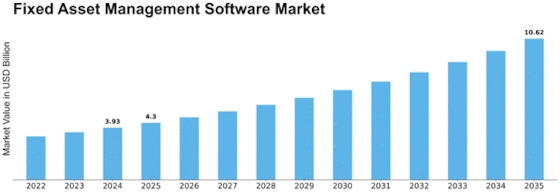

Fixed Asset Management Software Size

Fixed Asset Management Software Market Growth Projections and Opportunities

The Fixed Asset Management Software market is witnessing substantial growth as businesses recognize the importance of efficiently managing and tracking their assets. In this competitive landscape, companies are employing various market share positioning strategies to establish a strong presence and gain a larger market share.

Product differentiation is a key strategy used in the Fixed Asset Management Software market. Vendors aim to develop unique features and capabilities that set their software apart from competitors. This could include advanced asset tracking and maintenance functionalities, integration with other business systems, or customizable reporting capabilities. By offering innovative and value-added features, companies can position themselves as leaders in the market and attract customers who prioritize specific functionalities.

Target market segmentation is another effective positioning strategy employed by Fixed Asset Management Software vendors. They identify specific industries or verticals that have unique asset management needs and tailor their offerings accordingly. For example, companies may develop specialized solutions for healthcare, manufacturing, or construction sectors. By understanding the specific challenges and requirements of different industries, vendors can position themselves as experts in addressing those needs and gain a competitive advantage.

Price positioning is also a crucial factor in market share positioning within the Fixed Asset Management Software market. Some vendors choose to compete on price, offering affordable software solutions to attract cost-conscious customers. This can be effective in gaining market share, particularly in price-sensitive markets. On the other hand, some companies position themselves as premium providers, offering comprehensive asset management software with advanced features and scalability. This approach appeals to customers who prioritize performance and are willing to invest in robust asset management capabilities.

Partnerships and collaborations are another effective market share positioning strategy in the Fixed Asset Management Software market. By partnering with other technology providers or integrating their software with popular business systems, vendors can expand their reach and leverage their partners' customer base. Integration with ERP systems, financial software, or IoT platforms can provide vendors with a competitive advantage and increase their visibility in the market. Furthermore, collaborations with complementary technology providers can lead to joint marketing efforts and strengthen the overall market position of Fixed Asset Management Software vendors.

Effective marketing and branding are crucial in market share positioning within the Fixed Asset Management Software market. Vendors invest in creating compelling marketing campaigns that highlight the benefits and advantages of their software solutions. This includes thought leadership content, case studies, and customer testimonials that demonstrate the value and ROI of their products. By building a strong brand reputation and establishing thought leadership, Fixed Asset Management Software vendors can differentiate themselves from competitors and gain market share.

Leave a Comment