Glass Coating Market Summary

As per Market Research Future Analysis, the Global Glass Coatings Market was valued at USD 1.34 Billion in 2023 and is projected to reach USD 6.58 Billion by 2032, growing at a CAGR of 19.01% from 2024 to 2032. Key drivers include the adoption of innovative technologies and the rise in green commercial building projects. The market is significantly influenced by the growing demand for nanotechnology-based coatings, energy-efficient solutions, and self-cleaning coatings across various industries, particularly in construction and automotive sectors.

Key Market Trends & Highlights

The glass coatings market is experiencing rapid growth driven by several key trends.

- Nanotechnology-based coatings are enhancing performance, with applications in automotive and electronics.

- Energy-efficient glass coatings are in high demand due to green building initiatives and regulations.

- Self-cleaning and anti-fog coatings are gaining traction in automotive and construction sectors.

Market Size & Forecast

2023 Market Size: USD 1.34 Billion

2024 Market Size: USD 1.63 Billion

2032 Market Size: USD 6.58 Billion

CAGR (2024-2032): 19.01%

Largest Regional Market Share in 2024: North America.

Major Players

Key players include SCHOTT AG (Germany), P.P.G. Industries (U.S.A.), Morgan Advanced Materials (U.K.), Kyocera Corp (Japan), Saint-Gobain (France), Corning Inc. (U.S.A.), The N.S.G. Group (Japan), Murata Manufacturing Co., Ltd (Japan), and Emirates Float Glass (U.A.E.).

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Glass Coatings Market Trends

-

The growing adoption of nanotechnology-based coatings is driving the market growth

The rising adoption of nanotechnology-based Coatings drives market CAGR for glass coatings. Nanotechnology has revolutionized the glass coatings market, enabling the development of high-performance coatings with advanced functionalities. Nanotechnology-based coatings offer exceptional properties such as improved scratch resistance, enhanced durability, and superior optical clarity. These coatings are engineered at the nanoscale, allowing them to form a thin, transparent layer on the glass surface without compromising its transparency. The automotive industry has been at the forefront of adopting nanotechnology-based coatings. Car manufacturers are incorporating these coatings to enhance the appearance and performance of windshields and windows.

Additionally, the electronics industry utilizes nanocoatings to improve the durability and conductivity of glass substrates used in smartphones, tablets, and other electronic devices. The use of nanotechnology in glass coatings is expected to expand further as ongoing research and development efforts continue to uncover new applications and benefits.

With increasing concerns about environmental sustainability and energy conservation, industries are adopting glasscoating that improve the thermal performance of windows and other glass surfaces. These coatings help reduce energy consumption by minimizing heat transfer, thus reducing the need for excessive heating or cooling. The construction sector, in particular, has been a significant driver for energy-efficient glass coatings. Green building initiatives and stringent energy efficiency regulations have increased demand for high-performance glass coatings. Moreover, the automotive industry is also embracing energy-efficient coatings to enhance the fuel efficiency of vehicles by deducting the load on air conditioning systems.

As a result, manufacturers are developing innovative coatings with low emissivity and solar-reflective properties to meet the demand for energy-efficient solutions.

Another important trend in the glass coatings market is the growing focus on self-cleaning and anti-fog coatings. These coatings are designed to repel dirt, dust, water, and oil, reducing the need for frequent cleaning and maintenance. In the automotive industry, self-cleaning coatings have gained significant traction as they improve visibility during adverse weather conditions, ensuring safer driving experiences. The demand for self-cleaning coatings has also witnessed a sharp rise in the construction sector. These coatings are applied on windows, facades, and solar panels to maintain aesthetic appeal and improve energy efficiency.

On the other hand, anti-fog coatings find applications in eyewear, mirrors, and bathroom fittings, providing users with clear and fog-free surfaces. The increasing consumer preference for hassle-free maintenance and convenience drives the adoption of self-cleaning and anti-fog coatings across various industries.

The glass coatings market is witnessing rapid growth, driven by the increasing demand for energy-efficient solutions, self-cleaning and anti-fog coatings, and nanotechnology-based coatings. These trends reflect the industry's focus on addressing key challenges such as energy consumption, maintenance, and performance enhancement. As the demand for advanced glass coatings continues to rise across various sectors, manufacturers invest in research and development to introduce innovative products and capitalize on emerging opportunities, driving the Glass Coatings market revenue.

Glass Coatings Market Segment Insights

Glass Coatings Type Insights

The Glass Coatings market segmentation, based on type, includes pyrolytic coating, magnetron sputtering coating, and sol-gel coating. The sol-gel coating segment dominated the market. Sol-gel coatings provide a range of functionalities, including anti-fogging, self-cleaning, and anti-microbial properties. They are used in various applications, such as automotive windshields, electronic displays, and laboratory glassware. Sol-gel coatings offer flexibility in terms of formulation, allowing the incorporation of different additives to achieve desired properties.

Glass Coatings Technology Insights

The Glass Coatings market segmentation, based on technology, includes nano and liquid glass coating. The nano-glass coating category generated the most income. Nano coatings are thin layers of coatings applied to glass surfaces at a nanoscale level. These coatings provide excellent water repellency, anti-reflective properties, and self-cleaning abilities. The increasing demand for self-cleaning glass in domestic and commercial buildings is incorporating the growth of nanocoatings in the glass industry.

Glass Coatings Application Insights

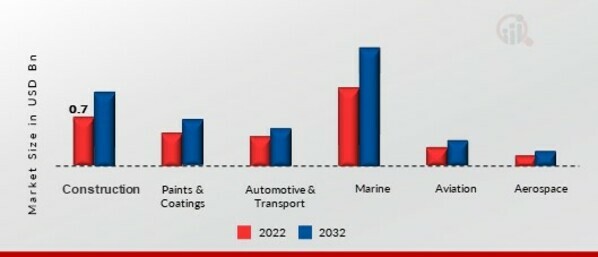

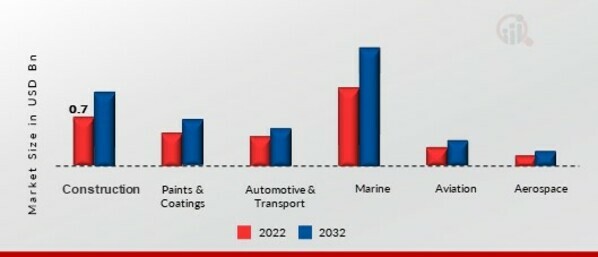

The Glass Coatings market segmentation, based on application, includes construction, paints & coatings, automotive & transport, marine, aviation, aerospace, and others. The construction segment generated the most income. Architectural glass coatings are used for energy efficiency, solar control, anti-glare properties, and self-cleaning abilities. The increasing focus on sustainable and green buildings is driving the demand for advanced glass coatings in the construction sector.

Figure 1: Glass Coatings Market, by Application, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

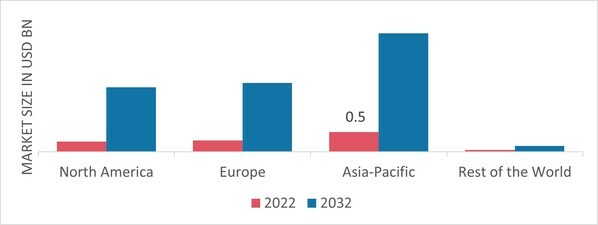

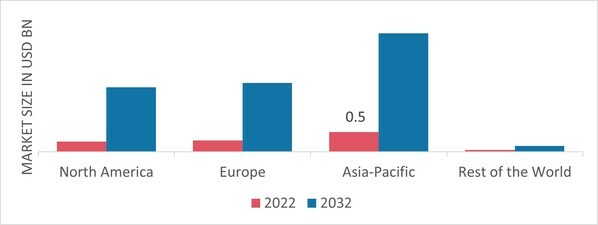

Glass Coatings Regional Insights

By region, the study provides market insights into North America, Europe, Asia-Pacific, and the Rest of the World. The North American Glass Coatings market area will grow significantly due to the well-established construction industry, where coated glass is extensively used for energy-efficient buildings. Additionally, the automotive sector is witnessing the adoption of coated glass for improved aesthetics and functional properties. The increasing focus on sustainable and green construction practices drives this region's demand for glass coatings.

Further, the major countries studied in the market report are The US, Canada, German, France, the U.K., Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: GLASS COATINGS MARKET SHARE BY REGION 2022 (USD Billion)

Source: Secondary Research, Primary Research, Market Research Future Database, and Analyst Review

Europe's Glass Coatings market accounts for the second-largest market share due to stringent regulations regarding energy efficiency and environmental sustainability, which has fueled the adoption of coated glass in construction and automotive applications. Furthermore, the presence of major automotive manufacturers and a growing emphasis on luxury and premium vehicles contribute to the demand for advanced glass coatings. Further, the German Glass Coatings market held the largest market share, and the U.K. Glass Coatings market was the fastest-growing market in the European region.

The Asia-Pacific Glass Coatings Market will dominate the CAGR from 2023 to 2032. It is due to rapid growth in the glass coatings market due to factors such as urbanization, industrialization, and increasing disposable income. The construction industry in Asia Pacific is booming, and coated glass is widely used to enhance the energy efficiency of buildings. Moreover, the automotive industry is expanding, with rising demand for coated glass for aesthetic appeal and functional purposes. Furthermore, China’s Glass Coatings market held the largest market share, and the Indian Glass Coatings market was the rapid-growing market in the Asia-Pacific region.

Glass Coatings Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development to expand their product lines, which will help the Glass Coatings market grow even more. Market participants are also undertaking several strategic activities to expand their footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. The Glass Coatings industry must offer cost-effective items to expand and survive in a more competitive and rising market climate.

Manufacturing locally to minimize operational costs is one of the key business tactics manufacturers use in the Glass Coatings industry to benefit clients and increase the market sector. The Glass Coatings industry has offered some of the most significant medical advantages in recent years. Major players in the Glass Coatings market, including SCHOTT AG (Germany), P.P.G. Industries (U.S.A.), Morgan Advanced Materials (U.K.), Kyocera Corp (Japan), Saint-Gobain (France), Corning Inc. (U.S.A.), The N.S.G. Group (Japan), Murata Manufacturing Co., Ltd (Japan), Emirates Float Glass (U.A.E.), and others, are attempting to increase market demand by investing in research and development operations.

Nippon Sheet Glass Co., Ltd., founded in 1918 in Osaka, Japan, is a Japanese glass manufacturing company. It is the fourth-largest glass company in the world. It is listed on Tokyo Stock Exchange. Its products include solar control, anti-reflective coatings, architectural glass, automotive glass, technical glass, glass fiber, and many more. It acquired the UK-based glass manufacturer Pilkington plc in 2006. It operates in more than 25 countries and employs many people worldwide.

Harry D. Cushman's Ferro Corporation, founded in 1919 in Mayfield Heights, Ohio, is an American producer of materials based on technology. Its products include colors, glass, pigments, powders, oxides, porcelain enamel, coating systems, conductive coatings, anti-reflective, and low-emissivity coating. Its main divisions are inorganics, organics, and electronic materials.

Key Companies in the Glass Coatings market include

- Murata Manufacturing Co., Ltd (Japan)

- Emirates Float Glass (U.A.E.)

Glass Coatings Industry Developments

P.P.G. Industries announced a partnership with Japan's major glass manufacturer, Nippon Sheet Glass, to develop new glass coatings for automotive and construction applications.

Glass Coatings Market Segmentation

Glass Coatings Type Outlook

- Magnetron Sputtering Coating

Glass Coatings Technology Outlook

Glass Coatings Application Outlook

Glass Coatings Regional Outlook

| Attribute/Metric |

Details |

| Market Size 2023 |

USD 1.34 Billion |

| Market Size 2024 |

USD 1.63 Billion |

| Market Size 2032 |

USD 6.58 Billion |

| Compound Annual Growth Rate (CAGR) |

19.01% (2024-2032) |

| Base Year |

2023 |

| Market Forecast Period |

2024-2032 |

| Historical Data |

2018- 2022 |

| Market Forecast Units |

Value (USD Billion) |

| Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered |

Type, Technology, Application, and Region |

| Geographies Covered |

North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered |

The US, Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled |

SCHOTT AG (Germany), P.P.G. Industries (U.S.A.), Morgan Advanced Materials (U.K.), Kyocera Corp (Japan), Saint-Gobain (France), Corning Inc. (U.S.A.), The N.S.G. Group (Japan), Murata Manufacturing Co., Ltd (Japan), Emirates Float Glass (U.A.E.) |

| Key Market Opportunities |

An increasing number of green commercial building construction projects. |

| Key Market Dynamics |

Increase in adoption of innovative technology such as computers, smartphones, and others. |

Glass Coating Market Highlights:

Frequently Asked Questions (FAQ):

The global Glass Coatings market was valued at USD 1.34 Billion in 2023.

The global market is projected to grow at a CAGR of 19.01% during the forecast period, 2024-2032.

Asia-Pacific had the largest share of the global Glass Coating Market.

The sol-gel coating category dominated the Glass Coating Market in 2023.

The Nano glass coating had the largest share in the global Glass Coating Market.

The construction category dominated the Glass Coating Market in 2023.