Market Share

Generative AI in Fintech Market Share Analysis

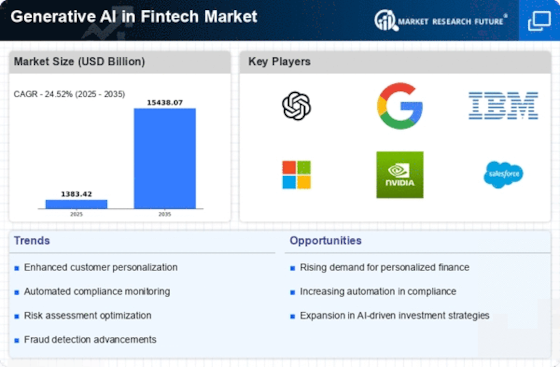

Generative AI's role in the fintech market is rapidly evolving, and its market share positioning strategies are pivotal in establishing a strong presence in this sector. One of the primary strategies involves showcasing the potential of Generative AI in enhancing fraud detection and risk management within financial institutions. By highlighting its capacity to detect significant trade data volumes and determine complex trends characteristic of illegal activity, Generative AI can position itself as a vital instrument in protecting financial structures that will attract banks and other financial services organizations interested in cutting-edge security applications.

Moreover, Generative AI has an immense market positioning strategy in the fintech sector as personalized customer experiences. The generative artificial intelligence can improve the ability of financial institutions to analyze customer behavior, preferences and trends in the market which will then enable them deliver tailor-made products and services. This approach not only improves customer satisfaction but also positions Generative AI as a key player in fostering customer engagement and retention within the cutthroat fintech industry.

Additionally, strategic partnerships with fintech businesses and financial organizations are key contributors to Generative AI’s market positioning. Through partnerships with established players in the industry, Generative AI can embed its technology into existing fintech platforms, improving data analysis and decision-making processes. This strategy not only extends Generative AI’s market footprint but makes it an essential element of the fintech environment and raises the demand for its cutting-edge solutions.

In addition, regulatory compliance and risk management are important components of market positioning for Generative AI in the fintech industry. Emphasizing its ability to support financial institutions with navigating complicated regulatory regimes and managing risks efficiently helps position Generative AI as an ally ensuring compliance in the industry. This approach is especially attractive for fintech firms looking to utilize sophisticated tools in addressing regulatory issues and minimizing operational risks.

Moreover, Generative AI can use thought leadership and industry advocacy to improve its positioning in the fintech market. Through active engagement in industry conferences, participation in regulatory conversations and publishing thought leadership on the nexus of AI and fintech, Generative AI can position itself as an authority figure within its field. This situates the company as a source of reference for fintech organizations with novel strategies and competence, thus cementing its market significance.

In addition, pricing and packaging are essential for the positioning of Generative AI in fintech. Offering flexible pricing models tailored to the unique needs of fintech companies, such as scalable usage-based pricing or value-added service bundles, can make Generative AI more appealing and accessible. By aligning its pricing with the value it brings to fintech organizations, Generative AI can effectively differentiate itself from competitors and capture market share.

Leave a Comment