Market Share

Game API Market Share Analysis

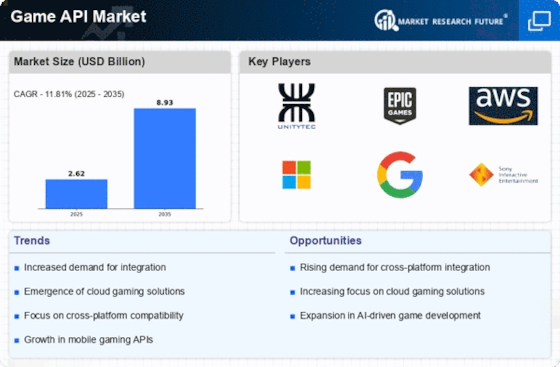

The Game API market provides an array of invaluable tools and services for game development which makes it one of the most dynamic industries today (MacDonald 2016). In order to attain significant market share, firms operating in this sector employ different strategies for positioning themselves on the market.

One major approach involves coming up with comprehensive and end-user friendly API solutions. The aim of game API providers is to develop APIs that can easily fit into game development frameworks having a wide range of functionalities. These functionalities include multiplayer capabilities, social media integration, in-app purchase systems or analytics tools. To attract game developers seeking efficient and feature-rich solutions, such companies must offer robust and flexible API solution.

Another effective strategy for positioning is targeting specific genres or platforms of games. These companies make their API solutions on the basis of understanding that different game developers have unique needs and as such they relate to specific platforms like mobile, PC or console gaming. Companies might also concentrate on certain types of games like role playing games (RPGs), first-person shooters (FPS) or puzzle games. By focusing on one genre or platform exclusively, these firms can present themselves as authorities in this area, thus attracting developers who need particular API features for their games.

Besides support and documentation many Game API market players focus on developer support and documentation. They know that game developers require full resources, documentations plus technical supports to use them properly in their APIs. With extensive developer documentation, sample code, SDKs and dedicated support channels these businesses can appear like reliable partners who prioritize success of the game developers.

In addition pricing strategies are instrumental in positioning market share within Game API market. Companies adopt various pricing models including revenue-sharing agreements; subscription-based pricing or tiered pricing based on usage or number of users among others. In order to cater for varying needs/budgets from indie studios through to large publishers therefore it becomes crucial that organizations provide flexible competitive price options. This enables capturing a huge chunk of the market by accommodating various prices choices which scales depending on delivered value.

Leave a Comment