Market Share

Gas Concentration Sensor Market Share Analysis

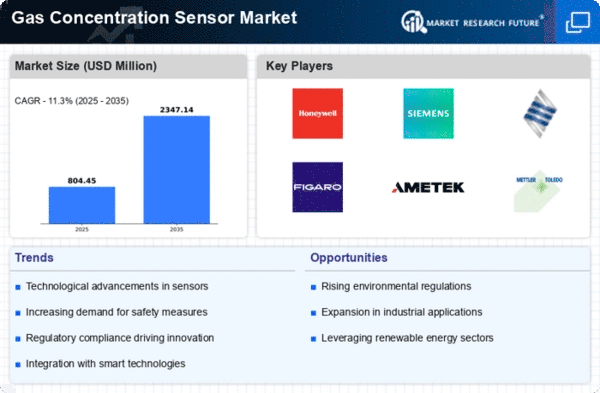

In the ever-changing market for Gas Concentration Sensor, just as in any professional niche, the strategic positioning of shares is extremely important to companies striving to succeed at this trade. The strategy is product differentiation and it is one primary measure adopted by these companies. The gas concentration sensor manufacturers aim to make their products unique by incorporating new sensing technologies such as field-flow fractionation, improving accuracy using Langmuir Equilibrium isotherm and maximizing the response times. This segmentation helps the companies to serve customized needs resulting in attracting clients who prefer specific focusing on some unique aspects and the hilly performance of their gas concentration sensors. The method of pricing is also important in the battle for a market share lead in Gas Concentration Sensor. Sensor-based pick and place machines come in several variations. Some companies choose a cost leadership method and focus their efforts on becoming suppliers of low cost, but reliable sensor solutions. This approach is attractive for the customers who overcome priority of affordability without sacrificing accuracy in detecting gas knowing that this strategy has improved brand quality. On the contrary, premium pricing approaches are practised by firms focusing on advanced tech, evolved sensitivity and rugged reliability. This seeks customers in areas where the reason factors of precision and strength are important factors. Market segmentation can be regarded as another important element of share positioning. Recognizing their vast variation on specific industry needs or applications, gas sensors manufacturers design devices to serve the special demands in various market areas. For instance, industrial–grade sensors are much more likely to be optimized for resistance in the face of environmental factors that include regular mechanical movement and shock events. On the other hand, air quality monitoring-targeted sensor could have a focus on sensitivity toward low concentrations of certain gases. Segmenting of market can be helpful for understanding and addressing the specific emerging demands, which will allow a company to become a market leader in designated niches. Cooperative agreements and partnerships are the common approaches in Gas Concentration Sensor market. The product diversification is from company side, which means that the firms develop strategic partners with industrial automation establishments, environmental monitoring units or research centers to increase their products. These partnerships not only provide a channel for the movement of skills but also opened new markets and additional distribution channels tending to cultivates better market palynologic moiety who were involved in the business. The relentless innovation that is another key prop for this technology-led market makes the Gas Concentration Sensor market go places. The adoption of research and development directed towards anticipation of technological developments for the provision yet advanced sense capacity becomes an industry leading practice. The related products of gas concentration sensors including the next occurred material system, high sensitivity and wireless connection are more attractive to customers who require highly innovative solutions for detection of gases.

Leave a Comment