- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

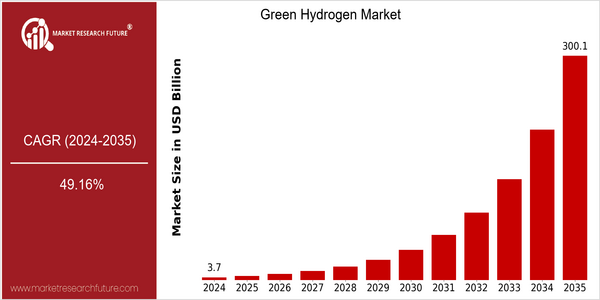

Green Hydrogen Market Size Snapshot

| Year | Value |

|---|---|

| 2024 | USD 3.69 Billion |

| 2035 | USD 300.06 Billion |

| CAGR (2025-2035) | 49.16 % |

Note – Market size depicts the revenue generated over the financial year

Green hydrogen is expected to grow significantly in the near future. The current green hydrogen market is estimated to reach $3.69 billion in 2024, but by 2035, it is expected to be worth $300 billion. A compound annual growth rate of 49.16% is expected from 2025 to 2035, which is an extremely fast growth rate, driven by the increasing demand for green energy. The urgent need to decarbonize and the urgent need to combat climate change are also important driving forces for the market. The industry and the government are both trying to reduce their carbon footprints and switch to greener energy sources. The efficiency and cost of green hydrogen production will continue to improve with the development of electrolysis and the integration of renewable energy. The big players in the industry, such as Siemens, Air Products and Chemicals, and Nel ASA, are investing heavily in new technology and forming strategic alliances to maintain their market share. In addition, energy companies and research institutions are working together to develop hydrogen production methods. The construction of hydrogen-related public facilities is also expected to promote the market. Green hydrogen will play a key role in the energy transition.

Regional Deep Dive

The Green Hydrogen market is growing strongly in many regions, driven by the world's growing need for sustainable energy solutions. The market is shaped by technological development, regulatory frameworks, and increasing investments in the renewable energy industry. Each region has its own characteristics, influenced by local policy, economic conditions, and cultural attitudes towards sustainable development. Together, these contribute to the growth potential of Green Hydrogen as a key player in the transition to a low-carbon economy.

North America

- The United States Department of Energy has launched the Hydrogen Energy X-switch, which aims to reduce the cost of hydrogen by 80 per cent by 2030, to a maximum of a dollar a kilogram.

- A number of large companies, such as Air Products and Plug Power, are investing heavily in hydrogen production, and in the United States, the latter plans to build a $ 1.7 billion green hydrogen plant in New York, a strong commitment to scale production.

- During the next few years, California’s government and industry will be faced with a challenge to decarbonize transportation and industry.

Europe

- The European Union has set ambitious goals for the production of hydrogen. The European hydrogen strategy aims at a green hydrogen production of 10 million tons in the EU by 2030.

- The Netherlands and Germany are investing heavily in hydrogen technology. The European Hydrogen Association was created to develop a European hydrogen economy.

- The framework of the European Union's Green Deal and the Fit-for-Five Package provides incentives for the use of hydrogen-based green technology, which is to be a cornerstone of the energy transition strategy.

Asia-Pacific

- Japan and South Korea have already made substantial progress in the field of hydrogen energy. The former's “Basic Plan for Hydrogen” aims at the development of hydrogen-based society, and the latter is investing in hydrogen and fuel cell technology.

- Then the Japanese said to the Americans, “We'll sell you a lot of hydrogen, but don't forget we're going to sell you a lot of electricity, too.”

- China’s commitment to achieving zero emissions by 2050 has resulted in an increased government emphasis on hydrogen, and state-owned companies have been investing in large-scale green hydrogen projects and in hydrogen-related equipment and facilities.

MEA

- The Gulf countries, especially Saudi Arabia and the United Arab Emirates, are investing heavily in the production of green hydrogen, with the aim of producing 4 million tons per year by 2030.

- The great wind and sun resources of the region are a source of advantage in the production of hydrogen, and the process is attracting international interest and investment from companies like Siemens and Air Products.

- The frameworks are evolving, governments in the region are becoming aware of the potential of hydrogen to diversify their economies away from oil, and are supporting the development of the industry.

Latin America

- Chile, for example, has set a goal of becoming one of the three leading hydrogen producers in the world by 2030, based on its rich natural resources of solar energy.

- In Chile, collaboration between the government and the private sector, such as Enel and Engie, is fostering the development of large-scale green hydrogen projects that are expected to attract significant foreign investment.

- There is growing support from the authorities in the form of measures to create a favourable investment climate for green hydrogen, such as tax breaks and simplified approval procedures.

Did You Know?

“Green hydrogen can be produced from wind and solar energy, which makes it a zero-emission fuel.” — International Renewable Energy Agency (IRENA)

Segmental Market Size

Green hydrogen is experiencing strong growth as the world turns to decarbonisation and green energy. This segment will play a key role in the transition to green energy, especially in the hard-to-abate transport and industry sectors. The main drivers are the increasingly stringent legislation on CO2 emissions, such as the European Union's Green Deal, and technological developments in electrolysis, which are making hydrogen production more efficient.

The hydrogen market is at the point where it is being rolled out in larger quantities. Notable examples are the HyNet project in the UK and the Hydrogen Energy Supply Chain in Australia. The main applications are fuel cell vehicles, hydrogen for industry, and energy storage. Growth is being accelerated by trends such as the government's drive for clean energy and the corporate drive for sustainability. Furthermore, the development of new hydrogen production methods such as proton exchange membrane (PEM) electrolysis and green ammonia synthesis are influencing the market.

Future Outlook

From 2024 to 2035, the Green Hydrogen Market is expected to increase from $ 3.69 billion to $ 317.4 billion, with a CAGR of 49.16%. This phenomenal growth is driven by the combination of technological progress, the expansion of investment in the development of green hydrogen, and the government's policy on reducing carbon emissions. In 2035, it is expected that green hydrogen will account for 10 to 15 percent of the total hydrogen market, and it will play a more important role in decarbonizing the difficult-to-abate transportation, industry and energy storage sectors.

The development of the technology of the electrolysis is still progressing and is becoming more efficient and less costly. The cost of producing hydrogen from electricity is falling. The integration of hydrogen into the energy system is gaining momentum, especially due to the development of fuel cells and hydrogen storage solutions. In the framework of the hydrogen strategy of the European Union and the national hydrogen plans, it is expected that the investment environment will be improved and the market will be expanded. Several new trends, such as the emergence of hydrogen as a service (HaaS) and the establishment of hydrogen hubs, will contribute to a wider use of hydrogen in all areas and thus to its role as a cornerstone of the energy transition.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Market Size Value In 2023 | USD 1.1 billion |

| Growth Rate | 54.69% (2024-2032) |

Green Hydrogen Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.