Market Growth Projections

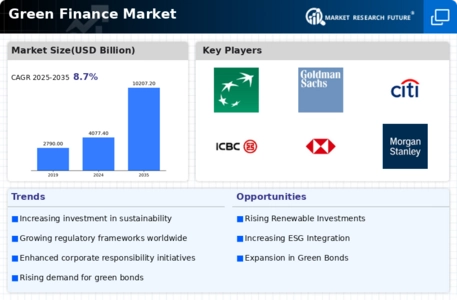

The Global Green Finance Market Industry is projected to experience substantial growth over the coming years. With a market value expected to reach 4077.4 USD Billion in 2024 and an anticipated increase to 10207.2 USD Billion by 2035, the industry is poised for a remarkable trajectory. The compound annual growth rate (CAGR) of 8.7% from 2025 to 2035 indicates a robust expansion driven by various factors, including regulatory support, technological advancements, and increasing public awareness of sustainability issues. These projections suggest a promising future for green finance as it becomes an integral part of the global financial landscape.

Growing Demand for Renewable Energy

The Global Green Finance Market Industry is significantly influenced by the rising demand for renewable energy sources. As countries strive to reduce their carbon footprints, investments in solar, wind, and hydroelectric power are surging. For example, the International Renewable Energy Agency reports that global renewable energy capacity has expanded dramatically, with solar power alone accounting for a substantial share of new installations. This shift towards clean energy necessitates increased financing, thereby propelling the market forward. By 2035, the Global Green Finance Market is expected to reach 10207.2 USD Billion, driven by this growing demand.

Corporate Sustainability Initiatives

The Global Green Finance Market Industry is increasingly shaped by corporate sustainability initiatives. Companies across various sectors are recognizing the importance of integrating environmental considerations into their business models. This trend is evidenced by the rise of Environmental, Social, and Governance (ESG) criteria in investment decisions. Corporations are issuing green bonds to fund sustainable projects, thereby attracting environmentally conscious investors. This shift not only enhances corporate reputation but also contributes to the overall growth of the Global Green Finance Market. The anticipated CAGR of 8.7% from 2025 to 2035 underscores the potential for continued expansion in this area.

Increased Public Awareness of Climate Change

The Global Green Finance Market Industry is experiencing growth due to increased public awareness of climate change and environmental issues. As individuals and communities become more informed about the impacts of climate change, there is a growing demand for sustainable investment options. This shift in consumer behavior is prompting financial institutions to develop green products and services that align with the values of environmentally conscious investors. Consequently, this heightened awareness is likely to drive the expansion of the Global Green Finance Market, as more capital is directed towards initiatives aimed at combating climate change.

Regulatory Support for Sustainable Investments

The Global Green Finance Market Industry benefits from increasing regulatory support aimed at promoting sustainable investments. Governments worldwide are implementing policies that encourage financial institutions to allocate resources towards environmentally friendly projects. For instance, the European Union's Green Deal aims to mobilize investments to achieve climate neutrality by 2050. This regulatory framework not only enhances investor confidence but also drives the growth of green bonds and sustainable funds. As a result, the Global Green Finance Market is projected to reach 4077.4 USD Billion in 2024, reflecting a robust commitment to sustainable development.

Technological Advancements in Financial Services

The Global Green Finance Market Industry is being transformed by technological advancements in financial services. Innovations such as blockchain and artificial intelligence are enhancing transparency and efficiency in green financing. For instance, blockchain technology is being utilized to track the use of funds in green projects, ensuring accountability and fostering trust among investors. Additionally, AI-driven analytics are helping financial institutions assess the environmental impact of their investments more accurately. These technological developments are likely to attract more capital into the green finance sector, further propelling the market's growth in the coming years.