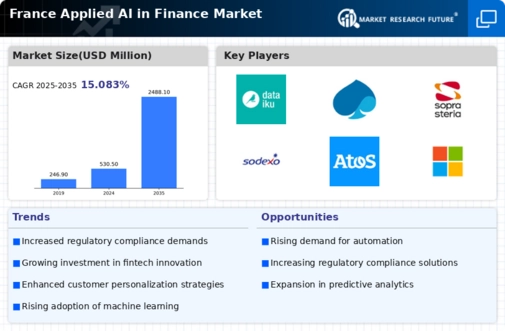

The France Applied AI in Finance Market has seen significant developments and innovations, positioning the country as a key player in the integration of artificial intelligence within the finance sector. The market is characterized by numerous players, each striving to leverage AI technologies to enhance operational efficiency, reduce costs, and improve customer experiences. With the increasing adoption of digital banking and financial services, coupled with evolving consumer expectations, various firms are employing AI to offer predictive analytics, automated workflows, and personalized user experiences.

As competition intensifies, understanding the strategic positioning and innovations of key players becomes crucial in assessing market dynamics.

Lemonway has established a notable presence in the France Applied AI in Finance Market by providing innovative payment processing solutions tailored for the marketplace and crowdfunding sectors. The company has developed a strong foundation by focusing on compliance and security, which is paramount in fintech operations. Leveraging artificial intelligence capabilities, Lemonway enhances its fraud detection mechanisms and optimizes transaction processes. The company's strengths lie in its adaptability to regulatory changes and its ability to provide seamless user experiences, thereby gaining the trust of businesses and individual users alike.

Through its thoughtful integration of AI into its services, Lemonway stands out as a robust player committed to driving efficiency and security in financial transactions.

Qonto represents another formidable presence in the France Applied AI in Finance Market, focusing on the needs of small and medium-sized enterprises. The company offers a suite of banking services that streamline financial management for businesses, including expense tracking, invoicing, and automated accounting processes. Qonto utilizes advanced algorithms and AI technologies to offer personalized financial insights, which empower users to make informed decisions. The company's strength lies in its intuitive user interface and responsive customer support, fostering a loyal customer base.

In recent years, Qonto has engaged in strategic mergers and partnerships to bolster its technology infrastructure and expand its market footprint within France. This growth trajectory, combined with its commitment to innovation, positions Qonto as a significant player in the evolving landscape of applied AI in finance.