Supportive Regulatory Environment

A favorable regulatory landscape is contributing to the growth of the Optical Genome Mapping Market. Regulatory bodies are increasingly recognizing the importance of genomic technologies in clinical settings, leading to streamlined approval processes for innovative diagnostic tools. Initiatives aimed at promoting genomic research and development are being implemented, which may enhance the accessibility of Optical Genome Mapping Market solutions. This supportive environment is likely to encourage investment in research and development, further propelling the market forward as new applications and technologies emerge.

Rising Incidence of Genetic Disorders

The Optical Genome Mapping Market is also influenced by the increasing prevalence of genetic disorders, which necessitates advanced diagnostic tools. As the global population ages, the incidence of conditions such as cancer and hereditary diseases is on the rise. According to recent estimates, genetic disorders affect approximately 1 in 10 individuals worldwide. This growing burden of genetic diseases drives the demand for Optical Genome Mapping Market technologies, which offer precise and comprehensive insights into genomic alterations, thereby facilitating early diagnosis and targeted treatment strategies.

Increased Investment in Genomic Research

Investment in genomic research is surging, significantly impacting the Optical Genome Mapping Market. Governments and private entities are allocating substantial funds to genomic studies, recognizing their potential to revolutionize healthcare. For instance, funding for genomic research initiatives has seen a year-on-year increase of over 20% in recent years. This influx of capital is expected to drive innovation in Optical Genome Mapping Market technologies, leading to the development of more sophisticated tools that can enhance genomic analysis and improve patient outcomes.

Growing Adoption of Personalized Medicine

The Optical Genome Mapping Market is experiencing a notable shift towards personalized medicine, driven by the increasing recognition of the need for tailored therapeutic approaches. As healthcare providers seek to enhance treatment efficacy, the demand for advanced genomic technologies rises. Personalized medicine, which relies heavily on genomic data, is projected to reach a market size of approximately 2 trillion USD by 2030. This trend underscores the importance of Optical Genome Mapping Market in identifying genetic variations that influence patient responses to therapies, thereby fostering a more individualized approach to healthcare.

Advancements in Optical Genome Mapping Technologies

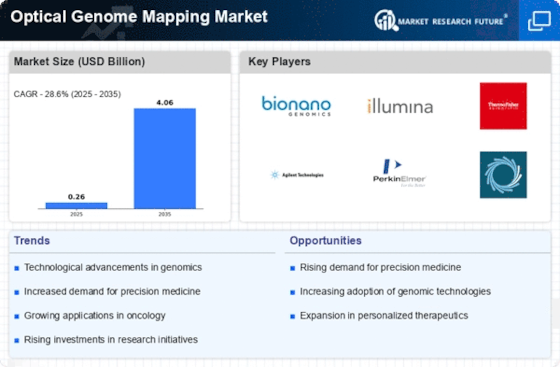

Technological innovations within the Optical Genome Mapping Market are propelling the field forward. Recent advancements in imaging techniques and data analysis algorithms have significantly improved the accuracy and efficiency of genome mapping. For instance, the introduction of high-throughput sequencing technologies has enabled researchers to process vast amounts of genomic data rapidly. The market for genomic analysis tools is expected to grow at a compound annual growth rate of 15% over the next five years, indicating a robust demand for Optical Genome Mapping Market solutions that can keep pace with these advancements.