Growing Awareness of Genetic Disorders

There is a notable increase in awareness regarding genetic disorders among the population in the GCC region, which is positively impacting the optical genome-mapping market. Educational campaigns and healthcare initiatives have contributed to a better understanding of genetic conditions, leading to a higher demand for advanced diagnostic tools. As individuals become more informed about the implications of genetic testing, the need for precise and comprehensive mapping of genomes is becoming apparent. This trend is reflected in the rising number of genetic testing procedures, which have increased by approximately 25% in recent years. Consequently, healthcare providers are increasingly adopting optical genome-mapping technologies to offer accurate diagnoses and personalized treatment plans. This growing awareness is likely to drive the optical genome-mapping market forward, as more patients seek genetic insights to inform their healthcare decisions.

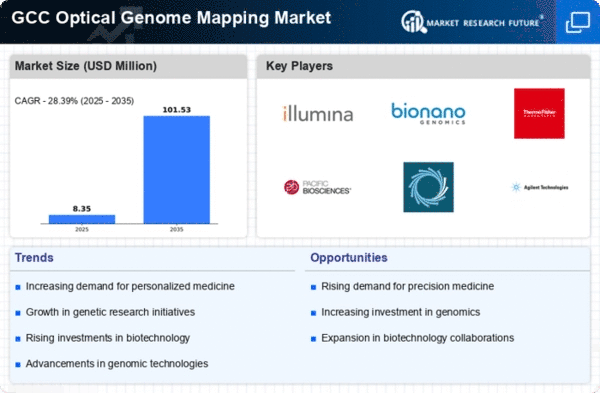

Increasing Investment in Genomic Research

The optical genome-mapping market is experiencing a surge in investment from both public and private sectors in the GCC region. Governments are recognizing the potential of genomic research to enhance healthcare outcomes and are allocating substantial budgets to support this field. For instance, funding for genomic initiatives has increased by approximately 30% over the past few years, indicating a strong commitment to advancing genetic research. This influx of capital is likely to drive innovation and development within the optical genome-mapping market, facilitating the introduction of new technologies and methodologies. Furthermore, partnerships between academic institutions and industry players are becoming more common, fostering an environment conducive to research and development. As a result, the optical genome-mapping market is poised for significant growth, with enhanced capabilities to address complex genetic disorders and improve patient care.

Regulatory Support for Genomic Technologies

The optical genome-mapping market is benefiting from favorable regulatory frameworks established by GCC governments. These regulations are designed to promote the safe and effective use of genomic technologies in clinical settings. By streamlining the approval processes for new diagnostic tools and therapies, regulatory bodies are encouraging innovation and investment in the optical genome-mapping market. For instance, recent policy changes have reduced the time required for product approvals by approximately 20%, facilitating quicker access to cutting-edge technologies for healthcare providers. This supportive regulatory environment is likely to enhance the market's growth prospects, as companies are more inclined to invest in research and development. Furthermore, collaboration between regulatory agencies and industry stakeholders is fostering a culture of compliance and safety, which is essential for the sustainable advancement of the optical genome-mapping market.

Rising Demand for Advanced Diagnostic Tools

The optical genome-mapping market is witnessing a rising demand for advanced diagnostic tools, driven by the need for accurate and timely genetic testing. As healthcare systems in the GCC region strive to improve patient outcomes, there is an increasing recognition of the importance of precise genomic analysis. This demand is reflected in the growing number of healthcare facilities adopting optical genome-mapping technologies to enhance their diagnostic capabilities. Market data indicates that the adoption rate of these advanced tools has increased by approximately 40% in the last few years. This trend is likely to continue, as healthcare providers seek to offer comprehensive genetic testing services that can inform treatment decisions. The optical genome-mapping market is thus positioned to benefit from this heightened demand, as it aligns with the broader goals of improving healthcare quality and accessibility.

Integration of Artificial Intelligence in Genomics

The integration of artificial intelligence (AI) into genomic research is emerging as a transformative driver for the optical genome-mapping market. AI technologies are being utilized to analyze vast amounts of genomic data, enabling researchers to identify patterns and correlations that were previously difficult to discern. This capability is particularly valuable in the GCC region, where there is a growing emphasis on precision medicine. By leveraging AI, healthcare providers can enhance the accuracy of genomic mapping and improve patient outcomes. The optical genome-mapping market is likely to see increased adoption of AI-driven solutions, as they offer the potential to streamline workflows and reduce the time required for data analysis. As AI continues to evolve, its applications in genomics are expected to expand, further propelling the growth of the optical genome-mapping market.