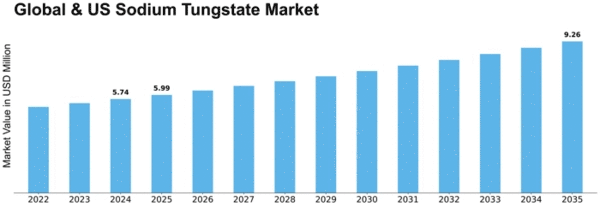

Global Us Sodium Tungstate Size

Global & US Sodium Tungstate Market Growth Projections and Opportunities

The global and US sodium tungstate market is influenced by several market factors that shape its dynamics and growth trajectory. Firstly, the demand for sodium tungstate is closely tied to its applications across various industries such as mining, chemical manufacturing, healthcare, and electronics. In the mining industry, sodium tungstate is utilized in the production of tungsten, a crucial material for manufacturing cutting tools, drilling equipment, and heavy machinery components. Similarly, in the chemical sector, it serves as a catalyst in certain reactions. Moreover, its role in healthcare as a contrast agent for X-ray imaging and in electronics for producing phosphors in displays adds to its market demand.

Secondly, the availability and pricing of raw materials significantly impact the sodium tungstate market. Tungsten ores, the primary source of tungstate, are mined worldwide, with major reserves located in countries like China, Russia, and Canada. Any disruptions in the supply chain due to geopolitical tensions, mining regulations, or natural disasters can affect the availability of raw materials and subsequently influence market prices. Additionally, fluctuations in energy costs, as tungsten extraction and processing are energy-intensive processes, also contribute to price volatility in the sodium tungstate market.

Thirdly, technological advancements play a crucial role in shaping market dynamics. Innovations in extraction and purification processes have improved the efficiency of sodium tungstate production, leading to cost reductions and increased competitiveness. Furthermore, advancements in end-user industries, such as the development of more efficient mining techniques or the adoption of alternative materials in electronics, can influence the demand for sodium tungstate.

Moreover, regulatory policies and environmental considerations have a significant impact on the sodium tungstate market. Stringent regulations regarding environmental protection and occupational health and safety in mining and chemical industries influence production practices and market dynamics. Compliance with these regulations often entails additional costs for manufacturers, which can affect product pricing and market competitiveness. Additionally, growing awareness of environmental sustainability and the shift towards eco-friendly alternatives may drive demand for greener alternatives to sodium tungstate in certain applications.

Furthermore, macroeconomic factors such as economic growth, inflation rates, and currency exchange rates also influence the sodium tungstate market. Strong economic growth typically translates to increased industrial activity, leading to higher demand for sodium tungstate across various sectors. Conversely, economic downturns or recessions may dampen demand as industries cut back on production and investment. Moreover, fluctuations in currency exchange rates can impact the competitiveness of sodium tungstate exports and imports, affecting market dynamics, especially in the context of global trade.

Lastly, market competition and industry structure play a pivotal role in shaping the sodium tungstate market. The presence of numerous manufacturers and suppliers competing for market share fosters innovation, price competition, and product differentiation. Market consolidation through mergers and acquisitions can also reshape the competitive landscape and influence pricing strategies. Additionally, factors such as brand reputation, product quality, and customer service play a crucial role in determining market competitiveness and the success of sodium tungstate suppliers in both global and US markets.

Leave a Comment