- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

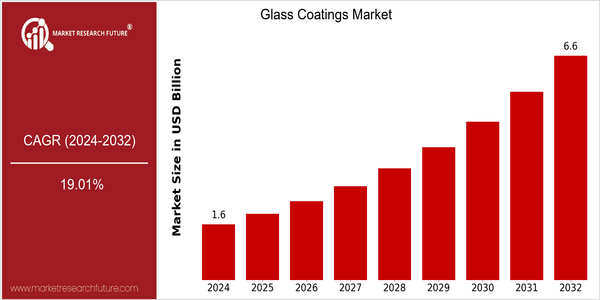

| Year | Value |

|---|---|

| 2024 | USD 1.63 Billion |

| 2032 | USD 6.58 Billion |

| CAGR (2024-2032) | 19.01 % |

Note – Market size depicts the revenue generated over the financial year

The Glass Coatings Market is set to reach a value of USD 1.63 billion in 2024 and is projected to reach USD 6.58 billion by 2032. The remarkable CAGR of 19.01% for the forecast period reflects the strong growth of the market. This is a result of the growing demand for advanced glass coatings in a number of applications such as architectural, automotive, and consumer electronics, owing to the need for improved functionality, energy-efficiency, and aesthetics. There are several factors driving this growth, namely the increasing adoption of energy-efficient solutions and the growing emphasis on the importance of sustainability. The development of self-cleaning and anti-reflective coatings is also driving the market. The major players, including PPG Industries, Sherwin-Williams, and BASF, are focusing on product innovations and strategic alliances to enhance their market share. In recent years, the companies have made substantial investments in the R&D of sustainable glass coatings and have formed strategic alliances with a view to expanding their product portfolios.

Regional Market Size

Regional Deep Dive

The glass coatings market is growing across the globe, driven by the increasing demand for energy-efficient and aesthetically appealing glass products. The North American glass coatings market is characterized by a strong focus on innovation and sustainability, with major players investing in advanced technologies to enhance product performance. Europe is undergoing a significant regulatory shift towards eco-friendly glass coatings, while the Asia-Pacific region is undergoing a rapid urbanization process and growing construction activities. The Middle East and Africa are increasingly using glass coatings in their architectural projects, while Latin America is gradually adopting these products as it becomes more aware of their benefits.

Europe

- The European Union's Green Deal is pushing for stricter regulations on building materials, leading to increased demand for sustainable glass coatings that meet environmental standards.

- Companies such as BASF and AkzoNobel are launching new product lines focused on low-VOC and eco-friendly glass coatings, responding to consumer demand for greener options.

Asia Pacific

- Rapid urbanization in countries like China and India is driving the construction sector, leading to increased demand for glass coatings in both residential and commercial buildings.

- Innovations in nanotechnology are being adopted by local manufacturers, such as Nippon Paint, to create high-performance glass coatings that enhance scratch resistance and self-cleaning properties.

Latin America

- Brazil's growing construction industry is leading to a rise in demand for glass coatings, particularly in urban areas where modern architecture is becoming more prevalent.

- Government programs aimed at improving energy efficiency in buildings are encouraging the adoption of advanced glass coatings, with companies like Tintas Coral responding to this trend.

North America

- The U.S. Department of Energy has introduced initiatives to promote energy-efficient building materials, including advanced glass coatings, which are expected to drive market growth.

- Major companies like PPG Industries and Sherwin-Williams are investing heavily in R&D to develop innovative glass coatings that offer superior durability and UV protection.

Middle East And Africa

- The UAE's Vision 2021 initiative emphasizes sustainable development, prompting increased investment in energy-efficient building materials, including glass coatings.

- Local companies like Jotun are expanding their product offerings to include specialized glass coatings tailored for the harsh climatic conditions of the region.

Did You Know?

“Did you know that glass coatings can reduce energy consumption by up to 30% in buildings by improving insulation and reducing heat transfer?” — U.S. Department of Energy

Segmental Market Size

The Glass Coatings Market is registering a steady growth, mainly driven by the growing demand for energy-efficient and protective glass coatings in various applications. In the building and construction industry, the use of energy-efficient glass coatings has become a necessity, owing to the rising demand for sustainable building materials and the stringent regulations for reducing the energy consumption in the construction sector. Also, the advancements in the field of nanotechnology are increasing the performance of glass coatings, which is expected to make them more popular among manufacturers and end users. The use of glass coatings is in the early stages of implementation, with companies such as PPG Industries and Sherwin-Williams leading the way in the development of these products. North America and Europe are the leading regions for the implementation of glass coatings, especially in the architectural and automotive sectors. The major applications of glass coatings include the anti-reflective coatings on solar panels and self-cleaning coatings on windows, which are increasingly being used in smart buildings. The emergence of newer trends, such as the growing demand for sustainable building materials and the introduction of energy-efficiency standards, are expected to drive the demand for glass coatings in the near future.

Future Outlook

The glass-coating market is expected to grow at a CAGR of 19.01% from 2024 to 2032, with a projected market size of $1.63 billion and $6.5 billion, respectively. The main growth drivers of the glass-coating market are the increasing demand for energy-saving and sustainable building materials, as well as the development of glass-coating technology to enhance the performance and aesthetics of glass products. Also, with the rapid urbanization of China and other countries, the use of glass in architectural design is expected to increase, which will further drive the market. Nanotechnology-based coatings have a higher performance and longer life, such as anti-fog, self-cleaning, and anti-static properties. Also, the demand for high-performance glass coatings will increase due to stricter energy-saving regulations. Moreover, the integration of smart glass and the increasing popularity of green glass coatings will also play an important role in the future development of the market. By 2032, the penetration of advanced glass coatings in the residential and commercial sectors will reach a new high, and the glass-coating market will be fully integrated into modern architectural design.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 1.34 Billion |

| Growth Rate | 19.01% (2024-2032) |

Glass Coating Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.