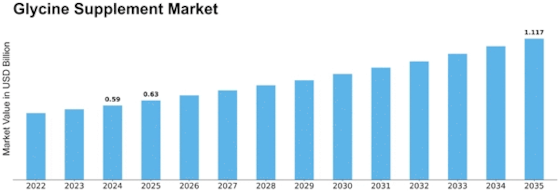

Glycine Supplement Size

Glycine Supplement Market Growth Projections and Opportunities

The glycine supplement market is experiencing rapid growth due to increasing demand for health and wellness products and a rise in awareness about lifestyle-related diseases. Several factors contribute to this growth, including an aging population, the expansion of urban areas, rising income levels, and increased consumerism.

One significant driver of the growing glycine supplement market is the increasing focus on health and well-being. More people are recognizing the importance of maintaining good health, leading to a higher demand for products that contribute to overall well-being. Glycine supplements, known for their potential health benefits, are gaining popularity as individuals seek ways to support their health.

Lifestyle-related diseases, such as those associated with poor dietary habits and sedentary lifestyles, have become more prevalent. The awareness of these diseases has prompted individuals to explore preventive measures and dietary supplements that may help in managing health conditions. Glycine, as a supplement, is gaining attention for its potential role in supporting various bodily functions.

The aging population is another factor contributing to the growth of the glycine supplement market. As people age, they often become more conscious of their health and may seek supplements to address specific health concerns associated with aging. Glycine supplements, with their potential anti-aging properties and support for cognitive function, appeal to this demographic.

Urbanization is a global trend, with more people living in cities than ever before. Urban lifestyles often come with challenges related to stress, pollution, and unhealthy dietary choices. In response, individuals in urban areas are increasingly turning to dietary supplements to fill potential nutritional gaps and support their health. Glycine supplements fit into this trend as a convenient option for urban dwellers looking to enhance their well-being.

Rising income levels and an increase in gross domestic product (GDP) also play a role in the growth of the glycine supplement market. With more disposable income, individuals are willing to invest in products that offer health benefits. The availability of glycine supplements in the market provides consumers with choices to support their health goals.

Consumerism, driven by a desire for personalized health solutions, is influencing the supplement market. People are actively seeking products that align with their specific health needs and preferences. Glycine supplements, with their diverse potential benefits, cater to the growing consumer demand for health-oriented products.

In summary, the glycine supplement market is on a growth trajectory due to a confluence of factors. The increasing focus on health and wellness, awareness of lifestyle-related diseases, aging populations, urbanization, rising income levels, and consumer preferences for personalized health solutions collectively contribute to the expanding market for glycine supplements. As individuals continue to prioritize health, the demand for supplements that support well-being is expected to fuel the sustained growth of the glycine supplement market.

Leave a Comment