Market Trends

Key Emerging Trends in the Hydrogen Generation Market

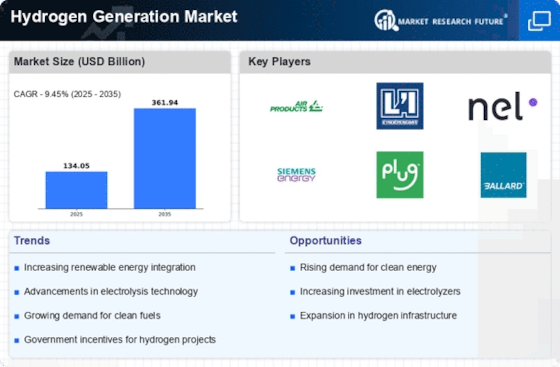

The market for hydrogen generation is going through critical changes because of the rising significance of hydrogen as a harmless to the ecosystem and practical energy asset. As the worldwide local area endeavours to battle environmental change, hydrogen has arisen as a huge member in the energy area. Green hydrogen creation strategies, which are driven by feasible energy sources like sunlight based or wind, are acquiring prevalence because of their decreased biological impression. This is predictable with worldwide drives to lessen fossil fuel byproducts and accomplish a more practical energy portfolio. A huge expansion in joint efforts and organizations among key industry members has portrayed the market. Associations are coming to recognize the significance of cooperative undertakings to grow hydrogen assembling and foundation. The target of these joint efforts is to overcome impediments including significant creation costs and lacking foundation, subsequently developing a hydrogen environment that is stronger and related. The advancement of new innovations altogether impacts the market patterns of hydrogen age. Electrolysis innovation progressions, including the execution of PEM electrolyzes, are increasing hydrogen's practicality as an energy transporter. Raised adaptability, reduced energy utilization, and improved effectiveness are delivering electrolysis an undeniably achievable and engaging option for the age of hydrogen. Strategy systems and government support are vital elements in deciding the direction of the hydrogen generation industry. Various countries are carrying out administrative measures, appropriations, and motivations to advance the utilization of hydrogen as a feature of their decarbonization endeavours. These approaches cultivate a climate that is helpful for business interest in hydrogen advancements, in this way animating the extension of the market. Furthermore, the market is going through a change toward a more extensive assortment of end-use applications for hydrogen. Hydrogen, which has generally been utilized in the substance and refining enterprises, is turning out to be progressively huge in the power age and transportation areas because of the multiplication of energy component innovation in the car area. The usage of energy components or the immediate burning of hydrogen into power age frameworks is turning into a rising concentration with an end goal to decrease fossil fuel byproducts in the power business. A worldwide obligation to environmentally friendly power and supportability is causing a huge change in the hydrogen age market. This envelops different end-use applications, mechanical progressions, key associations, government backing, and environmental hydrogen creation. With the continuation of these examples, the market is situated for development and will essentially add to the shift towards an energy future that is both manageable and low carbon.

Leave a Comment