Research Methodology on Hydrogen Generator Market

Introduction

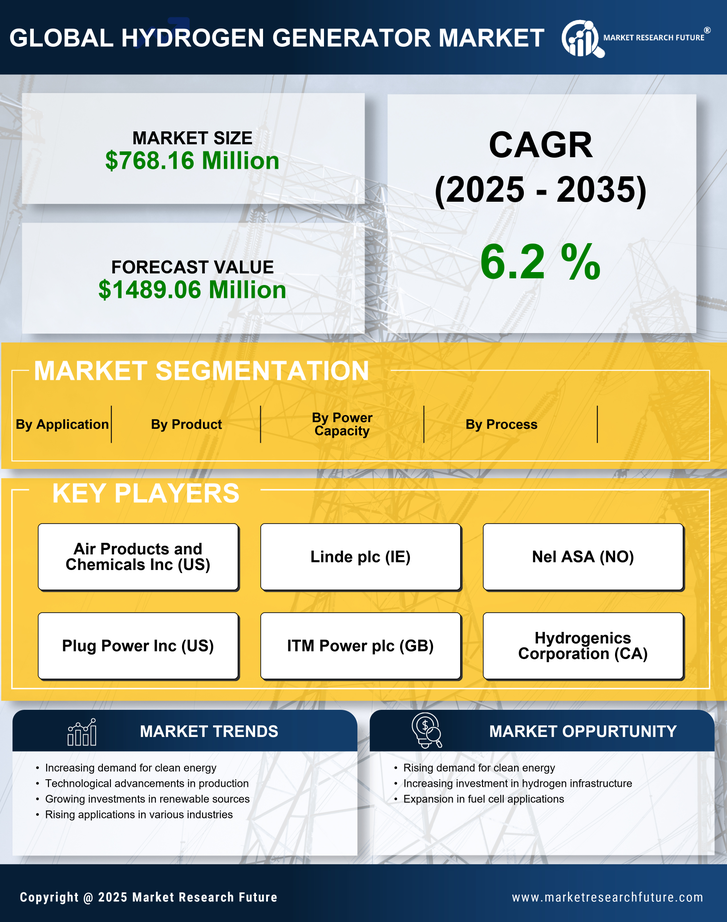

This research methodology is used to develop the nuclear industrial hydrogen generator Market report published by Market Research Future (MRFR). Hydrogen generators are industrial systems used to produce hydrogen on demand. Hydrogen generators are used in industrial and commercial applications in numerous industries. The global nuclear hydrogen generator market is expected to experience strong growth due to several factors, including increased demand for clean energy production, technological advancements and government regulations. The research focuses on the market size, market segmentation, recent developments, as well as the competitive landscape of the global nuclear hydrogen generator market.

Research Objective

This research aims to understand the factors affecting the growth of the global nuclear hydrogen generator market, analyze the current and projected market size, identify market segments and the main regional players, and provide an analysis of the competitive landscape.

Research Approach

A qualitative research approach is used to collect data for this study which involves the use of primary and secondary sources. Primary sources include in-depth interviews and surveys of industry experts, decision-makers, and business owners to gain a better understanding of the global nuclear hydrogen generator market. On the other hand, secondary data sources include industry reports, white papers, and other business and government publications.

Primary Methods

A variety of primary methods are employed to gain an in-depth understanding of the global nuclear hydrogen generator market. In-depth interviews are conducted with current and potential customers, as well as industry experts and decision-makers, to obtain their views on the market and their opinions on the factors pushing the growth of the nuclear hydrogen generator market. Surveys are administered to current customers to gather their feedback on the performance and reliability of current solutions in the nuclear hydrogen generator market.

Secondary Data

Secondary sources of data include industry reports, research papers, and other government and regulatory documents. This data is used to provide a comprehensive overview of the industry and its growth and opportunities.

Research Design and Instrumentation

The research design of the project includes qualitative and quantitative methods. Interviews and surveys are used to gain better insights into the customer’s perspective. Furthermore, secondary data sources are employed to develop an understanding of the industry by providing an analysis of the industry trends and customer behaviour.

Data Analysis

The data collected through primary and secondary research methods are analyzed and presented in the form of tables and charts. Statistical analysis is used to analyze customer surveys and interviews. Moreover, the data collected through secondary sources are used to obtain an overall understanding of the industry.

Validity and Reliability

The research study ensures the reliability and validity of the data collected through primary and secondary sources. The secondary sources of data are reviewed for accuracy and reliability. Furthermore, the sources for customer survey and interview data are checked for accuracy and reliability.

Conclusion

This research aims to analyze the global hydrogen generator market and provide an overview of the competitive landscape. Primary and secondary research methods are used to collect and analyze data for the report. Furthermore, data analysis is conducted to develop a comprehensive understanding of the industry and the competitive landscape.