Market Share

Green and Bio-Based Solvents Market Share Analysis

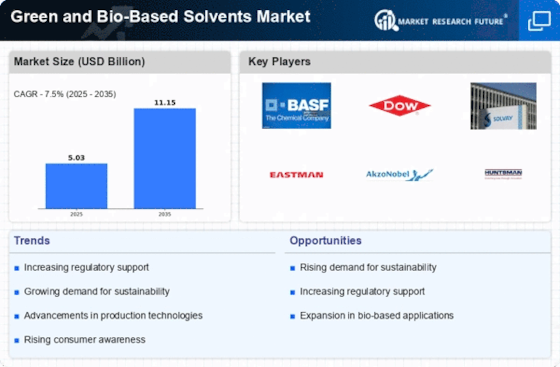

The Green and Bio-Based Solvents market has various positioning tactics that it uses to survive in a very competitive landscape as one of the most important industries in chemical solutions for sustainability transition. One such strategy revolves around promoting environmental advantages. Companies within this sector position themselves as producers of solvents made from renewable sources like biomass or wastes from agriculture. By emphasizing that their products have low environmental impacts and carbon footprints, these companies can attract environmentally conscious customers thereby taking up a significant portion of its market space. Green & Bio-Based Solvents refer to biomass-derived solvents e.g. soybean oil corn beet lactic acid sugarcane bio-succinic acid etc. These solvents are picking up momentum globally due to their recyclability biodegradability eco-friendly nature low VOC emissions high boiling point and low toxicity. Bio-based solvent is increasingly preferred since it emits less carbon compared to fossil fuels that are running out coupled with its efficiency. Innovation and development of new bio-based formulations provide an important avenue for positioning in terms of Green and Bio-Based Solvents’ market share. Corporations spend on research work concerning solvents with improved performance aspects which match or surpasses traditional equivalents as part of making innovative alternatives that meet stringent demands from different sectors thereby becoming frontline players in sustainable yet high capacity solutions thus expanding their respective markets. Another vital strategy involves strategic partnerships or collaboration with key stakeholders including chemical manufactures, users at end state as well as regulation authorities.Through collaborations businesses will pool resources together therefore combining expertise hence addressing challenges related to the use of green and bio-based solvents. In Green & Bio-Based Solvents, incorporation of circular economy principles and sustainable practices is important for market share positioning.Companies promoting recycling, waste reduction and sustainability sourcing align themselves with global trends towards circularity. These practices resonate well with the eco-friendly consumers making them responsible contributors to a better future. This approach boosts company’s image while attracting customers searching for environment friendly alternatives raising its market shares . The most effective means by which a firm can increase its market share is by communicating and marketing about benefits of green and bio-based solvents. Approximately every business enterprise that conveys some information about reduced toxicity, especially on issues to do with environmental effect besides adherence to regulations can easily differentiate itself from other firms in such overcrowded markets. Creating a strong brand identity emphasizing performance, safety, and sustainability builds trust among customers thereby increasing client loyalty which eventually pushes up sales volume.

Market share positioning strategies in the Green and Bio-Based Solvents market require geographical expansion and market diversification. The reasons why businesses seek to expand into new regions, as well as industries, are driven by the growth of demand for sustainable solvents that can be explored in these areas. This means that they have to move into developing markets with sustainability on their radar, while at the same time establishing solid niche in sectors where widespread use is possible.

Leave a Comment