Rising Demand for Clean Energy Solutions

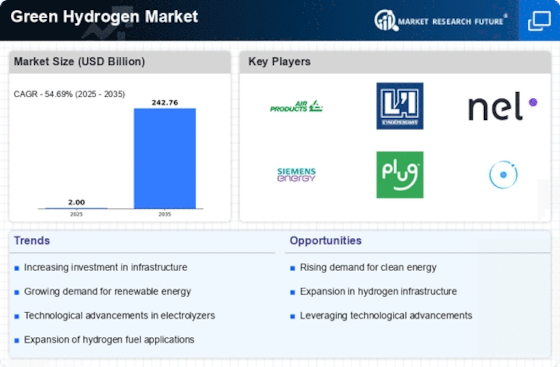

The increasing The Green Hydrogen Industry. As nations strive to meet their climate goals, the demand for hydrogen as a clean fuel alternative is surging. In 2025, the market is projected to reach a valuation of approximately 200 billion USD, reflecting a compound annual growth rate of around 15%. This demand is driven by various sectors, including transportation, industrial processes, and power generation, all seeking to reduce their carbon footprints. The Green Hydrogen Market is thus positioned to play a pivotal role in achieving net-zero emissions targets, as hydrogen can serve as a versatile energy carrier and storage medium.

Decarbonization Efforts Across Industries

The urgent need for decarbonization across various industries is driving the growth of the Green Hydrogen Market. Sectors such as steel manufacturing, chemical production, and heavy-duty transportation are increasingly seeking alternatives to fossil fuels to meet stringent emissions regulations. By 2025, it is projected that the demand for green hydrogen in industrial applications will grow by over 40%, as companies aim to achieve their sustainability targets. This shift not only reflects a broader commitment to environmental responsibility but also highlights the potential of hydrogen as a key enabler in the transition to a low-carbon economy. The Green Hydrogen Market is thus poised for substantial growth as industries adopt hydrogen solutions to decarbonize their operations.

Supportive Regulatory Frameworks and Incentives

The establishment of supportive regulatory frameworks and financial incentives is a crucial driver for the Green Hydrogen Market. Governments worldwide are implementing policies that promote the use of green hydrogen, including subsidies, tax breaks, and grants for research and development. In 2025, several countries are expected to allocate substantial budgets to support hydrogen initiatives, with investments projected to exceed 50 billion USD. This financial backing not only encourages innovation but also fosters collaboration between public and private entities. As a result, the Green Hydrogen Market is likely to expand rapidly, as these initiatives create a conducive environment for the development and deployment of hydrogen technologies.

Technological Innovations in Hydrogen Production

Technological advancements in hydrogen production methods, particularly electrolysis, are significantly influencing the Green Hydrogen Market. Innovations such as proton exchange membrane (PEM) electrolysis and alkaline electrolysis are enhancing efficiency and reducing costs. As of 2025, the cost of green hydrogen production is expected to decrease by nearly 30% compared to previous years, making it more competitive with fossil fuels. These advancements not only improve the feasibility of large-scale hydrogen production but also attract investments from both public and private sectors. Consequently, the Green Hydrogen Market is likely to witness accelerated growth as these technologies become more widely adopted, facilitating the transition to a hydrogen-based economy.

Growing Investment in Renewable Energy Infrastructure

The increasing investment in renewable energy infrastructure is a significant driver for the Green Hydrogen Market. As the world shifts towards renewable energy sources, the integration of hydrogen production with solar and wind energy is becoming more prevalent. In 2025, it is anticipated that investments in renewable energy projects will surpass 1 trillion USD, with a substantial portion allocated to hydrogen production facilities. This trend not only enhances the viability of green hydrogen but also supports the development of a sustainable energy ecosystem. The Green Hydrogen Market stands to benefit from this synergy, as renewable energy sources provide the necessary power for hydrogen production, thereby reducing reliance on fossil fuels.

Leave a Comment