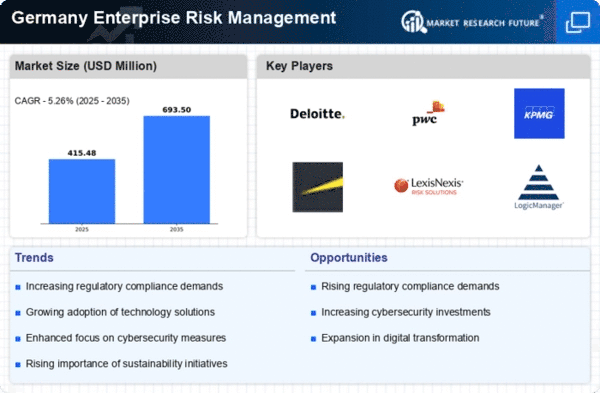

The enterprise risk-management market in Germany is characterized by a dynamic competitive landscape, driven by increasing regulatory requirements and the growing complexity of risks faced by organizations. Key players such as Deloitte (US), PwC (GB), and KPMG (NL) are strategically positioned to leverage their extensive expertise in risk assessment and management. These firms are focusing on digital transformation and innovation, which are essential for adapting to the rapidly evolving risk environment. Their collective strategies not only enhance their service offerings but also shape the competitive dynamics by setting high standards for operational excellence and client engagement.

In terms of business tactics, companies are increasingly localizing their operations to better serve the German market, optimizing supply chains to enhance efficiency and responsiveness. The competitive structure of the market appears moderately fragmented, with a mix of large multinational firms and specialized local players. This fragmentation allows for diverse service offerings, yet the influence of major players remains significant, as they often set benchmarks for quality and innovation that smaller firms strive to meet.

In October 2025, Deloitte (US) announced a strategic partnership with a leading technology firm to enhance its risk analytics capabilities. This collaboration is expected to integrate advanced AI tools into their risk management solutions, thereby improving predictive analytics and decision-making processes for clients. Such a move underscores Deloitte's commitment to staying at the forefront of technological advancements in risk management, potentially giving them a competitive edge in the market.

Similarly, in September 2025, PwC (GB) launched a new suite of digital risk management tools aimed at small and medium-sized enterprises (SMEs). This initiative reflects a growing recognition of the unique challenges faced by SMEs in managing risks effectively. By tailoring solutions to this segment, PwC not only expands its market reach but also positions itself as a thought leader in addressing the specific needs of diverse client bases.

In August 2025, KPMG (NL) expanded its operations in Germany by acquiring a local risk consultancy firm. This acquisition is likely to enhance KPMG's local expertise and client relationships, allowing for a more nuanced understanding of the regional risk landscape. Such strategic moves indicate a trend towards consolidation in the market, where larger firms seek to bolster their capabilities through targeted acquisitions.

As of November 2025, the competitive trends in the enterprise risk-management market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, as firms recognize the value of collaboration in enhancing service offerings and addressing complex client needs. Looking ahead, competitive differentiation is expected to evolve, shifting from traditional price-based competition to a focus on innovation, technological integration, and supply chain reliability. This transition may redefine how firms position themselves in the market, emphasizing the importance of adaptability and forward-thinking strategies.