Rising Global Population

The rising The Frozen Meat Industry. As the world population continues to grow, projected to reach 9.7 billion by 2050, the demand for protein sources, including frozen meat, is expected to escalate. This demographic shift is likely to create a substantial increase in food consumption, particularly in developing regions where meat consumption is on the rise. Recent projections indicate that the frozen meat segment could witness a growth rate of 6% annually over the next five years, driven by this increasing demand. Furthermore, urbanization trends are contributing to changes in dietary preferences, with more consumers opting for convenient and ready-to-cook frozen meat products. As a result, the Frozen Meat Market is poised to expand significantly in response to these demographic changes.

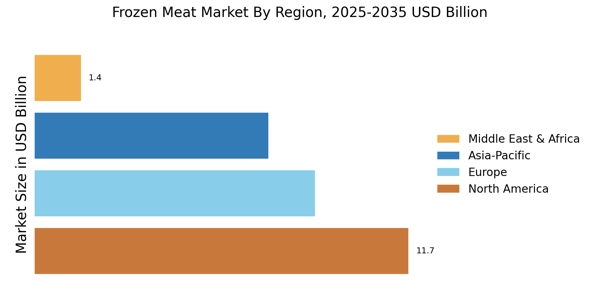

Expansion of Retail Channels

The expansion of retail channels is significantly influencing the Frozen Meat Market. With the rise of supermarkets, hypermarkets, and specialty stores, consumers now have greater access to a diverse range of frozen meat products. Recent data suggests that the number of retail outlets offering frozen meat has increased by 25% over the past two years, reflecting a shift in consumer shopping habits. This proliferation of retail options not only enhances convenience for consumers but also encourages impulse purchases, thereby boosting sales within the Frozen Meat Market. Additionally, the emergence of online grocery shopping platforms has further facilitated access to frozen meat products, allowing consumers to explore various brands and options from the comfort of their homes. As retail channels continue to evolve, the industry is likely to see sustained growth driven by increased consumer accessibility.

Increasing Health Consciousness

The Frozen Meat Market appears to be experiencing a notable shift as consumers become increasingly health-conscious. This trend is reflected in the rising demand for lean meats and organic options, which are perceived as healthier alternatives. According to recent data, the consumption of frozen chicken and turkey has surged, with a reported increase of 15% in the last year alone. This growing awareness of nutritional value is likely to drive innovation within the Frozen Meat Market, as manufacturers adapt their offerings to meet consumer preferences for healthier products. Additionally, the emphasis on protein-rich diets may further bolster the market, as frozen meat products are often seen as convenient sources of high-quality protein. As a result, the industry may witness a diversification of product lines to cater to this evolving consumer mindset.

Consumer Preference for Convenience Foods

Consumer preference for convenience foods is a prominent driver in the Frozen Meat Market. As lifestyles become increasingly hectic, many individuals and families are seeking quick and easy meal solutions. Frozen meat products, which offer the advantage of long shelf life and minimal preparation time, are becoming increasingly popular among busy consumers. Recent surveys indicate that nearly 70% of consumers prefer frozen meat options for their ease of use and versatility in meal preparation. This trend is likely to encourage manufacturers to innovate and expand their product lines, offering a wider variety of frozen meat options that cater to the convenience-seeking consumer. Additionally, the rise of meal kits and ready-to-cook frozen meals may further enhance the appeal of frozen meat products, driving growth within the Frozen Meat Market.

Technological Advancements in Preservation

Technological advancements in preservation methods are playing a crucial role in shaping the Frozen Meat Market. Innovations such as cryogenic freezing and improved packaging techniques have enhanced the quality and shelf life of frozen meat products. These advancements not only help in maintaining the nutritional integrity of the meat but also reduce waste, which is a growing concern among consumers. Recent statistics indicate that the efficiency of freezing processes has improved by approximately 20%, leading to better retention of flavor and texture. As consumers increasingly seek high-quality frozen meat options, the industry is likely to benefit from these technological improvements. Furthermore, the integration of smart technologies in supply chain management may streamline operations, ensuring that products reach consumers in optimal condition. This focus on quality and efficiency could potentially drive growth within the Frozen Meat Market.