Regulatory Framework Enhancements

The regulatory environment in France is evolving to support the development and approval of new surgical devices. Recent reforms aimed at streamlining the approval process for medical devices are likely to encourage innovation within the general surgical-devices market. These enhancements may reduce the time required for new products to reach the market, thereby fostering competition and improving patient access to advanced surgical technologies. The French government has also been actively promoting initiatives that facilitate collaboration between manufacturers and regulatory bodies, which could further stimulate growth in the market. As a result, the general surgical-devices market may see an influx of innovative products that meet the needs of healthcare providers and patients alike.

Rising Demand for Surgical Procedures

The increasing prevalence of chronic diseases and the aging population in France are driving the demand for surgical procedures. As the population ages, the incidence of conditions requiring surgical intervention, such as cardiovascular diseases and orthopedic issues, is likely to rise. This trend suggests a growing need for surgical devices, thereby positively impacting the general surgical-devices market. According to recent data, the surgical procedures in France are projected to increase by approximately 5% annually, indicating a robust growth trajectory for the market. The healthcare system's focus on improving surgical outcomes further emphasizes the necessity for advanced surgical devices, which could lead to increased investments in the general surgical-devices market.

Investment in Healthcare Infrastructure

France's commitment to enhancing its healthcare infrastructure is a significant driver for the general surgical-devices market. The government has been investing heavily in modernizing hospitals and surgical facilities, which is expected to improve the quality of surgical care. This investment includes upgrading surgical theaters and acquiring advanced surgical devices, which are essential for performing complex procedures. Reports indicate that healthcare spending in France is anticipated to reach €200 billion by 2026, with a substantial portion allocated to surgical services. This focus on infrastructure development not only enhances patient care but also stimulates demand for innovative surgical devices, thereby benefiting the general surgical-devices market.

Growing Awareness of Surgical Innovations

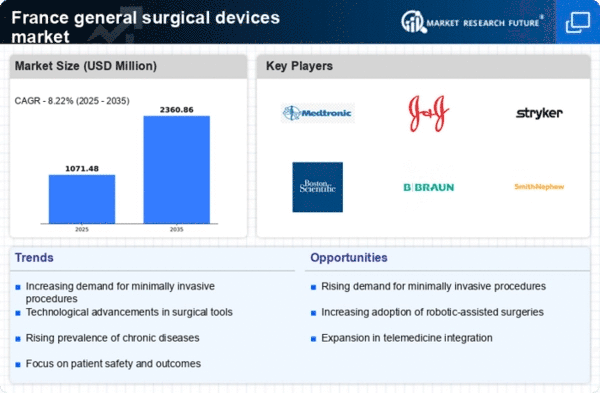

There is a notable increase in awareness regarding surgical innovations among healthcare professionals and patients in France. This heightened awareness is likely to drive the adoption of advanced surgical devices, as both surgeons and patients seek improved outcomes and reduced recovery times. Educational initiatives and professional training programs are contributing to this trend, fostering a culture of innovation within the medical community. As a result, the general surgical-devices market may experience a surge in demand for cutting-edge technologies, such as robotic-assisted surgical systems and advanced imaging devices. The market is expected to grow at a compound annual growth rate (CAGR) of around 6% over the next five years, reflecting the impact of this growing awareness.

Focus on Patient-Centric Surgical Solutions

The shift towards patient-centric care in France is influencing the general surgical-devices market significantly. Healthcare providers are increasingly prioritizing patient outcomes and satisfaction, leading to a demand for surgical devices that enhance the overall patient experience. This trend includes the development of devices that minimize pain, reduce recovery times, and improve surgical precision. As hospitals and clinics adopt more patient-focused approaches, the general surgical-devices market is likely to benefit from the introduction of innovative solutions that align with these goals. Market analysts predict that the emphasis on patient-centric solutions could drive a growth rate of approximately 4% annually in the general surgical-devices market, reflecting the changing dynamics of surgical care.