Growing Investment in Biotechnology

Investment in the biotechnology sector in South America is a key driver for the optical genome-mapping market. Governments and private investors are increasingly recognizing the potential of biotechnology to address health challenges. In 2025, it is estimated that investments in biotechnology could reach upwards of $5 billion in the region. This influx of capital is likely to facilitate the development and commercialization of optical genome-mapping technologies. As more companies enter the market, competition will drive innovation and reduce costs, making these technologies more accessible to healthcare providers and researchers alike.

Rising Awareness of Genetic Testing

There is a notable increase in awareness regarding the importance of genetic testing among the South American population. Educational campaigns and initiatives by healthcare organizations are informing the public about the benefits of genetic testing, including early disease detection and personalized treatment options. This heightened awareness is expected to boost the demand for optical genome-mapping solutions, as individuals seek more comprehensive genetic insights. The market could see a growth rate of approximately 10% as more people opt for genetic testing services, thereby expanding the customer base for optical genome-mapping technologies.

Advancements in Genomic Technologies

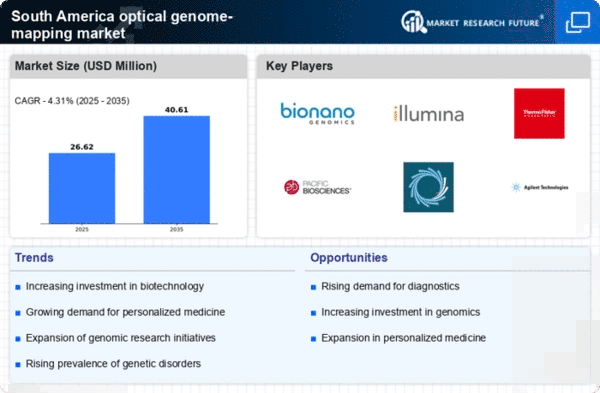

The optical genome-mapping market in South America is experiencing a surge due to rapid advancements in genomic technologies. Innovations in imaging techniques and data analysis are enhancing the accuracy and efficiency of genome mapping. This is particularly relevant as the market is projected to grow at a CAGR of approximately 15% over the next five years. The integration of artificial intelligence and machine learning into genomic analysis is also contributing to this growth, allowing for more precise interpretations of complex genomic data. As research institutions and biotechnology companies adopt these technologies, the demand for optical genome mapping solutions is likely to increase, thereby driving the market forward.

Increasing Prevalence of Genetic Disorders

The rising incidence of genetic disorders in South America is a significant driver for the optical genome-mapping market. With an estimated 1 in 200 births affected by a genetic condition, there is a pressing need for advanced diagnostic tools. Optical genome mapping offers a comprehensive approach to identifying structural variations in genomes, which is crucial for accurate diagnosis and treatment planning. As healthcare providers seek to improve patient outcomes, the adoption of optical genome mapping technologies is expected to rise. This trend is likely to contribute to a market growth rate of around 12% annually, reflecting the urgent need for effective genetic testing solutions.

Regulatory Support for Innovative Diagnostics

Regulatory bodies in South America are increasingly supportive of innovative diagnostic technologies, including optical genome mapping. Streamlined approval processes and favorable policies are encouraging the development and adoption of these advanced tools. As regulatory frameworks evolve to accommodate new technologies, companies in the optical genome-mapping market are likely to benefit from reduced barriers to entry. This supportive environment may lead to an increase in market players and innovations, potentially driving market growth by an estimated 8% over the next few years. The proactive stance of regulators is crucial for fostering a thriving optical genome-mapping market.