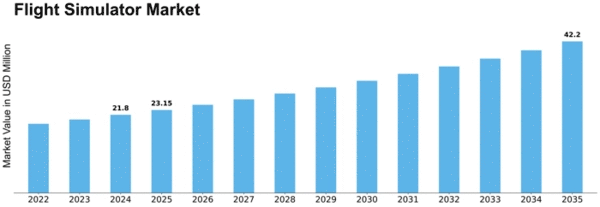

Flight Simulator Size

Flight Simulator Market Growth Projections and Opportunities

As, the aviation industry continues to experience significant growth and changes that affect operations in the flight simulator market. This is mainly driven by the growing focus on pilot training and skill development. With the increasing interest in air travel, airlines and aviation bodies are putting more resources into developing high-quality training programs for competent pilot workforces. Flight simulators have a significant role in giving realistic and immersive training, where pilots are able to develop their skills through different scenarios without needing real aircraft. The development of technologies is the main driver behind Flight Simulator market. Simulators that are highly realistic and sophisticated keep on increasing due to continuous innovation in the technology associated with simulation, graphics as well as software. Immersive training is enhanced using high-fidelity visuals, motion platforms and virtual reality integration replicating the complexities of different aircraft types and various flying conditions. These technological developments do not only enhance the effectiveness of training, but also save on costs by minimizing requirements for real flights and fuel burns.

The Flight Simulator market dynamics depend on regulatory requirements and safety standards. Across the globe, aviation authorities enforce stringent training and certification requirements for pilots. These standards must be followed by flight simulators to ensure that training programs accurately reflect real-world scenarios. Regulations address new challenges arising and improvements in the development of aviation technology. This helps meeting all compliance requirements while practising trust among regulators of this field as well its training institutions. Key players and market competition are the factors that greatly influence flight simulator market. Established simulation technology providers as well as emerging players are actively involved in the production of high quality simulators. Intensive competition motivates innovation and forces firms to invest in researching simulator technologies that become more realistic, cost-effective, and versatile. The competitive environment also impacts pricing strategies and services being offered to training institutions as well as aviation organizations giving them the opportunity for a wide variety of choices that would cater precisely into their own requirements.

Leave a Comment