Market Trends

Key Emerging Trends in the Gas Insulated Switchgear Market

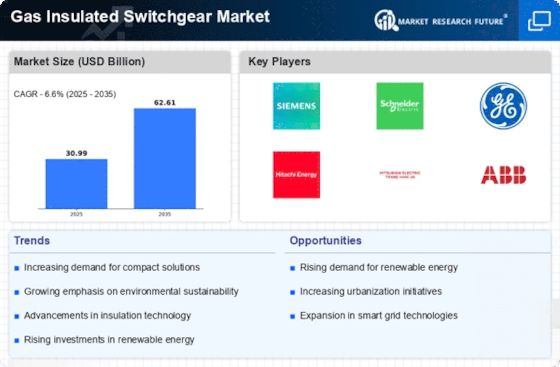

Need for stable and effective power transfer and delivery tools is a big trend that is changing the market. Strong power lines that can handle more power and keep the power on all the time are more important as businesses grow and the world becomes more connected. More and more people are choosing GIS because it is small and can make power sharing more effective. The market for Gas Insulated Switchgear is also paying a lot of attention to options that are eco-friendly and tough. Climate change is making people all over the world work to reduce their carbon footprints. To help with this, the power business is adopting more and more eco-friendly technologies. GIS is better for the earth than other switching choices because it uses gas to protect itself. It is better for the environment, so GIS is a good choice for companies and services that want to meet strict environmental rules and save the world. Adding digital technologies to Gas Insulated Switchgear is changing the market. Smart grid and the Internet of Things (IoT) have grown over time, making power systems better and more connected. Some of the new digital features that GIS manufacturers are adding to their switchgear systems are sensors, link units, and data analytics. Now that the power transfer system is digital, it can be watched in real time, fixes can be planned ahead of time, and the system works better overall. People who work for utilities and the grid can make it more effective and save money by making the best use of repair plans. There is also a lot of research and development going on in the market to come up with new ideas and make products better. Companies are putting money into making the next version of GIS, which will be more efficient, require less upkeep, and have better safety features. Most of the time, these new ideas come from the need to solve problems caused by the changing energy environment, such as the need to include green energy sources, deal with changing demand trends, and make power systems more complicated. A lot of people are moving to cities and using a lot more energy in developing areas, like the Asia-Pacific and the Middle East. As these areas spend money to improve their power systems, more and more people want to use GIS. In North America and Europe, on the other hand, stable markets are seeing a move toward updating the power grid and replacing old infrastructure. This is pushing the use of more advanced switchgear options.

Leave a Comment