Supportive Regulatory Environment

The optical genome-mapping market is likely to thrive in the context of a supportive regulatory environment in the UK. Regulatory bodies are increasingly recognizing the importance of genomic technologies in improving patient outcomes. The UK Medicines and Healthcare products Regulatory Agency (MHRA) has established clear guidelines for the approval of genomic testing technologies, which facilitates the entry of innovative products into the market. This regulatory clarity is essential for companies operating in the optical genome-mapping market, as it reduces barriers to market entry and encourages investment in research and development. As a result, the optical genome-mapping market is expected to see a steady influx of new technologies and applications.

Advancements in Bioinformatics Tools

The optical genome-mapping market is being propelled by advancements in bioinformatics tools that enhance data analysis capabilities. As the complexity of genomic data increases, the need for sophisticated analytical tools becomes critical. Recent developments in machine learning and artificial intelligence are enabling more efficient processing of optical genome mapping data, allowing for quicker and more accurate interpretations. This trend is particularly relevant in the UK, where research institutions are investing heavily in bioinformatics infrastructure. The integration of these advanced tools into the optical genome-mapping market is expected to streamline workflows and improve the overall efficiency of genomic research and clinical applications.

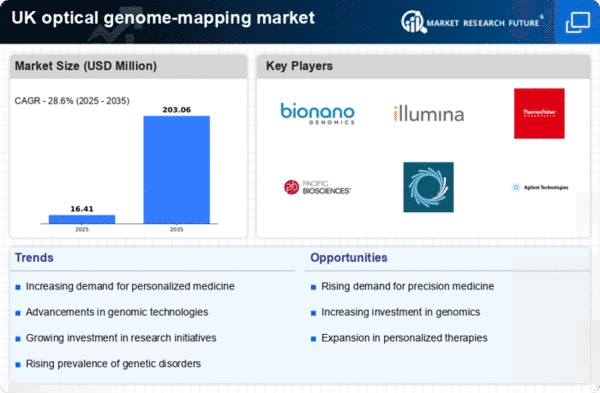

Rising Demand for Precision Medicine

The optical genome-mapping market is experiencing a notable surge in demand driven by the increasing focus on precision medicine. As healthcare systems in the UK shift towards personalized treatment plans, the need for advanced genomic analysis tools becomes paramount. Optical genome mapping offers high-resolution insights into genetic variations, enabling clinicians to tailor therapies to individual patients. This trend is reflected in the growing investments in genomic technologies, with the UK government allocating approximately £200 million to genomics research in recent years. Such financial backing is likely to bolster the optical genome-mapping market, as healthcare providers seek to integrate these technologies into routine diagnostics and treatment protocols.

Growing Awareness of Genetic Disorders

The optical genome-mapping market is poised for growth due to the rising awareness of genetic disorders among the UK population. As more individuals seek genetic testing for hereditary conditions, the demand for comprehensive genomic analysis tools is increasing. Optical genome mapping provides a robust solution for identifying structural variations associated with various genetic disorders. This heightened awareness is reflected in the increasing number of genetic testing services offered by healthcare providers, which have reportedly risen by 30% over the past two years. Consequently, the optical genome-mapping market is likely to expand as healthcare professionals incorporate these technologies into their diagnostic workflows.

Increased Investment in Genomic Research

The optical genome-mapping market is benefiting from heightened investment in genomic research across the UK. Public and private sectors are increasingly recognizing the potential of genomic technologies to revolutionize healthcare. For instance, the UK Biobank has reported a significant increase in funding, amounting to £100 million, aimed at enhancing genomic data collection and analysis. This influx of capital is expected to drive innovation within the optical genome-mapping market, as researchers and institutions seek to develop more sophisticated mapping techniques. Furthermore, collaborations between universities and biotech firms are likely to emerge, fostering an environment conducive to advancements in optical genome mapping.