Growing Awareness of Genetic Disorders

In Germany, there is a rising awareness regarding genetic disorders and their implications for public health. This awareness is fostering a greater demand for advanced genomic technologies, including optical genome-mapping. As healthcare professionals and patients alike become more informed about the benefits of genetic testing, the optical genome-mapping market is likely to expand. Reports indicate that approximately 1 in 20 individuals in Germany is affected by a genetic disorder, which underscores the need for effective diagnostic tools. The optical genome-mapping market is positioned to address this need, providing comprehensive insights into genetic variations that can aid in diagnosis and treatment. Consequently, the increasing focus on genetic disorders is expected to drive market growth, as stakeholders seek innovative solutions to improve patient outcomes.

Increasing Investment in Genomic Research

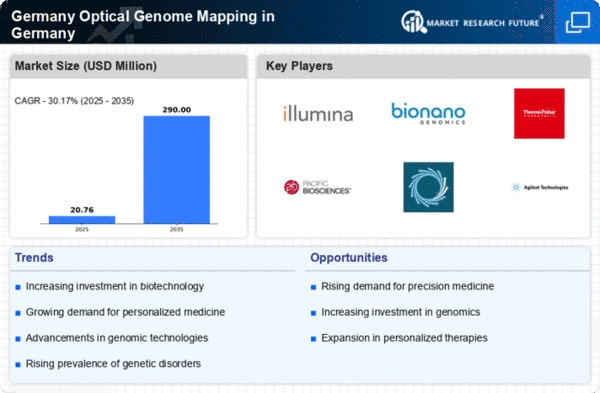

The optical genome-mapping market in Germany is experiencing a surge in investment, driven by both public and private sectors. Government funding for genomic research has seen a notable increase, with allocations reaching approximately €200 million in recent years. This financial support is aimed at enhancing research capabilities and fostering innovation in genetic technologies. Additionally, private companies are also investing heavily, with estimates suggesting that the market could grow at a CAGR of 15% over the next five years. This influx of capital is likely to accelerate the development of optical genome-mapping technologies, making them more accessible to researchers and healthcare providers. As a result, the optical genome-mapping market is poised for significant growth, reflecting the increasing recognition of the importance of genomic data in various applications.

Collaboration Between Academia and Industry

In Germany, there is a notable trend of collaboration between academic institutions and industry players in the field of genomics. This synergy is fostering innovation and accelerating the development of optical genome-mapping technologies. Universities and research centers are partnering with biotech companies to conduct cutting-edge research, which is essential for advancing the optical genome-mapping market. These collaborations often result in the sharing of resources, expertise, and data, which can lead to breakthroughs in genomic research. Furthermore, funding from both public and private sectors is often directed towards these collaborative efforts, enhancing their impact. As a result, the optical genome-mapping market is likely to benefit from this collaborative environment, which is expected to drive technological advancements and market growth.

Regulatory Support for Genomic Technologies

The regulatory landscape in Germany is becoming increasingly supportive of genomic technologies, which is beneficial for the optical genome-mapping market. Recent initiatives by the Federal Ministry of Health aim to streamline the approval processes for genetic testing technologies, thereby facilitating quicker access to innovative solutions. This regulatory support is crucial, as it encourages companies to invest in research and development, knowing that their products will have a clearer pathway to market. Furthermore, the optical genome-mapping market is likely to benefit from harmonized regulations across the European Union, which could enhance market access for German companies. As a result, the favorable regulatory environment is expected to stimulate growth in the optical genome-mapping market, promoting advancements in genetic research and diagnostics.

Integration of Optical Genome-Mapping in Clinical Settings

The integration of optical genome-mapping technologies into clinical settings is becoming more prevalent in Germany. Hospitals and diagnostic laboratories are increasingly adopting these advanced genomic tools to enhance their diagnostic capabilities. This trend is supported by the growing body of evidence demonstrating the effectiveness of optical genome-mapping in identifying structural variations in genomes. As healthcare providers recognize the potential of these technologies to improve patient care, the optical genome-mapping market is likely to see increased demand. Estimates suggest that the adoption rate of optical genome-mapping in clinical applications could reach 30% by 2027. This integration not only enhances diagnostic accuracy but also supports personalized treatment plans, further driving the growth of the optical genome-mapping market.