Changing Consumer Lifestyles

Changing consumer lifestyles are a pivotal driver of the convenience frozen food Market. As more individuals adopt busy schedules, the demand for quick and easy meal solutions continues to rise. This shift is particularly evident among younger generations, who often prioritize convenience over traditional cooking methods. The market has responded by offering a variety of frozen food options that cater to diverse tastes and dietary needs. Additionally, the trend towards meal prepping and batch cooking has led to an increased interest in frozen ingredients, such as vegetables and proteins, which can be easily incorporated into home-cooked meals. This evolving consumer behavior suggests that the Convenience Frozen Food Market will likely see sustained growth as it adapts to the changing preferences and lifestyles of its target audience.

Expansion of Retail Channels

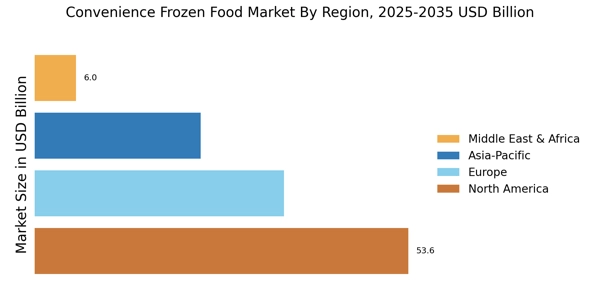

The Convenience Frozen Food Market benefits from the expansion of retail channels, which enhances product accessibility for consumers. The proliferation of supermarkets, hypermarkets, and convenience stores has made frozen food products more readily available to a broader audience. Additionally, the rise of online grocery shopping has transformed the way consumers purchase frozen foods, allowing for greater convenience and variety. E-commerce platforms have reported a significant increase in frozen food sales, with some retailers noting a 30% rise in online orders for frozen products. This shift in purchasing behavior is likely to continue, as consumers appreciate the ease of ordering frozen meals from the comfort of their homes. As retail channels evolve, the Convenience Frozen Food Market is poised to capitalize on these trends, ensuring that consumers have access to a diverse range of frozen food options.

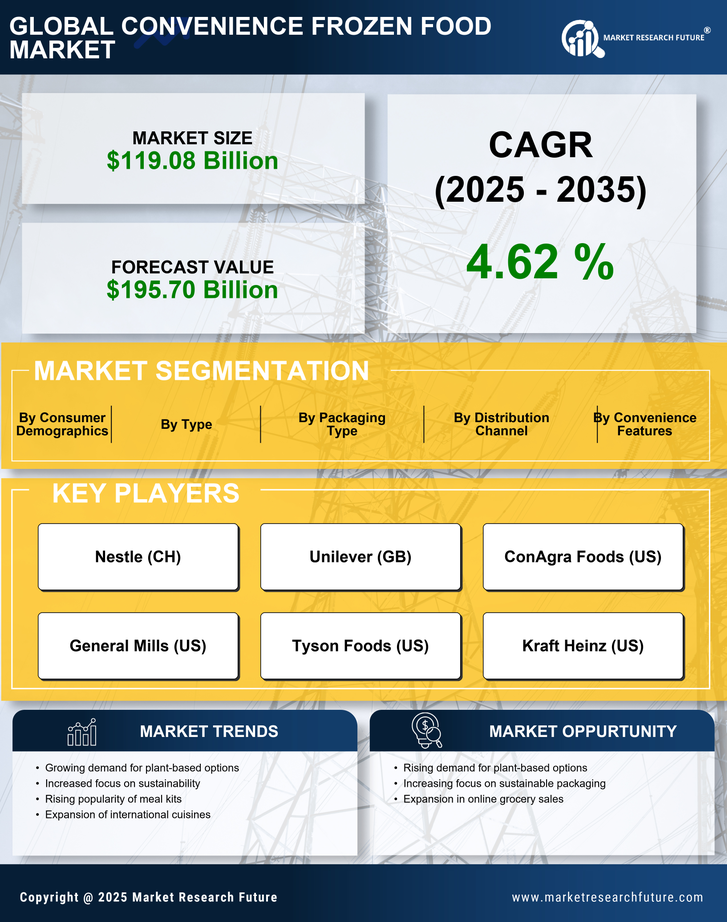

Rising Demand for Convenience

The Convenience Frozen Food Market experiences a notable surge in demand as consumers increasingly prioritize convenience in their busy lifestyles. The fast-paced nature of modern life compels individuals to seek quick meal solutions that do not compromise on quality. This trend is reflected in the growing sales of frozen meals, which have seen a rise of approximately 25% over the past five years. As more households embrace dual-income dynamics, the need for ready-to-eat options becomes paramount. Consequently, manufacturers are innovating to provide a diverse range of frozen food products that cater to various dietary preferences, including vegetarian and gluten-free options. This shift towards convenience is likely to continue driving growth in the Convenience Frozen Food Market, as consumers increasingly opt for products that save time while still delivering on taste and nutrition.

Increased Focus on Health and Nutrition

The Convenience Frozen Food Market is increasingly influenced by a heightened focus on health and nutrition among consumers. As awareness of dietary choices grows, there is a rising demand for frozen food products that align with healthier eating habits. This trend is evidenced by the introduction of frozen meals that are lower in sodium, free from artificial preservatives, and enriched with whole grains and vegetables. Market data indicates that health-oriented frozen food products have experienced a growth rate of approximately 15% annually. This shift towards healthier options is not only driven by consumer preferences but also by the food industry’s response to public health initiatives aimed at reducing obesity and related health issues. Consequently, manufacturers are reformulating existing products and developing new offerings that cater to this health-conscious demographic, thereby propelling the Convenience Frozen Food Market forward.

Technological Advancements in Food Preservation

Technological advancements play a crucial role in enhancing the Convenience Frozen Food Market. Innovations in freezing techniques, such as flash freezing and cryogenic freezing, have significantly improved the quality and shelf life of frozen foods. These methods preserve the nutritional value and flavor of products, making them more appealing to health-conscious consumers. Furthermore, advancements in packaging technology, including vacuum sealing and modified atmosphere packaging, help maintain product freshness and reduce waste. As a result, the market has witnessed a steady increase in the availability of high-quality frozen meals, which are now more accessible to consumers. The integration of smart technology in food storage and preparation also contributes to the convenience factor, allowing consumers to enjoy frozen meals with minimal effort. This ongoing evolution in food preservation technology is likely to bolster the Convenience Frozen Food Market in the coming years.