- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

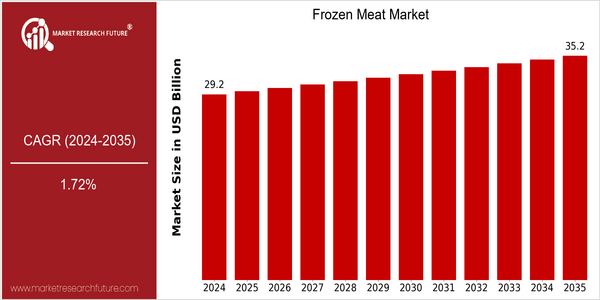

| Year | Value |

|---|---|

| 2024 | USD 29.19 Billion |

| 2035 | USD 35.2 Billion |

| CAGR (2025-2035) | 1.72 % |

Note – Market size depicts the revenue generated over the financial year

Frozen meat is a market with a great future, which is estimated to be worth about $29 billion in 2024 and is expected to rise to $36 billion by 2035. Its CAGR (compound annual growth rate) from 2025 to 2035 is 1.72%. There are many reasons for this, such as the increasing demand for convenient and long-lasting food, the increase in meat consumption around the world, and the improvement of freezing technology, which can ensure the quality and safety of the product. Also, the cryogenic freezing method and the packaging solution play a very important role in driving the development of the market. Frozen meat has a long shelf life and retains nutrients and flavor. It is more and more popular among consumers. The leading companies in this industry are Tyson Foods, JBS S.A., and Nestlé. They are actively investing in product development and strategic cooperation to enhance their market share. The competition in this market is intense. Tyson Foods, for example, has been expanding its frozen meat product line and looking for new distribution channels, which further highlights the competitiveness of the market.

Regional Market Size

Regional Deep Dive

Frozen meat is a market that is experiencing significant growth across the globe, driven by the changing preferences of consumers, the increased demand for convenience food, and the technological advancements in freezing. The market in North America is characterized by the presence of many established players and a high consumption of frozen meat products. Europe has a wide variety of frozen meat products, which are influenced by cultural preferences and a growing trend towards sustainable sourcing. The Asia-Pacific region is experiencing rapid urbanization and rising incomes, which are driving the consumption of frozen meat. The Middle East and Africa are seeing the demand for frozen meat increase as a result of population growth and changing dietary preferences. In Latin America, the agricultural strength is driving the frozen meat exports.

Europe

- The European market is increasingly focusing on sustainability, with initiatives like the European Green Deal encouraging meat producers to adopt eco-friendly practices, which is reshaping sourcing and production methods.

- Innovations in packaging technology, such as vacuum sealing and modified atmosphere packaging, are being adopted by companies like Danish Crown to extend shelf life and reduce food waste, positively impacting market growth.

Asia Pacific

- The rapid urbanization in countries like China and India is leading to a shift in dietary patterns, with a growing preference for frozen meat products due to their convenience and longer shelf life.

- Government initiatives aimed at improving food safety standards, such as the Food Safety and Standards Authority of India (FSSAI) regulations, are enhancing consumer confidence in frozen meat products.

Latin America

- Latin America is leveraging its agricultural resources, with countries like Brazil and Argentina becoming key exporters of frozen meat, particularly beef, to international markets.

- The region is witnessing a rise in local processing facilities, supported by government programs aimed at boosting the meat processing industry, which is expected to enhance product availability and quality.

North America

- The rise of e-commerce platforms has significantly transformed the distribution of frozen meat, with companies like Tyson Foods and Smithfield Foods investing in online sales channels to meet consumer demand for convenience.

- Regulatory changes, such as the USDA's new guidelines on meat labeling, are pushing companies to enhance transparency in their product offerings, which is expected to foster consumer trust and drive sales.

Middle East And Africa

- The increasing population and urbanization in the Middle East are driving demand for frozen meat, with companies like Al Islami Foods expanding their product lines to cater to diverse consumer preferences.

- Cultural factors, such as the preference for halal meat, are influencing the frozen meat market, prompting suppliers to ensure compliance with halal certification standards to capture this niche market.

Did You Know?

“Did you know that frozen meat can retain its quality for several months, making it a preferred choice for consumers looking to minimize food waste?” — USDA Food Safety and Inspection Service

Segmental Market Size

The frozen-meat market is currently booming, with consumers opting for greater convenience and longer shelf-life. This is driven by the growing popularity of ready-to-eat food, and growing awareness of food safety, which makes consumers opt for frozen foods that maintain nutritional value. In addition, technological advances in freezing have improved product quality and extended shelf-life, further boosting demand. The current market for frozen meat is mature, with companies such as Tyson and Nestlé leading the way with their product innovations and extensive distribution networks. Supermarkets and e-commerce platforms are the main channels for frozen-meat products. Sales of frozen foods are expected to continue to rise, especially in the wake of the pandemic, as consumers stockpile essentials. In addition, companies are exploring sustainable packaging and sourcing to meet consumers’ demands for responsible consumption.

Future Outlook

Frozen meats will continue to grow steadily from 2024 to 2035, with a projected market value rise from $29.19 billion to $35.2 billion, at a CAGR of 1.72%. This growth is attributed to a growing demand for convenient, long-lasting foods, especially in urban areas where the fast pace of life creates a greater need for quick meal solutions. The penetration of frozen meats is expected to rise, and by 2035 the proportion of households consuming frozen meat regularly will have increased from 35% to 45%. The development of new technology and the introduction of new policies will also have a significant impact on the market. New freezing and packaging technology, such as flash freezing and vacuum sealing, have greatly improved the quality and shelf life of frozen meats, thus enhancing their appeal to health-conscious consumers. Moreover, a push towards sustainable development and a reduction in food waste will help to drive the frozen meats market, as frozen foods have a longer shelf life than fresh foods. Nevertheless, emerging trends such as a rise in the popularity of frozen meat alternatives and a greater focus on the transparency and traceability of food sources will ensure that the market remains resilient and adaptable.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 4.78% (2023-2032) |

Frozen Meat Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.