Research Methodology on Hydrogen Generation Market

The published research is conducted to identify and analyze the Global Hydrogen Generation Market. The data collected for the research is accumulated from numerous secondary sources such as books, websites, journals, magazines, press releases and white papers from various authorities such as government departments, private businesses, and governmental institutions. Primary research such as interviews and surveys are used for quality assurance and verification of the data.

The research methodology utilized for the study includes the following steps:

1. Conceptualization:

The scientific method is used as the conceptual framework to define the framework of the research. The research is based on the idea of seeking to provide an understanding of the global hydrogen generation market which can extend beyond the immediate potential of the market. The research analyzes the necessity, availability and impact of all the factors and market drivers involved, their direct and indirect effects on the market, and the relationship between the global hydrogen generation market, individual market forces, and the overall molecular research ecosystem.

2. Identification of Data Sources:

Primary data sources such as industry experts, stakeholders and consumers in the hydrogen generation market are used to compile a comprehensive database of the global hydrogen production market. Secondary data sources such as press releases, consumer reports, reference books and periodicals, scientific publications, surveys, data collections and government databases are used to supplement the primary sources.

3. Analyzing Quantitative and Qualitative Data:

Various quantitative and qualitative methods are used to analyze the information. To account for the key market factors and indicators, a Delphi survey is conducted and analyzed to determine the primary market forces, trends, and drivers and to assess the overall market’s assessment of threats, opportunities and challenges in the hydrogen generation industry.

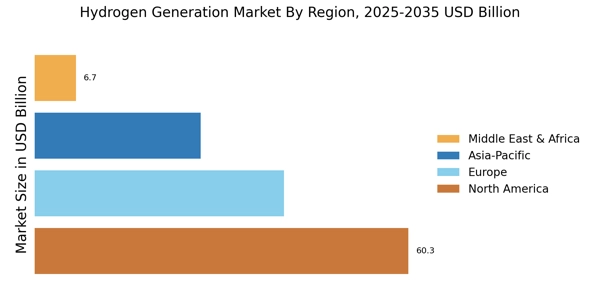

Market segmentations such as geographical split, product type and application type, and target customer segments are used to analyze the data. Statistical analysis such as regression analysis, clustering and analysis of variance, as well as graphical analysis such as trend analysis, mapping analysis, and relative analysis, are used to uncover relationships in the data.

4. Final Research Output:

The analysis and the data triangulation method are used to compile the report. Finally, the report is presented in the form of data tables, graphs and infographics, and summaries to present the most important findings.

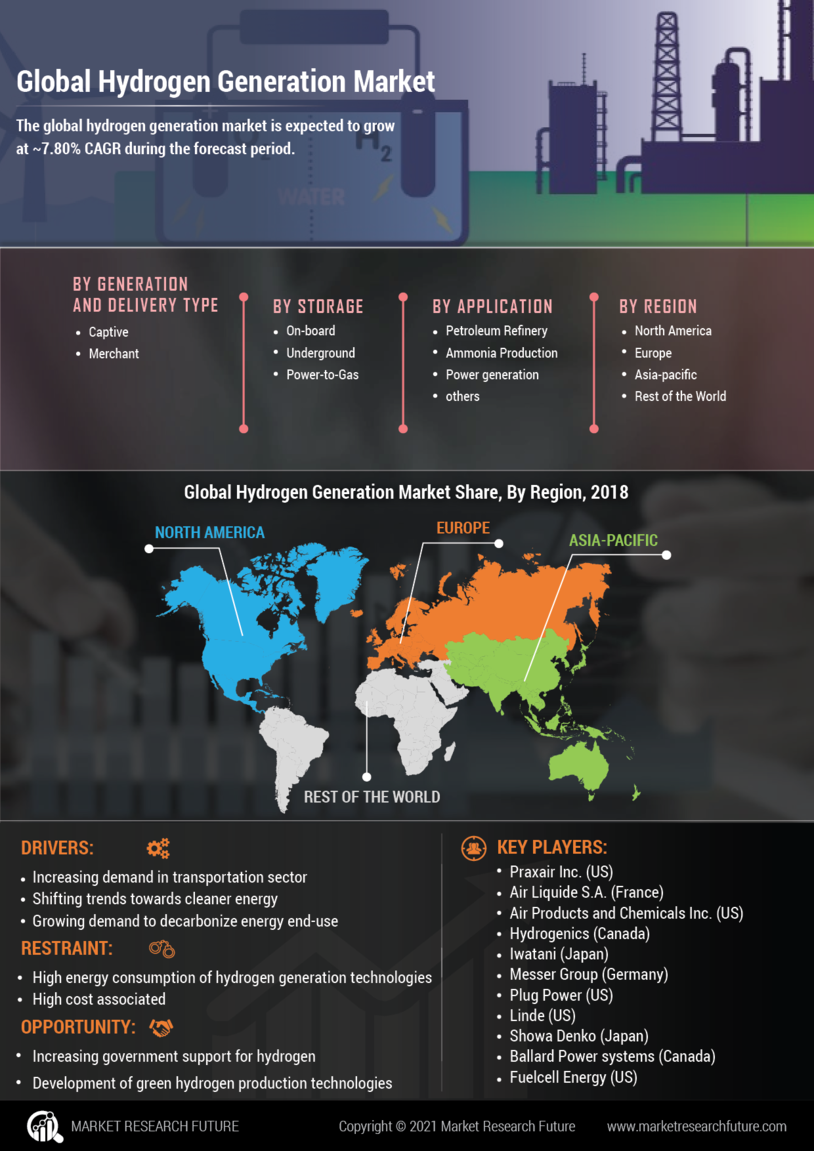

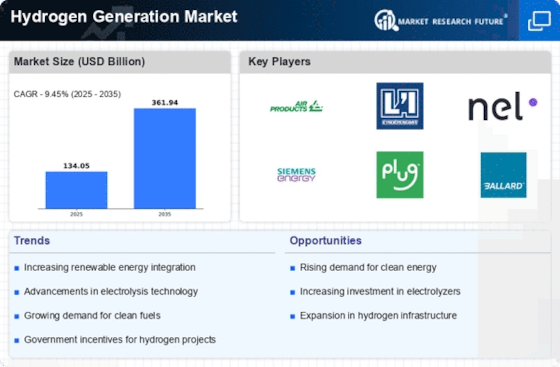

Conclusion

The research study offers an overview of the Global Hydrogen Generation Market, along with a detailed analysis of various drivers and restraints that are influencing the market’s growth. The research methodology employed for the research study aims to analyze the various drivers and restraining factors of the hydrogen generation market, as well as understand the geographical dynamics of the industry. Market segmentation is used to differentiate various product types and applications of the industry, thereby providing a clear view of the market. The research gathers information from both primary and secondary sources to compile a comprehensive assessment of the market.