Diverse Product Offerings

The Frozen Snacks Market is characterized by a wide array of product offerings, catering to various consumer preferences and dietary needs. This diversity includes options such as vegetarian, gluten-free, and organic frozen snacks, which appeal to health-conscious consumers. The market has expanded to include international flavors and unique combinations, attracting a broader audience. Recent statistics suggest that the frozen snack segment has diversified significantly, with a notable increase in the introduction of new products. This trend not only enhances consumer choice but also stimulates competition among manufacturers, encouraging innovation and quality improvements. As consumers continue to seek variety in their diets, the Frozen Snacks Market is likely to benefit from this trend, leading to sustained growth and increased market share.

Convenience and Time-Saving

The Frozen Snacks Market is experiencing a surge in demand due to the increasing need for convenience among consumers. Busy lifestyles and the fast-paced nature of modern living have led to a preference for quick meal solutions. Frozen snacks offer an easy and time-efficient option for consumers, allowing them to prepare meals with minimal effort. According to recent data, the frozen snacks segment has seen a growth rate of approximately 5% annually, driven by the rising number of working professionals and dual-income households. This trend indicates that consumers are likely to continue seeking convenient food options, thereby propelling the Frozen Snacks Market forward. As a result, manufacturers are focusing on developing innovative products that cater to this demand, further enhancing the appeal of frozen snacks.

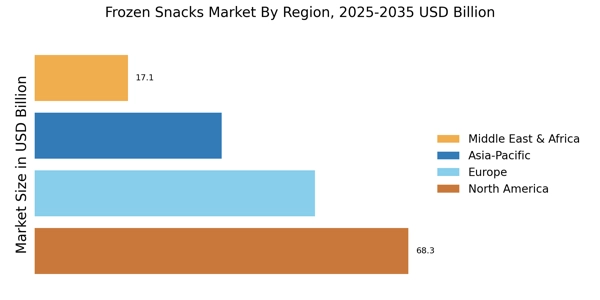

Increased Retail Availability

The Frozen Snacks Market is experiencing enhanced retail availability, which is contributing to its growth. Supermarkets, convenience stores, and online platforms are expanding their frozen snack sections, making these products more accessible to consumers. This increased availability is particularly evident in emerging markets, where the demand for frozen snacks is on the rise. Recent data indicates that retail sales of frozen snacks have increased by approximately 7% in the last year, reflecting a growing consumer base. Retailers are also investing in promotional strategies to highlight frozen snack offerings, further driving consumer interest. As the Frozen Snacks Market continues to expand its presence in various retail channels, it is likely to attract a wider audience, ultimately leading to increased sales and market penetration.

Rising Demand for Healthy Snacks

The Frozen Snacks Market is witnessing a notable shift towards healthier snack options, driven by changing consumer preferences. As individuals become more health-conscious, there is a growing demand for frozen snacks that are lower in calories, fat, and sodium. This trend is reflected in the increasing availability of products that incorporate whole grains, vegetables, and lean proteins. Market data indicates that health-oriented frozen snacks have experienced a growth rate of approximately 6% over the past year, highlighting the potential for further expansion in this segment. Manufacturers are responding to this demand by reformulating existing products and introducing new lines that align with health trends. Consequently, the Frozen Snacks Market is likely to continue evolving, with a focus on providing nutritious and appealing options for consumers.

Technological Advancements in Freezing Techniques

The Frozen Snacks Market is benefiting from advancements in freezing technologies that enhance product quality and shelf life. Innovations such as flash freezing and cryogenic freezing are enabling manufacturers to preserve the taste, texture, and nutritional value of snacks more effectively. These technologies not only improve the overall quality of frozen snacks but also reduce waste and extend the marketability of products. As a result, consumers are increasingly drawn to frozen snacks that maintain their freshness and flavor. Recent developments in packaging technology also contribute to this trend, ensuring that products remain appealing and safe for consumption. The integration of these technological advancements is likely to play a crucial role in shaping the future of the Frozen Snacks Market, as companies strive to meet consumer expectations for high-quality offerings.

Leave a Comment