Supportive Regulatory Framework

The regulatory environment in Germany is increasingly favorable for the development of electrolyzer technologies. The government has implemented various policies aimed at promoting hydrogen production and utilization, which directly benefits the Germany Electrolyzer Market. For instance, the National Hydrogen Strategy outlines ambitious targets for hydrogen production, aiming for 5 gigawatts of electrolyzer capacity by 2030. This supportive framework not only encourages investment but also fosters innovation within the sector, potentially leading to a more competitive landscape for electrolyzer manufacturers.

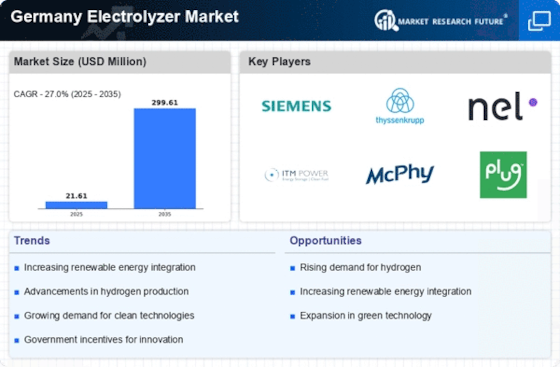

Rising Demand for Green Hydrogen

The increasing emphasis on sustainable energy solutions is driving the demand for green hydrogen, which is produced using electrolyzers. In the Germany Electrolyzer Market, the transition towards renewable energy sources is evident, with projections indicating that the hydrogen market could reach a value of approximately 9 billion euros by 2030. This shift is largely influenced by the European Union's commitment to reducing carbon emissions, which has led to substantial investments in hydrogen technologies. As industries seek to decarbonize their operations, the role of electrolyzers becomes crucial, suggesting a robust growth trajectory for the Germany Electrolyzer Market.

Increased Investment in Renewable Energy

The surge in investments directed towards renewable energy sources is significantly impacting the Germany Electrolyzer Market. With the German government aiming to achieve a carbon-neutral economy by 2045, substantial funding is being allocated to renewable projects, including hydrogen production. Reports suggest that investments in renewable energy could exceed 50 billion euros by 2030, creating a favorable environment for electrolyzer deployment. This influx of capital not only supports the development of new electrolyzer projects but also enhances the overall infrastructure necessary for hydrogen integration into the energy system.

Growing Industrial Applications of Hydrogen

The industrial sector's increasing reliance on hydrogen as a feedstock is a key driver for the Germany Electrolyzer Market. Industries such as steel manufacturing and chemical production are exploring hydrogen as a cleaner alternative to fossil fuels. The demand for hydrogen in these sectors is projected to rise significantly, with estimates suggesting that hydrogen could account for up to 20% of the total energy consumption in industrial processes by 2030. This trend underscores the importance of electrolyzers in producing green hydrogen, thereby positioning the Germany Electrolyzer Market for substantial growth.

Technological Innovations in Electrolyzer Design

Advancements in electrolyzer technology are playing a pivotal role in shaping the Germany Electrolyzer Market. Innovations such as improved membrane materials and enhanced efficiency in electrolysis processes are making electrolyzers more viable for large-scale applications. Recent developments indicate that new designs can achieve efficiencies exceeding 80%, which is crucial for reducing the cost of hydrogen production. As these technologies continue to evolve, they are likely to attract further investment and interest from various sectors, thereby bolstering the growth of the Germany Electrolyzer Market.

Leave a Comment