- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

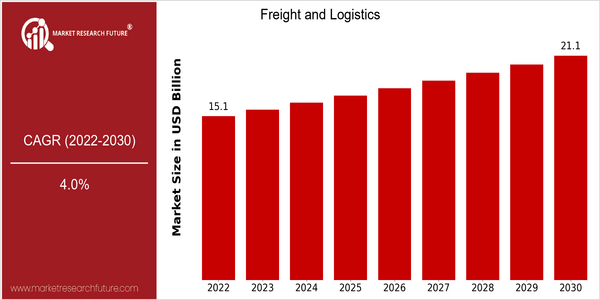

| Year | Value |

|---|---|

| 2022 | USD 15.08 Billion |

| 2030 | USD 21.13 Billion |

| CAGR (2024-2030) | 4.0 % |

Note – Market size depicts the revenue generated over the financial year

In the year 2022, the world’s freight and logistics market is estimated to be worth US$15.08 billion and is projected to reach US$21.13 billion by the year 2030, growing at a CAGR of 4.0% from 2024 to 2030. The growth of the freight and logistics market is driven by an increasing demand for efficient supply chain management and the increasing complexity of logistics operations in a globalized economy. As companies place more and more emphasis on the cost-effective and timely delivery of goods, the logistics industry will continue to grow. And the trend will continue. Among the many factors driving this growth are advances in automation, artificial intelligence, and the IoT, which enhance the efficiency of supply chains and improve the visibility of goods. The growth of e-commerce is also a major factor, as consumers are demanding faster and more reliable delivery services. The leading players in the industry, such as DHL, FedEx, and UPS, are investing in innovation and forming strategic alliances to strengthen their services and expand their markets. FedEx, for example, has been focusing on integrating AI and automation into its operations, while DHL has been exploring sustainable logistics solutions to meet the demands of its customers and the requirements of government regulations.

Regional Market Size

Regional Deep Dive

The freight and logistics market is undergoing major changes across the world, driven by technological advancements, changing customer demands, and regulatory changes. North America is characterised by a strong logistics network and a focus on e-commerce. In Europe, the emphasis is on sustainable logistics and green logistics. Asia-Pacific is characterised by rapid growth, driven by urbanisation and the growth in trade. The Middle East and Africa are taking advantage of their strategic geographical locations to strengthen their logistics capabilities. Latin America is gradually developing its logistics network, driven by economic reforms and investment in infrastructure.

Europe

- The European Union's Green Deal is driving logistics companies to invest in sustainable practices, with initiatives like the European Commission's 'Fit for 55' package aiming to reduce greenhouse gas emissions by 55% by 2030.

- Innovations in digital logistics platforms are gaining traction, with companies like DHL and Kuehne + Nagel leveraging AI and big data analytics to optimize supply chain operations and improve efficiency.

Asia Pacific

- China's Belt and Road Initiative is significantly enhancing regional connectivity and trade, leading to increased investment in logistics infrastructure across participating countries.

- The rapid urbanization in countries like India is driving demand for integrated logistics solutions, with companies such as Delhivery expanding their services to cater to the growing e-commerce market.

Latin America

- Brazil's government is investing in infrastructure improvements, such as the BR do Mar project, which aims to enhance maritime logistics and reduce transportation costs.

- The rise of digital platforms for logistics services is transforming the market, with startups like Loggi in Brazil providing innovative solutions to improve last-mile delivery efficiency.

North America

- The rise of e-commerce has led to increased demand for last-mile delivery solutions, prompting companies like Amazon and UPS to innovate their logistics strategies, including the use of drones and autonomous vehicles.

- Regulatory changes, such as the implementation of stricter emissions standards, are pushing logistics companies to adopt greener practices, with firms like FedEx committing to carbon-neutral operations by 2040.

Middle East And Africa

- The UAE is positioning itself as a global logistics hub, with projects like the Dubai Logistics City aiming to streamline supply chain operations and attract international businesses.

- Regulatory reforms in countries like Saudi Arabia are enhancing the ease of doing business, encouraging foreign investment in logistics and transportation sectors.

Did You Know?

“Approximately 90% of the world's goods are transported by sea, highlighting the critical role of maritime logistics in global trade.” — International Maritime Organization (IMO)

Segmental Market Size

The freight and transport market is currently experiencing considerable growth, driven by the growing demand for effective supply chain solutions. E-commerce, which requires faster delivery, and the introduction of legislation on reducing carbon emissions, which requires companies to adopt more sustainable logistics practices, are driving this market. In addition, technological developments, such as automation and artificial intelligence, which enable greater operational efficiency, are driving demand. In terms of market development, the market is currently in the process of rolling out, with Amazon and DHL leading the way in adopting new logistics solutions. The most notable applications are the last-mile delivery and real-time tracking of packages, which are becoming the norm in city logistics. The global pandemic of influenza has led to the acceleration of digital solutions, while the Green Deal has led to an increase in investment in green logistics. In terms of technology, the most important developments are IoT, which enables real-time tracking of goods, and blockchain, which ensures the security and transparency of transactions.

Future Outlook

The world’s freight and logistics industry is expected to show significant growth from 2022 to 2030, with a projected market size increase from $ 15.08 billion to $ 21 billion, at a CAGR of 4.0%. This growth is attributed to the rising demand for efficient supply-chain solutions driven by the rise of e-commerce and the increasing internationalization of trade. In order to meet the demands for faster and more reliable transport, the use of advanced technology such as artificial intelligence, the Internet of Things, and the blockchain will be essential. The two key trends influencing the future of the freight and logistics industry are the ongoing digital transformation and the increasing focus on sustainability. These two trends will require companies to invest in green logistics to reduce their carbon footprint, in line with international policies and the consumers’ desire for eco-friendly products. In addition, the use of self-driving vehicles and drones will bring about a revolution in the field of last-mile delivery, with the aim of improving efficiency and reducing costs. In the future, automation will be adopted in up to 30 percent of the freight and logistics industry, and the market will be reshaped.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2022 | USD 15.08 Billion |

| Growth Rate | 4% (2024-2030) |

Freight and Logistics Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.