Market Trends

Key Emerging Trends in the Generative AI in Data Analytics Market

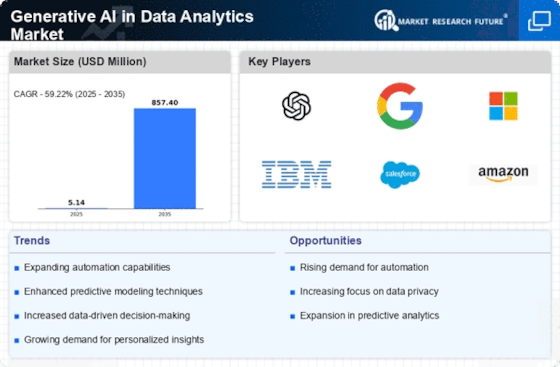

Generative AI, a subset of synthetic intelligence, has been making considerable strides within the data analytics market. Its capability to generate new content, pictures, and even tunes has captured the attention of businesses looking to gain insights from vast amounts of statistics. One of the distinguished market traits of Generative AI is its growing adoption across various industries. Moreover, Generative AI is revolutionizing the way corporations approach facts analysis by permitting them to generate artificial information. This artificial reality may be used to teach system learning fashions, validate algorithms, and conduct thorough testing without compromising the privacy and security of facts. As a result, the demand for Generative AI solutions in the data analytics market is on the upward thrust, with groups in search of innovative approaches to harness the energy of artificial records for progressed insights and selection-making. Another brilliant trend is the combination of Generative AI with natural language processing (NLP) for textual content generation and summarization. This integration permits corporations to system and examine unstructured textual content records extra successfully, mainly through superior sentiment analysis, content era, and automated report summarization. Furthermore, the emergence of generative hostile networks (GANs) has considerably influenced the market trends of Generative AI in data analytics. GANs, a class of gadgets gaining knowledge of structures, pit neural networks against each other to generate new records. This is indistinguishable from actual information. This era has discovered applications in statistics augmentation, anomaly detection, and picture synthesis, offering companies a powerful tool to enhance their data analytics capabilities. As a result, the adoption of GANs and comparable Generative AI strategies is reshaping the data analytics panorama, riding the demand for more robust and versatile Generative AI answers. Additionally, the market traits of Generative AI in data analytics replicate a developing emphasis on the moral and accountable use of AI-generated content material. With the capability to misuse and manipulate generated content, agencies are increasingly prioritizing ethical issues and transparency in their use of Generative AI. This fashion has led to the improvement of suggestions and first-class practices for the ethical deployment of Generative AI in data analytics, making sure that businesses leverage this generation responsibly while retaining records integrity and privacy.

Leave a Comment