Growing Focus on Patient Safety and Outcomes

The growing emphasis on patient safety and improved surgical outcomes is a crucial driver for the minimally invasive-surgery-devices market. Healthcare providers in France are increasingly prioritizing techniques that minimize risks and enhance recovery experiences for patients. Minimally invasive procedures are associated with lower rates of infection and complications, which aligns with the healthcare sector's commitment to patient safety. As hospitals and surgical centers adopt protocols that prioritize these outcomes, the demand for minimally invasive devices is expected to increase. This focus on safety not only enhances patient satisfaction but also encourages healthcare providers to invest in advanced surgical technologies, thereby propelling market growth.

Aging Population and Increased Surgical Needs

The aging population in France is a significant driver for the minimally invasive-surgery-devices market. As the demographic shifts towards an older population, the prevalence of chronic diseases and conditions requiring surgical intervention is expected to rise. This demographic trend indicates a growing need for effective surgical solutions that minimize recovery time and complications. Reports suggest that by 2030, nearly 25% of the French population will be over 65 years old, thereby increasing the demand for minimally invasive procedures. Consequently, healthcare providers are likely to invest more in minimally invasive devices to cater to this demographic, further stimulating market growth.

Technological Innovations in Surgical Devices

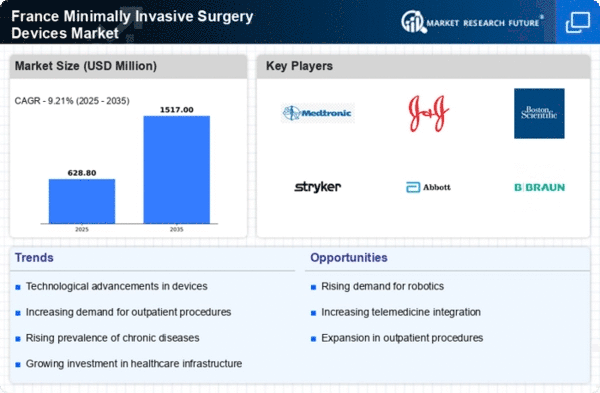

Technological innovations play a pivotal role in shaping the minimally invasive-surgery-devices market. The introduction of advanced imaging systems, robotic-assisted surgical tools, and enhanced visualization techniques has revolutionized surgical practices in France. These innovations not only improve surgical precision but also enhance patient outcomes. For instance, the integration of augmented reality in surgical procedures has shown promising results, leading to a potential increase in the adoption of minimally invasive devices. The market is projected to witness a compound annual growth rate (CAGR) of around 7% over the next few years, driven by continuous advancements in technology that cater to the evolving needs of healthcare professionals.

Rising Demand for Minimally Invasive Procedures

The increasing preference for minimally invasive procedures among patients is a key driver for the minimally invasive-surgery-devices market. Patients are increasingly aware of the benefits associated with these procedures, such as reduced recovery times, lower risk of complications, and minimal scarring. In France, the demand for such procedures has surged, with a reported growth rate of approximately 8% annually. This trend is further supported by advancements in surgical techniques and technologies, which enhance the efficacy and safety of these procedures. As healthcare providers strive to meet patient expectations, the adoption of minimally invasive devices is likely to expand, thereby propelling the market forward.

Cost-Effectiveness of Minimally Invasive Techniques

The cost-effectiveness of minimally invasive techniques is becoming increasingly recognized within the healthcare sector in France. These procedures often result in shorter hospital stays and reduced postoperative care, leading to lower overall healthcare costs. The economic benefits associated with minimally invasive surgeries are compelling, as they can lead to savings of up to 30% compared to traditional surgical methods. This financial advantage is prompting healthcare institutions to adopt minimally invasive devices more widely, thereby driving market growth. As cost containment becomes a priority for healthcare systems, the demand for cost-effective surgical solutions is likely to rise, benefiting the minimally invasive-surgery-devices market.