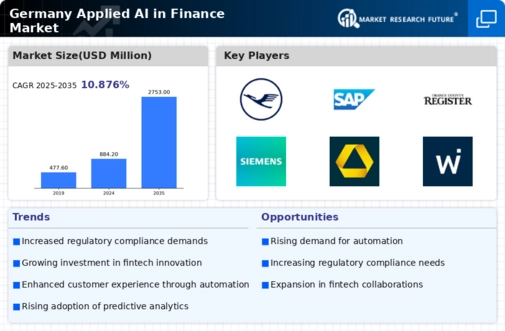

The Germany Applied AI in Finance Market is characterized by rapid advancements and significant competition, driven by the increasing need for automation, efficiency, and enhanced decision-making processes within the financial sector. German companies are keenly adopting applied AI technologies to address challenges such as algorithmic trading, risk management, and customer service enhancements. The competitive landscape is influenced by a combination of established financial institutions and tech-driven startups, all vying to innovate and differentiate themselves.

The integration of AI capabilities is becoming a crucial factor in achieving operational excellence and driving strategic growth, compelling players to invest substantially in developing cutting-edge AI tools and platforms tailored for financial applications.

Lufthansa, while primarily recognized as a leading airline, has effectively leveraged its data analytics and AI capabilities within its operations, including aspects related to financial management and service optimizations. The company has capitalized on its vast troves of consumer data and behavioral insights to refine its pricing strategies and improve customer loyalty programs. This position enables Lufthansa to optimize revenue management, enhance forecasting, and streamline financial reporting processes.

Additionally, the company's strong brand reputation and established market presence within Germany provide it with a robust platform for exploring innovative AI applications that can further enrich its service delivery and operational efficiency in the financial context.

SAP is a prominent player in the Germany Applied AI in Finance Market, known for delivering enterprise software solutions that integrate advanced AI functionalities. The company offers a suite of products aimed at enhancing business processes across various financial applications, including predictive analytics, real-time financial reporting, and automated reconciliation. SAP's strategic focus on innovation has led to significant investments in AI research and development, positioning itself as a leader in helping companies harness the power of AI to drive financial insights and compliance.

The firm has also engaged in multiple mergers and acquisitions to bolster its technology portfolio, thereby amplifying its capabilities in serving the financial industry in Germany, reinforcing its market presence as a trusted partner for digital transformation in finance.