Gin Market Share

Gin Market Research Report Information by Type (London Dry, Plymouth, Old Tom and others), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, And Others), And by Region (North America, Europe, Asia-Pacific, And Rest of The World) – Market Forecast Till 2035

Market Summary

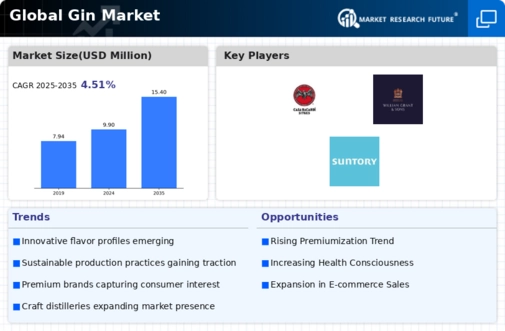

As per Market Research Future Analysis, the global gin market was valued at USD 9895.50 million in 2024 and is projected to reach USD 16079.28 million by 2035, growing at a CAGR of 4.51% from 2025 to 2035. The market is driven by increasing demand for premium ready-to-drink and luxury spirits, fueled by rising disposable incomes and changing consumer preferences. Europe leads the market with a valuation of USD 9895.50 million in 2024, while North America follows as the second-largest market. The gin market is also witnessing a surge in craft and flavored gins, catering to the evolving tastes of millennials and urban consumers.

Key Market Trends & Highlights

Key trends driving the gin market include urbanization, premiumization, and evolving consumer preferences.

- The gin industry is expected to grow from USD 9895.5 million in 2024 to USD 13475.4 million by 2032.

- Plymouth gin held a ~35% market share in 2021, indicating strong consumer preference.

- Supermarkets and hypermarkets dominated the distribution channel in 2021, projected to grow faster during 2022-2030.

- The Asia-Pacific region is anticipated to grow at the fastest CAGR from 2022 to 2030.

Market Size & Forecast

| 2024 Market Size | USD 9895.50 million |

| 2035 Market Size | USD 16079.28 million |

| CAGR (2024-2035) | 4.51% |

| Largest Regional Market in 2021 | Europe (USD 4336.5 million) |

Major Players

Major players include Bacardi Limited, Diageo plc, William Grant & Sons Ltd, and The East India Company Ltd.

Market Trends

Growing disposable income to boost market growth

The industry's expansion is aided by increased disposable income, expanding populations in established and developing nations, rising millennial alcohol consumption, and rising demand for alcoholic beverages. Additionally, it is projected that shifting customer preferences for premium liquor varieties will increase demand for premium brands. Large populations are migrating to bigger cities where they are exposed to a wider variety of alcoholic beverage goods, thus assisting industry expansion. Meanwhile, the sector is growing due to expanding urbanization, lavish consumption, and rising social acceptance.

Gin is prized for its natural flavor and earthy appeal, and most on-trade counters use a sizable amount of gin to create premium cocktails. The market for alcoholic drinks is evolving as more distilleries enter the beverage industry due to a rise in alcohol usage among young people and millennials.

Comparatively speaking, the younger generation has more sophisticated palates and is continuously hunting for distinctive, premium alcoholic beverages. Alcoholic beverages that contain natural components perform better, and customers are becoming increasingly interested in these goods. As a result, natural flavors are becoming increasingly popular to boost the beverage's innate appeal. Because it has a natural flavor and gives a drink an earthy charm, gin is popular. Most on-trade counters utilize a sizable amount of gin to create premium beverages. Consumers, especially millennials, are experimenting with gin and other alcoholic beverages at social gatherings and festive events.

The global gin market appears to be experiencing a renaissance, driven by a growing consumer preference for artisanal and premium spirits, which suggests a shift in drinking culture towards quality over quantity.

U.S. Department of Agriculture

Gin Market Market Drivers

Rising Consumer Demand

The Global Global Gin Market Industry experiences a notable surge in consumer demand, driven by the increasing popularity of gin-based cocktails and premium spirits. As of 2024, the market is valued at 9.9 USD Billion, reflecting a growing preference for artisanal and craft gin products. This trend is particularly evident in urban areas where consumers seek unique flavor profiles and high-quality ingredients. The rise of social media platforms has also contributed to this demand, as consumers share their experiences and recommendations, further fueling interest in gin. This evolving consumer landscape suggests a robust growth trajectory for the industry.

Market Growth Projections

Growth of the Cocktail Culture

The cocktail culture continues to flourish globally, significantly impacting the Global Global Gin Market Industry. Bars and restaurants are increasingly incorporating gin into their cocktail menus, showcasing its versatility and enhancing its status as a premium spirit. This trend is particularly pronounced in metropolitan areas where mixologists craft innovative gin cocktails that attract discerning consumers. The cocktail renaissance has led to a resurgence in gin consumption, contributing to the industry's growth. As the market evolves, it is anticipated that the cocktail culture will further bolster gin sales, supporting the industry's projected CAGR of 4.09% from 2025 to 2035.

Innovative Flavors and Craftsmanship

Innovation in flavors and craftsmanship plays a pivotal role in the Global Global Gin Market Industry. Distilleries are increasingly experimenting with botanicals, resulting in a diverse array of gin varieties that cater to evolving consumer tastes. For instance, the introduction of floral, fruity, and spicy gins has attracted a broader audience, enhancing the market's appeal. This trend aligns with the industry's projected growth, as the market is expected to reach 15.4 USD Billion by 2035. The emphasis on quality and creativity in gin production not only differentiates brands but also fosters a deeper connection with consumers, ultimately driving sales.

E-commerce and Digital Marketing Strategies

The Global Global Gin Market Industry is witnessing a transformation due to the rise of e-commerce and digital marketing strategies. Online platforms provide consumers with convenient access to a wide range of gin products, facilitating purchases and expanding market reach. Distilleries are leveraging social media and targeted advertising to engage with consumers, fostering brand loyalty and awareness. This shift towards digital channels is particularly relevant in the context of the growing younger demographic, who are more inclined to shop online. As e-commerce continues to evolve, it is expected to play a crucial role in driving sales and enhancing the overall market landscape.

Health Consciousness and Low-Alcohol Options

The rising health consciousness among consumers is influencing the Global Global Gin Market Industry, as individuals seek lower-alcohol and healthier beverage options. This shift has prompted distilleries to develop low-alcohol and non-alcoholic gin alternatives, appealing to a demographic that prioritizes wellness without sacrificing flavor. The introduction of these products aligns with the broader trend of mindful drinking, which is gaining traction globally. As consumers increasingly opt for lighter options, the market is likely to see a diversification of product offerings, catering to health-conscious individuals while maintaining the essence of gin.

Market Segment Insights

Gin Type Insights

The gin market segmentation0, based on type, includes London dry, Plymouth, old tom, and others. The Plymouth segment held the majority share in 2021, contributing around ~35% concerning the gin market revenue. London Dry Gin is a widely consumed beverage worldwide because it offers consumers superior flavor and refreshment. London Dry Gin uses a fruit with a strong juniper flavor for its characteristic flavor. It also has a lot of undertones of crisp citrus. This is why adding a lemon twist to a martini brings out its citrus notes.

With a depth of natural ingredients, Plymouth Gin's smooth and rich flavor offers consumers a distinctive experience.

Gin Distribution Channel Insights

Based on distribution channels, the gin market segmentation includes supermarkets, hypermarkets, specialty stores, and others. The Supermarkets and Hypermarkets segment dominated the market in 2021 and is projected to be the faster-growing segment during the forecast period, 2022-2030. This is because of trends toward quick westernization and the growth of contemporary pubs and restaurants in developing nations. Hence, rising applications of implants for gin positively impact the market growth.

Figure 2: Gin Market, by Distribution Channel, 2021 & 2030 (USD Million)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

Get more detailed insights about Gin Market Research Report - Forecast till 2032

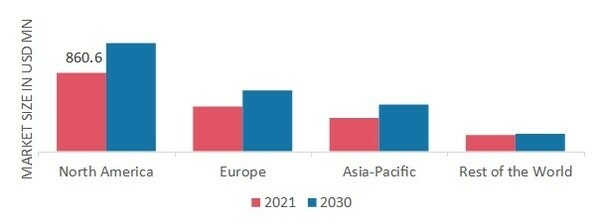

Regional Insights

By Region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. Europe's gin market accounted for USD 4336.5 million in 2021 and is expected to exhibit a significant CAGR growth during the study period. The demand for din is rising in various locations, which effectively fuels the growth of the gin industry.

Further, the major countries studied in the market report are The U.S., Canada, Germany, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 3: GIN MARKET SHARE BY REGION 2021 (%)

Source: Secondary Research, Primary Research, Market Research Future Database and Analyst Review

North America gin market accounts for the second-largest market share. The growing number of millennials in the area is anticipated to fuel the gin market. The gin sector is also driven by the region's urbanization, changing lifestyles, and disposable income. Because of the security clearance procedures established by regulatory organizations, the number of manufacturers in the United States has increased quickly. Gin distribution, sale, and production are all tightly regulated in the US. Due to the regulatory framework, several industries have consolidated at different levels.

Further, the UK gin market held the largest market share, and the Canada gin market was the fastest-growing market in the European region.

The Asia-Pacific Gin Market is expected to grow at the fastest CAGR from 2022 to 2030. This is due to the rising urbanization and rise in disposable income's effects on the number of potential consumers. According to data published by the IMF and World Bank, Asian consumers have been consistently spending more money overall on alcohol and tobacco products, which has been fueling market expansion. By 2025, overall spending will likely equal over USD 425 billion. Further, in response to changes in patron preferences, pubs and bars specialize in the unique cocktail party lounge.

Most wealthy consumers prefer vodka and gin-based cocktails like the Asian Pear Mule, Whisky Mac, Japanese Highball, Singapore Sling, and Soju Watermelon Cocktail. Moreover, China gin market held the largest market share, and the Indian gin market was the fastest-growing market in the Asia-Pacific region.

Key Players and Competitive Insights

Major market players are investing a lot of money in R&D to expand their product offerings, which will spur further growth for the gin industry. Participants in the market are also undertaking various strategic initiatives to expand their footprint. Significant market developments include new product launches, contractual agreements, mergers and acquisitions, increased investments, and collaboration with other organizations. Gin industry rivals must provide affordable goods to grow and thrive in a more cutthroat and competitively heated market environment.

One of the primary business strategies manufacturers adopt in the gin industry to benefit clients and expand the market sector is manufacturing locally to reduce operating costs. In recent years, gin industry has provided some of the most significant benefits. Major gin market players such as Bombay Sapphire, Diageo India, and others are working on expanding the market demand by investing in research and development activities.

The Bombay Spirits Company, a division of Bacardi, produces Bombay Sapphire gin in Laverstoke Mill in the English village of Laverstoke in the county of Hampshire. In April 2022, A gin with a Mediterranean lemon flavor called Citron Presse was introduced by Bombay Sapphire, a brand owned by Bacardi. The business intends to launch new items in several important nations, including Australia, Spain, and Ireland. Germany, Austria, Belgium, Portugal, Switzerland, France, Denmark, and Andorra.

Also, the largest beverage and alcoholic beverage firm in the nation, Diageo India, has an exceptional portfolio of premium brands. In march 2022, Diageo India invested in Nao Spirits, a maker of "Greater Than" and "Hapusa," two premium Indian handmade gins. Diageo India hopes to extend its participation in India's fast-growing premium gin industry with this investment.

Key Companies in the Gin Market market include

Industry Developments

On April 10, 2024, Tanqueray, the worldwide gin brand, introduced a new craft gin that will be manufactured in limited amounts. The new gin’s fragrance and flavor will come from wild juniper and some rare citrus fruits. There is a rise in the consumption of premium and craft gins and so there is a need for gins that are fresh and new in the market for people that only need them in special occasions.

In December of 2023, the district distillery Beefeater Gin announced that they would be expanding their facilities in London due to the increase in demand globally. The new expansion is set to help beefeater increase the production capacity by twenty percent also is an indication of the branding strategies aimed at consolidating the company’s position in the focal international markets like the US and the Asian countries.

In the month of November 2023, a new brand “Bombay Bramble” which deals with gin infused with raspberry and blackberry was launched by Bombay sapphire. The introduction of such kind of product was focused to the market as a flavored gin aided in demand within the market primarily in the UK’s and the US’s where a demand for flavored spirits had skyrocketed.

In October 2023, Hernö Gin a brand-based Sweden was awarded for aged gins form at World Gin Awards. This award confirms Hernö Gin’s position in the market as a quality producing gin and emphasizes the growing trend on gins that are aged for consumers looking for distinctive and premium tastes.

In September 2023, Gin Mare, which is precisely a gin coming from Holland, worked with some of the first-class cocktail bars across the world to start a campaign that seeks to raise awareness of gins and cocktails made using gins infused with botanicals common in the Mediterranean region. The campaign seeks to enhance the market presence of Gin Mare Mediterranean taste and allow the company to expand to strategic regions like Europe and the US.

Future Outlook

Gin Market Future Outlook

The Global Gin Market is projected to grow at a 4.51% CAGR from 2025 to 2035, driven by premiumization, innovative flavors, and expanding distribution channels.

New opportunities lie in:

- Develop craft gin brands targeting millennials' preferences for unique flavors.

- Leverage e-commerce platforms to enhance direct-to-consumer sales strategies.

- Explore sustainable packaging solutions to appeal to environmentally conscious consumers.

By 2035, the Global Gin Market is expected to achieve substantial growth, reflecting evolving consumer preferences and market dynamics.

Market Segmentation

Gin Type Outlook

- London Dry

- Plymouth

- Old Tom

- Others

Gin Regional Outlook

- US

- Canada

Gin Distribution Channel Outlook

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2024 | USD 9895.5 million |

| Market Size 2035 | 16079.28 (Value (USD Million)) |

| Compound Annual Growth Rate (CAGR) | 4.51% (2025 - 2035) |

| Base Year | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 & 2023 |

| Market Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Distribution Channel, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and Rest of the World |

| Countries Covered | The U.S, Canada, Germany, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | The East India Company Ltd (U.K.), William Grant & Sons Ltd (U.K.), Ginebra San Miguel Inc. (Philippines), The Poshmakers Ltd (U.K.), Forest Dry Gin (Belgium), West End Drinks Ltd (U.K.), Boudier Gabriel Ets SA (France), Diageo plc (U.K.) |

| Key Market Opportunities | Customers desire new experiences and higher-quality products. |

| Key Market Dynamics | Rising prevalence of premium alcoholic beverages |

| Market Size 2025 | 10341.99 (Value (USD Million)) |

Market Highlights

Author

Latest Comments

This is a great article! Really helped me understand the topic better.

Thanks for sharing this. I’ve bookmarked it for later reference.

FAQs

How much is the gin market?

The gin market size was valued at USD 9468.5 Million in 2023

What is the growth rate of the gin market?

The market is projected to grow at a CAGR of 4.51% during the forecast period, 2024-2032.

Which region held the largest market share in the gin market?

Europe had the largest share in the market

Who are the key players in the gin market?

The key players in the market are The East India Company Ltd (U.K.), William Grant & Sons Ltd (U.K.), Ginebra San Miguel Inc. (Philippines), The Poshmakers Ltd (U.K.), Forest Dry Gin (Belgium).

Which Type led the gin market?

The London dry category dominated the market in 2023.

Which distribution channel had the largest market share in the gin market?

The supermarkets and hypermarket had the largest share in the market.

-

Table of Contents

-

Executive Summary

-

Scope of the Report

- Market Definition

-

Scope of the Study

- Research Objectives

- Assumptions & Limitations

- Market Structure

-

Market Research Methodology

- Research Process

- Secondary Research

- Primary Research

- Forecast Model

-

Market Landscape

-

Supply Chain Analysis

- Raw Material Suppliers

- Manufacturers/Producers

- Distributors/Retailers/Wholesalers/E-Commerce

- End Users

-

Porter’s Five Forces Analysis

- Threat of New Entrants

- Bargaining Power of Buyers

- Bargaining Power of Suppliers

- Threat of Substitutes

- Rivalry

-

Supply Chain Analysis

-

Market Dynamics of the Global Gin Market

- Introduction

- Drivers

- Restraints

- Opportunities

- Challenges

-

Global Gin Market, by Type

- Introduction

-

London Dry

- Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Region, 2024-2030

-

Plymouth

- Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Region, 2024-2030

-

Old Tom

- Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Region, 2024-2030

-

Others

- Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Region, 2024-2030

-

Global Gin Market, by Distribution Channel

- Introduction

-

Hypermarkets & Supermarkets

- Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Region, 2024-2030

-

Specialty Stores

- Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Region, 2024-2030

-

Others

- Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Region, 2024-2030

-

Global Gin Market, by Region

- Introduction

-

North America

- Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Type, 2024-2030

- Market Estimates & Forecast, by Distribution Channel, 2024-2030

- US

- Canada

- Mexico

-

Europe

- Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Type, 2024-2030

- Market Estimates & Forecast, by Distribution Channel, 2024-2030

- Germany

- France

- Italy

- Spain

- UK

- Rest of Europe

-

Asia-Pacific

- Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Type, 2024-2030

- Market Estimates & Forecast, by Distribution Channel, 2024-2030

- China

- India

- Japan

- Australia & New Zealand

- Rest of Asia-Pacific

-

Rest of the World (RoW)

- Market Estimates & Forecast, 2024-2030

- Market Estimates & Forecast, by Type, 2024-2030

- Market Estimates & Forecast, by Distribution Channel, 2024-2030

- South America

- Middle East

- Africa

-

Company Landscape

- Introduction

- Market Strategy

- Key Development Analysis

-

(Expansions/Mergers & Acquisitions/Joint Ventures/New Product Developments/Agreements/Investments)

-

Company Profiles

-

Bacardi Limited

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Diageo plc

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Pernod Ricard S.A.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Ginebra San Miguel Inc.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Suntory Holdings Limited

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

William Grant & Sons Ltd

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

The Sustainable Spirit Co.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Boudier Gabriel Ets SA

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Davide Campari-Milano S.p.A.

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

The East India Company Ltd

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Forest Dry Gin

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

The Black Bottle Distillery

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

The Poshmakers Ltd

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

West End Drinks Ltd

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Langtons Gin Ltd

- Company Overview

- Financial Updates

- Product/Business Segment Overview

- Strategy

- Key Developments

- SWOT Analysis

-

Bacardi Limited

-

Conclusion

-

-

List of Tables and Figures

- LIST OF TABLES

- Table 1 Global Gin Market, by Region, 2024-2030 (USD Million)

- Table 2 Global Gin Market, by Type, 2024-2030 (USD Million)

- Table 3 Global Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 4 North America: Gin Market, by Country, 2024-2030 (USD Million)

- Table 5 North America: Gin Market, by Type, 2024-2030 (USD Million)

- Table 6 North America: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 7 US: Gin Market, by Type, 2024-2030 (USD Million)

- Table 8 US: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 9 Canada: Gin Market, by Type, 2024-2030 (USD Million)

- Table 10 Canada: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 11 Mexico: Gin Market, by Type, 2024-2030 (USD Million)

- Table 12 Mexico: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 13 Europe: Gin Market, by Country, 2024-2030 (USD Million)

- Table 14 Europe: Gin Market, by Type, 2024-2030 (USD Million)

- Table 15 Europe: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 16 Germany: Gin Market, by Type, 2024-2030 (USD Million)

- Table 17 Germany: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 18 France: Gin Market, by Type, 2024-2030 (USD Million)

- Table 19 France: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 20 Italy: Gin Market, by Type, 2024-2030 (USD Million)

- Table 21 Italy: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 22 Spain: Gin Market, by Type, 2024-2030 (USD Million)

- Table 23 Spain: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 24 UK: Gin Market, by Type, 2024-2030 (USD Million)

- Table 25 UK: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 26 Rest of Europe: Gin Market, by Type, 2024-2030 (USD Million)

- Table 27 Rest of Europe: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 28 Asia-Pacific: Gin Market, by Country, 2024-2030 (USD Million)

- Table 29 Asia-Pacific: Gin Market, by Type, 2024-2030 (USD Million)

- Table 30 Asia-Pacific: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 31 China: Gin Market, by Type, 2024-2030 (USD Million)

- Table 32 China: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 33 India: Gin Market, by Type, 2024-2030 (USD Million)

- Table 34 India: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 35 Japan: Gin Market, by Type, 2024-2030 (USD Million)

- Table 36 Japan: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 37 Australia & New Zealand: Gin Market, by Type, 2024-2030 (USD Million)

- Table 38 Australia & New Zealand: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 39 Rest of Asia-Pacific: Gin Market, by Type, 2024-2030 (USD Million)

- Table 40 Rest of Asia-Pacific: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 41 Rest of the World (RoW): Gin Market, by Country, 2024-2030 (USD Million)

- Table 42 Rest of the World (RoW): Gin Market, by Type, 2024-2030 (USD Million)

- Table 43 Rest of the World (RoW): Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 44 South America: Gin Market, by Type, 2024-2030 (USD Million)

- Table 45 South America: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 46 Middle East: Gin Market, by Type, 2024-2030 (USD Million)

- Table 47 Middle East: Gin Market, by Distribution Channel, 2024-2030 (USD Million)

- Table 48 Africa: Gin Market, by Type, 2024-2030 (USD Million)

- Table 49 Africa: Gin Market, by Distribution Channel, 2024-2030 (USD Million) LIST OF FIGURES

- FIGURE 1 Global Gin Market Segmentation

- FIGURE 2 Forecast Research Methodology

- FIGURE 3 Five Forces Analysis of the Global Gin Market

- FIGURE 4 Value Chain of the Global Gin Market

- FIGURE 5 Share of the Global Gin Market in 2022, by Country (%)

- FIGURE 6 Global Gin Market, by Region, 2024-2030

- FIGURE 7 Global Gin Market Size, by Type, 2022

- FIGURE 8 Share of the Global Gin Market, by Type, 2024-2030 (%)

- FIGURE 9 Global Gin Market Size, by Distribution Channel, 2022

- FIGURE 10 Share of the Global Gin Market, by Distribution Channel, 2024-2030 (%)

Gin Market Segmentation

Gin Type Outlook (USD Million, 2018-2030)

- London Dry

- Plymouth

- Old Tom

- Others

Gin Distribution Channel Outlook (USD Million, 2018-2030)

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

Gin Regional Outlook (USD Million, 2018-2030)

North America Outlook (USD Million, 2018-2030)

- North America Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- North America Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

US Outlook (USD Million, 2018-2030)

- US Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- US Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

CANADA Outlook (USD Million, 2018-2030)

- CANADA Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- CANADA Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

- North America Gin by Type

Europe Outlook (USD Million, 2018-2030)

- Europe Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- Europe Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

Germany Outlook (USD Million, 2018-2030)

- Germany Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- Germany Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

France Outlook (USD Million, 2018-2030)

- France Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- France Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

UK Outlook (USD Million, 2018-2030)

- UK Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- UK Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

ITALY Outlook (USD Million, 2018-2030)

- ITALY Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- ITALY Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

SPAIN Outlook (USD Million, 2018-2030)

- Spain Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- Spain Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

Rest Of Europe Outlook (USD Million, 2018-2030)

- Rest Of Europe Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- REST OF EUROPE Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

- Europe Gin by Type

Asia-Pacific Outlook (USD Million, 2018-2030)

- Asia-Pacific Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- Asia-Pacific Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

China Outlook (USD Million, 2018-2030)

- China Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- China Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

Japan Outlook (USD Million, 2018-2030)

- Japan Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- Japan Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

India Outlook (USD Million, 2018-2030)

- India Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- India Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

Australia Outlook (USD Million, 2018-2030)

- Australia Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- Australia Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

Rest of Asia-Pacific Outlook (USD Million, 2018-2030)

- Rest of Asia-Pacific Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- Rest of Asia-Pacific Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

- Asia-Pacific Gin by Type

Rest of the World Outlook (USD Million, 2018-2030)

- Rest of the World Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- Rest of the World Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

Middle East Outlook (USD Million, 2018-2030)

- Middle East Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- Middle East Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

Africa Outlook (USD Million, 2018-2030)

- Africa Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- Africa Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

Latin America Outlook (USD Million, 2018-2030)

- Latin America Gin by Type

- London Dry

- Plymouth

- Old Tom

- Others

- Latin America Gin by Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Others

- Rest of the World Gin by Type

Free Sample Request

Kindly complete the form below to receive a free sample of this Report

Customer Strories

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

Leave a Comment