Formulation Development Outsourcing Market Overview

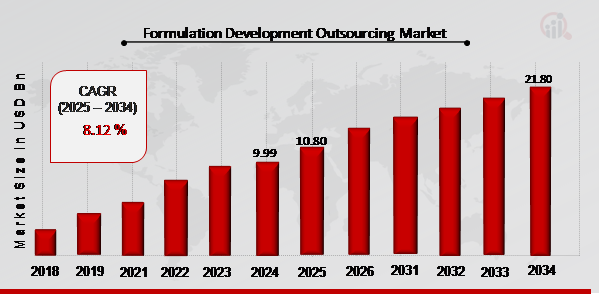

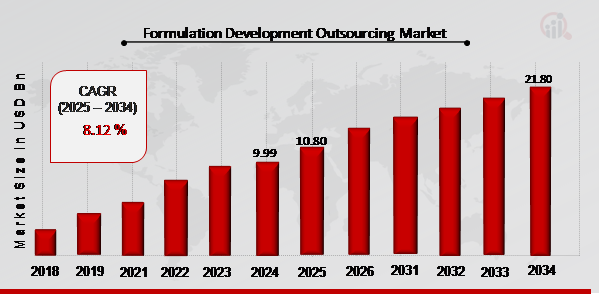

As per MRFR analysis, the Formulation Development Outsourcing Market Size was estimated at 9.99 (USD Billion) in 2024. The Formulation Development Outsourcing Market Industry is expected to grow from 10.8 (USD Billion) in 2025 to 21.8 (USD Billion) till 2034, at a CAGR (growth rate) is expected to be around 8.12% during the forecast period (2025 - 2034).

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Formulation Development Outsourcing Market Trends

- Demand is high in response to the increased R&D activities to propel market growth.

The growing number of pharmaceutical and biopharmaceutical enterprises outsourcing their services. The growing trend of patent protection expiration of major drugs is driving the market growth. For instance, according to an update in 2021 by the Generics and Biosimilar Initiative, as an element of ongoing activities to enhance the quality of generics and provide an efficient and competitive generics need, the Korean Ministry of Food and Drug Safety (MFDS) declared that 158 patents for pharmaceutical products were expected to expire in 2021. The MFDS's Green List declares that 44 of the patents will be ready for rapid generics entry, having no additional patents on the products concerned. Thus, this increases the demand for formulation development outsourcing for substitute candidates, thereby contributing to the market CAGR.

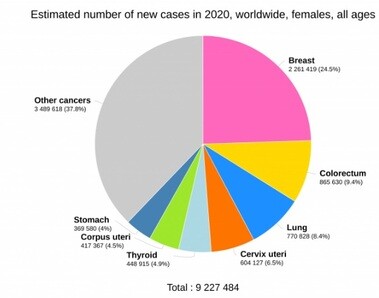

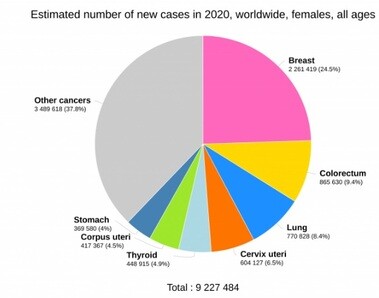

Figure 1: Number of people diagnosed with cancer around the globe

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

However, the growing demand for overcoming the risk associated with formulation development outsourcing further contributes to market growth. As per the report by IQVIA, in developed countries, the demand for generics and biosimilars is expected to grow, improving the medicine spending in these countries. This is likely to improve the demand for formulation development outsourcing of generics and biosimilar post-pandemic. Furthermore, despite the COVID-19 pandemic's immediate concerns, the pharmaceutical industry's quest for innovative and effective therapeutics continues to drive longer-term growth, and clinical research for new and existing COVID-19 therapies continues to expand. Thus, it is anticipated that this aspect will accelerate formulation development outsourcing market revenue globally.

Formulation Development Outsourcing Market Segment Insights

Formulation Development Outsourcing Services Insights

The market segments of formulation development outsourcing, based on services, includes pre-formulation services and formulation optimization. The formulation optimization segment held the majority market share in 2022 in the. Formulation development outsourcing is required in each stage of clinical trials, and the number of clinical studies has increased significantly over the years. According to ClinicalTrials.gov, over 293,251 research studies were registered in 2019, while the number of registered studies climbed to 362,503 in 2021. However, pre-formulation services are the fastest-growing category because the growing number of clinical studies is likely to positively impact the market growth for formulation development outsourcing.

Formulation Development Outsourcing Dosage Form Insights

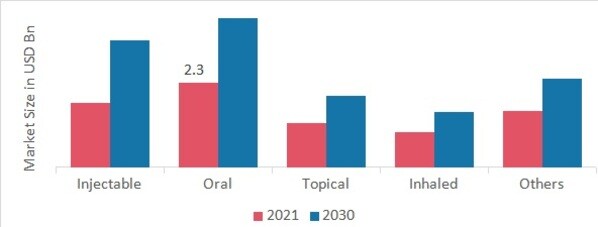

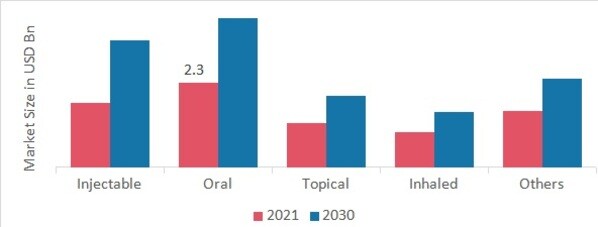

The formulation development outsourcing market segmentation, based on dosage form, includes injectable, oral, topical, inhaled, and others. The oral segment dominated the market growth in 2022 and is projected to be the faster-growing segment during the forecast period, 2023-2030. Oral formulations are used in treating common diseases such as migraines, fever, infectious diseases, and diabetes, among others. Oral formulations are self-administering and do not require a trained physician for drug administration. However, the injectable is the fastest-growing category over the forecast period due to the high bioavailability of injectable formulations leading to the immediate onset of action is the prime factor for its fastest growth.

Figure 2: Formulation Development Outsourcing Market, by Form, 2022 & 2030 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Formulation Development Outsourcing Application Insights

The formulation development outsourcing market data, based on application, includes oncology, genetic disorders, neurology, infectious disease, respiratory, cardiovascular, and others. The oncology segment dominated the market revenue of formulation development outsourcing in 2022 and is projected to be the faster-growing category over the forecast period, 2022-2030. Cancer is one of the primary causes of demise globally, which has significantly led to the demand for new cancer therapies. According to ClinicalTrials.gov, as of June 6, 2022, over 29,662 studies were in the active stage for cancer. The high number of clinical studies for cancer is likely to improve the demand for formulation development outsourcing services for cancer treatment. However, respiratory is the fastest-growing category due to the growing number of people suffering from respiratory problems.

Formulation Development Outsourcing End User Insights

The market data of ormulation development outsourcing, based on end users, include pharmaceutical and biopharmaceutical, government, and academic institutes. The academic institutes' segment dominated the market revenue of formulation development outsourcing in 2022 due to growing R&D costs. However, pharmaceutical and biopharmaceutical is the fastest-growing category due to the rising number of pharmaceutical and biopharmaceutical companies outsourcing their services.

Formulation Development Outsourcing Regional Insights

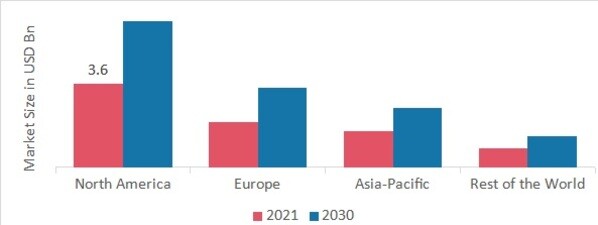

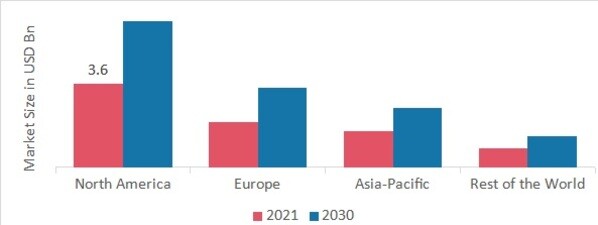

By region, the study provides market insights into North America, Europe, Asia-Pacific and Rest of the World. The North America formulation development outsourcing market accounted for USD 3.61 billion in 2022, with a share of around 45.80%, and is expected to exhibit a significant CAGR growth during the study period. This can be attributed to the increasing burden of chronic diseases and the existence of key players in the region, especially in the US. As most of the prominent drugs are in the stage of patent expiration, major players are involved in novel drug formulation development outsourcing, which may drive market growth in the region.

Further, the major countries studied in the market report are: The U.S, Germany, Canada, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: FORMULATION DEVELOPMENT OUTSOURCING MARKET SHARE BY REGION 2022 (%)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe formulation development outsourcing market accounts for the second-largest market share. This is attributed to the presence of a significant number of CROs offering cost-effective formulation developing services, which is one of the major reasons for the largest market share. Moreover, UK market of formulation development outsourcing held the largest market share, and the Germany market of formulation development outsourcing was the fastest-growing market in the region.

The Asia-Pacific formulation development outsourcing market is expected to enhance at the fastest CAGR from 2023 to 2030. Several market players implement strategic initiatives, thereby contributing to market growth. For instance, in October 2021, the Department of Pharmaceuticals (India) drafted new rules to reduce the time required for the approval of innovative products by at least 50% within the next two years, to improve the R&D activities in the country. Such initiatives will likely improve the demand for formulation development outsourcing services in the country. Further, the China market of formulation development outsourcing held the largest market share, and the India market of formulation development outsourcing was the fastest-growing market in the region.

Formulation Development Outsourcing Key Market Players & Competitive Insights

Key market players are spending a huge amount of money on R&D to expand their product lines, which will assist the market of formulation development outsourcing to grow even more. Market participants are also taking several strategic initiatives to expand their worldwide footprint, with key market developments including new product launches, mergers and acquisitions, contractual agreements, increased investments, and collaboration with other organizations. Competitors in the formulation development outsourcing industry must provide cost-effective items to expand and survive in an increasingly competitive and increasing market environment.

One of the major business strategies manufacturers adopts in the formulation development outsourcing industry to benefit clients and enhance the market sector is manufacturing locally to reduce operating costs. In recent years, the formulation development outsourcing industry has provided drugs with some of the most significant advances. In the formulation development outsourcing market players such as Charles Rover laboratories (US), Laboratory Corporation of America (US), Intertek (US) and others are working on enhancing the market demand by investing in research and formulation development outsourcing activities.

Recro Pharma (REPR) is a specialty pharmaceutical firm that operates through two business divisions. An Acute Care division and a revenue-generating CDMO division. Each of these divisions is deemed a reportable segment for financial reporting purposes. In January 2022, Recro Pharma Inc., an agreement development and manufacturing firm dedicated to solving difficult formulation and manufacturing challenges, especially in small molecule therapeutic development, was awarded a new formulation development and manufacturing contract from a critical department of the US government.

Coriolis is one of the leaders in formulation R&D of (bio)pharmaceutical drugs and vaccines and a globally operating analytical service provider. Their motivation is to allow the development of innovative medicines by performing outstanding biopharmaceutical research to enhance the quality of life for humankind. In January 2022, Coriolis Pharma opened new ATMP Formulation Development Facilities. The new facilities are located near Coriolis’ headquarters in Martinsried, which will significantly increase Coriolis’ capabilities for ATMP development.

Key Companies in the market of formulation development outsourcing include

- Charles Rover laboratories (US)

-

Laboratory Corporation of America (US)

- Intertek (US)

- Quotient Sciences

- Reddy’s Laboratories (India)

- Catalent Inc. (US)

- Thermo Fischer Scientific Inc. (US)

- Emergent Biosolutions Inc.(US)

- Syngene International Limited (India)

- Irisys LLC Laboratory Corporation of America Holdings (US)

Formulation Development Outsourcing Industry Developments

February 2022:Berkshire Sterile Manufacturing (BSM), a sterile filling contract manufacturer, added formulation, lyophilization, and method development capabilities to complement its clients’ drug productions.

Formulation Development Outsourcing Market Segmentation

Formulation Development Outsourcing Services Outlook (USD Billion, 2019-2030)

-

Pre Formulation Services

-

Formulation Optimization

Formulation Development Outsourcing Dosage Form Outlook (USD Billion, 2019-2030)

- Injectable

- Oral

- Topical

- Inhaled

- Others

Formulation Development Outsourcing Application Outlook (USD Billion, 2019-2030)

- Oncology

- Genetic Disorders

- Neurology

- Infectious Disease

- Respiratory

- Cardiovascular

- Others

Formulation Development Outsourcing End User Outlook (USD Billion, 2019-2030)

- Pharmaceutical and Biopharmaceutical

- Government

- Academic Institutes

Formulation Development Outsourcing Regional Outlook (USD Billion, 2019-2030)

- North America

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

- Australia

- Rest of Asia-Pacific

- Rest of the World

- Middle East

- Africa

- Latin America

|

Report Attribute/Metric

|

Details

|

|

Market Size 2024

|

9.99 (USD Billion)

|

|

Market Size 2025

|

10.80 (USD Billion)

|

|

Market Size 2034

|

21.80 (USD Billion)

|

|

Compound Annual Growth Rate (CAGR)

|

8.12 % (2025 - 2034)

|

|

Report Coverage

|

Revenue Forecast, Competitive Landscape, Growth Factors, and Trends

|

|

Base Year

|

2024

|

|

Market Forecast Period

|

2025 - 2034

|

|

Historical Data

|

2020 - 2024

|

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Services, Dosage Form, Application, End User and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered |

The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

Charles Rover laboratories (US), Reddy’s Laboratories (India), Lonza Group AG(Switzerland), Aizant Drug Research Solutions Pvt. Ltd.(US), Syngene International Limited (India), and Irisys LLC Laboratory Corporation of America Holdings (US) |

| Key Market Opportunities |

The growing demand for new drugs owing to the high burden of chronic |

| Key Market Dynamics |

The increased R&D costs |

Formulation Development Outsourcing Market Highlights:

Frequently Asked Questions (FAQ) :

The formulation development outsourcing market size was valued at USD 7.9 Billion in 2022.

The market is projected to grow at a CAGR of 8.1% during the forecast period, 2024-2032.

North America had the largest share of the market

The key players in the market are Charles Rover laboratories (US), Reddy’s Laboratories (India), Catalent Inc. (US), Thermo Fischer Scientific Inc. (US), and Emergent Biosolutions Inc.(US).

The formulation optimization category dominated the market in 2022.

The oral had the largest share in the market.

The oncology category dominated the market in 2022.

The academic institutes had the largest share of the market.